NEW BRUNSWICK (dpa-AFX) - The biotech space this week witnessed significant key milestones, including FDA approvals, NDA path-setting meetings, rejections, licensing agreements, and oncology drug acquisitions.

The clinical trial arena achieved positive results in therapeutic areas such as idiopathic nephrotic syndrome, age-related macular degeneration, ulcerative colitis, plaque psoriasis, obesity, autoimmune and inflammatory diseases.

Let us unpack the key developments and milestones of this week.

FDA Approvals & Rejections

NRx Pharmaceuticals Charts Approval Path for NRX-100

NRx Pharmaceuticals, Inc. (NRXP) has completed a Type C guidance meeting with the U.S. FDA related to NRX-100 (preservative-free ketamine). The FDA indicated that existing clinical trial data plus Real-World Evidence from over 65,000 patients could support an NDA under Fast Track Designation, with no additional nonclinical or bridging studies required.

NRx plans to seek a broader indication in treatment-resistant depression with suicidality and will finalize its Real-World Evidence analysis protocol in the coming weeks. The meeting included input from Osmind, Inc., Psychiatry Products, and leadership of FDA's CDER and OSMID.

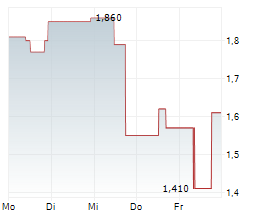

NRXP closed Thursday's (February 19, 2026) trading at $1.84, up 3.66%.

Kane Biotech Secures FDA Clearance for Revyve Cleanser

Kane Biotech Inc. (KNBIF) announced that the U.S. FDA has granted 510(k) clearance for its Revyve Antimicrobial Skin and Wound Cleanser, supporting its use across a broad range of acute and chronic dermal lesions. The clearance reinforces the reyvye platform's ability to target wound bacteria and biofilms, with manufacturing scale-up and technology transfer planned for later in 2026.

The company also expanded its ISO certification under MDSAP to include distribution and wound cleaners, aligning with the FDA's new Quality Management System Regulation. The revyve product line-including the Antimicrobial Wound Gel and Wound Gel Spray- is already FDA-cleared and approved by Health Canada.

KNBIF closed Thursday's trading at $0.02, down 1.69%.

Johnson & Johnson Gains FDA Nod for Monthly RYBREVANT FASPRO Dosing

The FDA has approved Johnson & Johnson's (JNJ) simplified monthly dosing schedule for RYBREVANT FASPRO or amivantamab and hyaluronidase-lpuj, allowing patients to transition to monthly dosing as early as week 5. The company noted that when combined with oral LAZCLUZE for the first-line treatment of EGFR-mutated advanced non-small cell lung cancer, the monthly regimen delivers consistent outcomes with the previously approved bi-weekly subcutaneous schedule.

JNJ closed Thursday's trading at $246.91, up 0.78%.

Spruce Biosciences Reports Positive FDA Type B Meetings on TA-ERT

Spruce Biosciences Inc. (SPRB) announced positive feedback from two FDA Type B meetings supporting its planned BLA for tralesinidase alfa enzyme replacement therapy (TA-ERT) for the treatment of Sanfilippo syndrome type B.

The agency indicated that integrated clinical and natural-history data may support accelerated approval using CSF HS- NRE as a reasonably likely surrogate endpoint and outlined CMC requirements ahead of a targeted fourth-quarter 2026 filing.

SPRB closed Thursday's trading at $52.62, down 1.61%.

Moderna Says FDA Will Initiate Review of Its Seasonal Influenza Vaccine Submission

Moderna, Inc. (MRNA) announced that the U.S. FDA has agreed to initiate the review of its BLA for mRNA-1010, the company's investigational seasonal influenza vaccine, following a recent Type A meeting. The agency had previously issued a Refusal-to-File letter, but Moderna resubmitted an amended application seeking full approval for adults 50-64 and accelerated approval for adults 65 and older, along with a post-marketing study requirement. The FDA has now accepted the filing and set a PDUFA date of August 5, 2026, with potential U.S. availability for the 2026/2027 flu season. Moderna added that mRNA-1010 is also under review in Europe, Canada, and Australia.

MRNA closed Thursday's trading at $49.70, up 6.65%.

Disc Medicine Receives CRL for Bitopertin in EPP

Disc Medicine, Inc. (IRON) announced receipt of a Complete Response Letter (CRL) from the U.S. FDA for its NDA seeking accelerated approval of Biopertin for erythropoietic protoporphyria (EPP). While the agency acknowledged Biopertin's ability to lower PPIX levels and supported the biomarker's mechanistic rationale, it cited insufficient correlation with sunlight exposure endpoints. Disc plans to submit results from the ongoing Phase 3 APOLLO trial, with topline data expected in Q4 2026, and will request a Type A meeting to discuss next steps toward traditional approval.

IRON closed Thursday's trading at $63.35, down 1.75%.

AbbVie Wins FDA Approval for VENCLEXTA and Acalabrutinib in CLL

AbbVie Inc. (ABBV) and Genetech, a member of Roche Holding AG (RHHBY), announced FDA approval of the combination regimen of VENCLEXTA (venetoclax) and Acalabrutinib for previously untreated patients with chronic lymphocytic leukemia (CLL). The approval was supported by results from the Phase III AMPLIFY study, which showed the regimen reduced the risk of disease progression or death by 35% compared with standard chemoimmunotherapy. VENCLEXTA is already approved across CLL, SLL, and AML indications, and the new frontline approval expands its reach as a chemotherapy-free option. The companies jointly commercialize VENCLEXTA in the U.S., with AbbVie marketing the therapy outside the U.S.

ABBV closed Thursday's trading at $224.35, down 1.91%.

Deals

Theriva Licenses SYN-020 To Rasayana For Multiple Indications

Theriva Biologics, Inc. (TOVX), a clinical-stage company, has entered into an exclusive worldwide license agreement with Rasayana Therapeutics for the development and commercialisation of SYN-020, an oral recombinant intestinal alkaline phosphatase enzyme.

SYN-020 is designed to restore intestinal barrier function and reduce systemic inflammation by targeting gut-organ axis biology.

Under the terms of the deal, Theriva received a $3 million upfront payment and is eligible for up to $38M in development, regulatory, and sales milestones along with tiered single-digit royalties on net product sales.

Rasayana will assume full responsibility and costs for advancing SYN-020 through clinical development and commercialisation.

TOVX closed Thursday's trading at $0.19, up at 2.45%.

Sensei Acquires Faeth Therapeutics

Sensei Biotherapeutics, Inc. (SNSE), a clinical-stage oncology firm, announced it has acquired Faeth Therapeutics Inc., a clinical-stage biotechnology company developing multi-node therapies that target tumour metabolism and signalling.

The deal brings Faeth's lead asset, PIKTOR- an investigational all-oral, multi-node inhibitor of the PI3K/AKT/mTOR pathway- into Sensei's portfolio, expanding its development focus across endometrial and breast cancer.

Concurrently, Sensei announced a concurrent private placement of $200 million, and intend to use the gross proceeds primarily to advance the acquired PIKTOR through key clinical milestones, including topline data from an ongoing Phase 2 trial in second-line advanced endometrial cancer, as well as the initiation of a Phase 1b trial in HR+/HER2- advanced breast cancer, both expected by year-end 2026.

SNSE closed Thursday's trading at $27.22, up 3.70%.

Clinical Trials - Breakthroughs

Eli Lilly's Taltz-Zepbound Shows Positive Results In Psoriasis and Obesity

Eli Lilly and Co. (LLY) announced positive topline results from the TOGETHER-PsO open-label Phase 3b clinical trial evaluating the concomitant use of Taltz and Zepbound compared to Taltz alone in adults with moderate-to-severe plaque psoriasis and obesity or overweight.

At 36 weeks, treatment with Taltz and Zepbound met the primary and all key secondary endpoints, delivering superior skin clearance and weight loss versus Taltz monotherapy.

In the study, 27.1% of participants receiving Taltz and Zepbound reached complete skin clearance or PASI 100 and at least 10% weight loss, compared to 5.8% of patients treated with Taltz alone.

In a key secondary endpoint, Taltz plus Zepbound delivered a 40% relative increase over Taltz monotherapy in the proportion of patients who achieved PASI 100, demonstrating that treatment of obesity or overweight with Zepbound reduced the burden of psoriasis.

LLY closed Thursday's trading at $1023.22, up 0.26%

Zealand Pharma Reports Positive Phase 1a Results For Kv1.3 Channel Blocker ZP9830

Zealand Pharma A/S (ZEAL) reported positive topline results from its Phase 1a clinical trial of ZP9830, which is a Kv1.3 channel blocker for autoimmune and inflammatory diseases.

The first-in-human single ascending dose (SAD) part of the combined SAD/multiple ascending dose (MAD) Phase 1a trial was conducted in healthy male participants to investigate the effects of single ascending doses of ZP9830 administered subcutaneously across a wide dose range, as well as intravenously at one dose level.

The study met its primary endpoint, demonstrating safety and tolerability in healthy volunteers. Secondary endpoints also confirmed target engagement, supporting further development of the candidate.

In addition, results showed dose-dependent target engagement with no serious adverse events reported.

Zealand Pharma expects Phase 1a multiple ascending dose data and Phase 1b/2a initiation in H2 2026.

ZEAL.CO closed Thursday's trade at $382.80 DKK, down 0.25%.

Novartis' Phase 3 Trial of Remibrutinib Meets Primary Endpoint In Chronic Inducible Urticaria

Novartis AG (NVS, NOVN.SW), a healthcare firm, announced positive results from a phase 3 trial of its oral drug, Remibrutinib, in chronic inducible urticaria.

Remibrutinib is a selective, oral BTK inhibitor that blocks the BTK pathway involved in the release of histamine, a key driver of hives and swelling.

In the phase 3 trial, dubbed RemIND, Remibrutinib achieved significantly higher complete response rates than placebo at Week 12, i.e., the primary endpoint for the study. This key goal was met for the three most prevalent types of chronic inducible urticaria (CIndU), namely symptomatic dermographism, cold urticaria and cholinergic urticaria.

NVS closed Thursday's trading at $163.92, down 0.88%.

Ocular Therapeutix's AXPAXLI Meets Superiority Endpoint In Wet AMD Trial

Ocular Therapeutix, Inc. (OCUL) reported positive topline results from its pivotal Phase 3 SOL-1 trial that evaluated AXPAXLI against aflibercept in wet age-related macular degeneration (AMD). But the stock plunged over 20% that day as investors were disappointed that the control arm of aflibercept performed better than expected.

The SOL-1 trial compared a single intravitreal dose of AXPAXLI (OTX-TKI), a bioresorbable hydrogel incorporating axitinib, against aflibercept (2 mg).

At Week 36, 74.1% of patients in the AXPAXLI arm-maintained vision, a statistically significant improvement over aflibercept.

AXPAXLI also demonstrated durability at Week 52, with 65.9% of AXPAXLI-treated patients maintaining vision compared to 44.2% in the control arm.

Rescue-free rates remained high, with nearly two-thirds of patients avoiding supplemental injections through Week 52.

Safety findings were favourable, with no treatment-related ocular or systemic serious adverse events observed

This marks the first successful demonstration of superiority over an approved anti-VEGF therapy in an FDA-aligned study.

OCUL closed Thursday's trading at $7.03, up 2.18%

Rallybio Reports Positive Data for RLYB116 Phase 1 Study

Rallybio (RLYB), a clinical-stage biotechnology company, announced positive results from its phase 1 clinical trial evaluating RLYB116 in immune platelet transfusion refractoriness and refractory antiphospholipid syndrome.

The Phase 1 clinical trial is a confirmatory pharmacokinetic/pharmacodynamic trial evaluating RLYB116.

RLYB116 is Rallybio's lead once-weekly, small volume, subcutaneously injected C5 inhibitor, in development for patients with complement-mediated diseases with its initial focus on immune platelet transfusion refractoriness (PTR) and refractory antiphospholipid syndrome (APS).

The study evaluated a 4-week treatment duration that included two cohorts of eight participants each, randomized 3-to-1 to receive either RLYB116 or placebo once weekly. Cohort 1 evaluated dosing of 150 mg and Cohort 2 evaluated dosing of 300 mg.

The study demonstrated that 300 mg once-a-week dose RLYB116 achieved complete and sustained inhibition of terminal complement.

Rallybio plans to initiate the RLYB116 phase 2 clinical trial for immune platelet transfusion refractoriness in the second half of 2026, with potential for topline data in 2027.

RLYB closed Thursday's trading at $4.75, up at 5.20%.

Teva, Sanofi's Phase 2b Trial of Duvakitug Shows Durable Efficacy in UC & Crohn's

Teva Pharmaceutical Industries Ltd. (TEVA) and Sanofi (SNY) highlighted new Phase 2b maintenance data for Duvakitug in patients with ulcerative colitis (UC) and Crohn's disease (CD).

The RELIEVE UCCD long-term extension (LTE) study followed patients who had responded to Duvakitug during the 14-week induction phase. Participants were re-randomised to receive either 450 mg or 900 mg subcutaneous doses every four weeks, for up to 58 weeks of exposure.

At week 44, nearly half of patients with UC achieved clinical remission, with higher rates at the 900 mg dose. In CD, more than half of patients on the higher dose achieved endoscopic response, reinforcing Duvakitug's durable efficacy.

Safety outcomes were consistent with the induction phase, confirming Duvakitug's tolerability over extended use. These findings strengthen the rationale for ongoing Phase 3 programs in both UC and CD, which will be critical for regulatory advancement.

TEVA closed Thursday's trading at $34.33, up at 0.64%.

Genentech Reports Positive Phase III Results For Gazyva In Primary Membranous Nephropathy

Genentech, a member of the Roche Group (RHHBY), announced that its lead candidate, Gazyva or obinutuzumab, met its primary endpoint, showing statistically significant and clinically meaningful results in the Phase III MAJESTY study in adults with primary membranous nephropathy.

Gazyva is a glycoengineered, anti-CD20 monoclonal antibody designed to achieve deep tissue B cell depletion.

MAJESTY is the fourth positive Phase III study of Gazyva in immune-mediated diseases, following REGENCY in lupus nephritis, ALLEGORY in systemic lupus erythematosus and INShore in idiopathic nephrotic syndrome.

Results showed that significantly more people achieved complete remission at 104 weeks with Gazyva than with tacrolimus.

The analysis of key secondary endpoints showed statistically significant and clinically meaningful benefits with Gazyva versus tacrolimus in overall remission at week 104 and complete remission at week 76.

Safety was in line with the well-characterised profile of Gazyva, and no new safety signals were identified. Data will be presented at an upcoming medical meeting and shared with health authorities, including the U.S. Food and Drug Administration and the European Medicines Agency.

RHHBY closed Thursday's trading at $59.24, down at 0.69%.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News