Sotkamo Silver AB | Stock Exchange Release | February 20, 2026 at 09:00:00 EET

HIGHLIGHTS

October - December (Q4)

- Net sales increased by 25% to 135 MSEK (109 MSEK*). Silver production was lower than in the same period last year, but the positive development of silver and gold prices supported net sales which increased by 97% compared to Q1 2025, 71% compared to Q2 2025 and 23% compared to Q3 2025

- EBITDA rose by 119% to 51 MSEK (23) and EBITDA margin strengthened to 38% (21) compared to Q4 2024. Compared to Q1 2025 EBITDA increased 58 MSEK, 49 MSEK compared to Q2 2025 and compared to Q3 2025 16 MSEK

- EBIT increased to 33 MSEK (3). EBIT was 56 MSEK higher than in Q1 2025, 49 MSEK higher than in Q2 2025 and 16 MSEK higher than in Q3 2025

- Profitability improved significantly from the comparison period due to positive price development of silver and gold. The Company's profitability improved quarter by quarter in 2025

- CAPEX fell to 15 MSEK (24)

- The production amounted to approximately 193,000 ounces of silver (271,000), 579 ounces of gold (604), 154 tonnes of lead (154), and 389 tonnes of zinc (438) in concentrates

- Cash and cash equivalents amounted to 14 MSEK (88). The Company has a credit facility of 2 MEUR (22 MSEK)

- The Company updated Mineral Resource and Ore Reserve Estimates which supported significant extension of life of the mine

January - December

- Net sales decreased by 5% to 393 MSEK (412 MSEK). Lower silver grade and lower mill feed led to lower silver production. Higher silver and gold prices did not fully compensate for the decline in net sales caused by lower production volumes

- EBITDA weakened to 80 MSEK (109), EBITDA margin fell to 20% (26)

- EBIT fell to 9 MSEK (33)

- Inadequate mining resources and rock mechanical challenges led to lower silver production and decreased profitability especially during the first half of 2025

- Cash and cash equivalents decreased to 14 MSEK (88)

- CAPEX decreased by 10% to 63 MSEK (70)

- The production was approximately 803 000 ounces of silver (1 166 000), 1,829 ounces of gold (2,595), 602 tonnes of lead (729), and 1,472 tonnes of zinc (1,642) in concentrates

*Comparative figures refer to the corresponding period of the previous year.

In case of discrepancies, the official Swedish version of this report prevails.

OUTLOOK

Guidance for 2026

The Board of Directors concluded 20 February on new guidance for year 2026:

- The Company expects to produce 0.9 -1.2 million ounces of silver

- Annual EBITDA is expected to be over 25 MEUR

- Net debt-to-EBITDA is expected to be below 1.0 at year-end

The Company's profitability is significantly affected by external factors, such as metal prices and exchange rates and internal factors like uncertainties related to ore volumes and metal grades. The prices used in the guidance for silver and gold are slightly lower than at the time of publication of the guidance (20 February 2026).

CEO REVIEW

Significant impact of rising silver price on profit and cash flow

The positive development continued in the fourth quarter. Our net sales and EBITDA increased very strongly compared with the previous quarter and the previous year due to the rapid rise in the silver price. Although our financial figures developed positively, silver production volume still fell short of target.

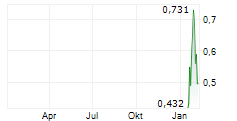

The price of silver has been at historical high levels. During 2025, the price already rose from 23 dollars to 72 dollars. At the beginning of 2026, the price continued to rise and reached nearly 120 dollars per ounce. Since then, the price has declined to the levels seen at the end of 2025. Even though silver prices have fluctuated significantly during the early part of the year, they have remained at a high level. This has a very positive impact on our profit and cash flow. All in all, the year 2026 has started on a positive note!

Although silver production recovered during the second half of the year, 2025 was operationally challenging for us for underground mining. We are now investing heavily in development projects at the current mine to ensure the early opening of new production areas. We are confident that, with these investments and the new mining contractor who started on 1 January 2026, we will be able to secure the achievement of our mining targets. Cooperation with the new contractor has also started well.

At the end of 2025, we published our updated medium-term targets, according to which we aim to reach an annual silver production level of 1.4 million ounces. We will not yet reach this level in 2026, but we strongly believe that production will grow compared with 2025 figures.

According to the estimates published at the end of 2025, mineral resources increased by more than four million tonnes, and the most accurate category, Measured, grew very significantly. Current resources and reserves are estimated to enable operations to continue at least until 2035. Mineralisation both at greater depth and west of the current operating area provides promising targets for continued exploration.

I would like to thank our personnel for their excellent work and achievements, such as strengthening our safety performance and extending the life of the mine. The ongoing development measures in underground mining, together with the improved profitability, create a strong foundation for this year.

KEY FIGURES

| Q4/25 | Q4/24 | Change, % | 2025 | 2024 | Change, % | |

| Net sales, MSEK | 135 | 109 | 25 | 393 | 412 | -5 |

| EBITDA, MSEK* | 51 | 23 | 119 | 80 | 109 | -27 |

| EBITDA margin % | 37.6 | 21.4 | 76 | 20.3 | 26.4 | -23 |

| EBIT, MSEK* | 33 | 3 | 872 | 9 | 32 | -73 |

| EBIT margin % | 24.0 | 3.1 | 680 | 2.2 | 7.9 | -72 |

| Equity ratio %* | 40 | 41 | -3 | 40 | 41 | -3 |

| Cash liquidity %* | 49 | 75 | -35 | 49 | 75 | -35 |

| Net debt-to-EBITDA ratio* | 2.5 | 1.6 | 56 | 2.5 | 1.6 | 56 |

| Personnel at the end of the period | 48 | 51 | -6 | 48 | 51 | -6 |

| Silver production, koz* | 193 | 271 | -29 | 804 | 1 166 | -31 |

| Mill feed, kt* | 110 | 123 | -10 | 425 | 497 | -14 |

| Average silver grade, g/tonne* | 65 | 84 | -23 | 71 | 89 | -20 |

Alternative key performance measures are marked with asterisk. For more detailed definitions, please see the full report.

EVENTS AFTER THE REPORTING PERIOD

As part of the long-term consistency and development of underground mining performance, a new mining contractor started the operations from the beginning of 2026.

During January, the number of shares and votes in Sotkamo Silver AB has increased as a result of the conversion of convertibles of series 2022/2026. Before the conversion, there were a total of 322,068,107 shares and votes in the company. At the end of January, there was a total of 322,718,497 shares and votes in the Company. The conversion reduced the principal of the convertible loan from EUR 0.54 million (SEK 5.7 million) to EUR 0.44 million (SEK 4.6 million).

FINANCIAL CALENDAR

- Financial Statements and the Board of Directors' Report for the Year 2025: Week commencing 30 March 2026

- Q1/2026: 29 April 2026

- Q2/2026: 31 July 2026

- Q3/2026: 23 October 2026

The Annual General Meeting is planned to be held on 21 April 2026 in Stockholm.

WEBINAR

The result webinar will be held today on 20 February at 1:00 p.m. Finnish time (EET). You can participate in the event through the link provided below: https://events.inderes.com/fi/sotkamosilver/2025-tulos

The webinar will be conducted in Finnish, with the material presented in English. During the event, you can ask questions using the chat function. The presentation from the webinar will be made available on the company's website at: https://www.silver.fi/en/investors/presentations

Stockholm, 20 February 2026

Sotkamo Silver AB's Board of Directors and CEO

CONTACT INFORMATION

Mikko Jalasto,

CEO of Sotkamo Silver AB

mikko.jalasto@silver.fi

+358 50 482 1689

Tommi Talasterä,

CFO of Sotkamo Silver AB

tommi.talastera@silver.fi

+358 40 712 6970

This is information that Sotkamo Silver AB is obliged to make public pursuant to the EU Market Abuse Regulation.

This is a summary of Sotkamo Silver's Financial Statements report. The complete report is attached to this release and available at the Company webpage: https://www.silver.fi/en/investors

Sotkamo Silver in brief

Sotkamo Silver is a mining and ore prospecting company that develops and utilises mineral deposits in the Kainuu region in Finland. Sotkamo Silver supports the global development towards green transition technologies and produces the metals needed responsibly and by taking local stakeholders into account. Sotkamo Silver's main project is a silver mine located in Sotkamo, Finland. In addition to silver, the mine produces gold, zinc and lead. The company also has mining and ore prospecting rights for mineral deposits in the vicinity of the silver mine in Kainuu. Sotkamo Silver Group consists of the parent company Sotkamo Silver AB and its wholly-owned Finnish subsidiary (Sotkamo Silver Oy). Sotkamo Silver AB is listed at NGM Main Regulated in Stockholm (SOSI), Nasdaq Helsinki (SOSI1), and Börse Berlin.

Read more about Sotkamo Silver at www.silver.fi/en/