As announced on 24 December 2024, Desenio Group AB (publ) ("Desenio") and an ad hoc committee of holders of Desenio's outstanding senior secured bonds 2020/2025 (the "AHC" and the "Existing Bonds", respectively) have agreed on a restructuring of the Existing Bonds and of Desenio's capital structure, including a debt-for-equity swap through a set-off issue of shares (the "Debt-for-Equity Swap"), the issue of a new super senior bond of SEK 150 million (under a framework of SEK 250 million) (the "Super Senior Bond") and restatement of the remaining part of the Existing Bonds in a new bond (together, the "Restructuring").

In February and March 2025, the Restructuring was approved by a written procedure under the Existing Bonds, received the necessary approvals from an extraordinary general meeting of shareholders in Desenio and the AHC and a number of other holders of Existing Bonds received an exemption from the mandatory bid requirement from the Swedish Securities Council.

All shares under the Debt-for-Equity Swap have now been subscribed for, allotted and paid by way of set-off against the Existing Bonds. Also, the Super Senior Bond has been issued and the remainder of the Existing Bonds have been restated.

Debt-for-Equity Swap

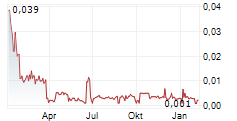

A total of 2,832,567,690 new shares, of which 832,774,900 are ordinary shares and 1,999,792,790 are restructuring shares, have been issued to holders of Existing Bonds and NT Refectio XII AS. Payment for the newly issued shares has been made by way of write down of the remaining nominal amount and accrued interest of the Existing Bonds, of which 75% constitutes payment for the newly issued shares (with the remaining amount being restated as set out below). The total subscription price for the newly issued shares amounts to SEK 716,340,534, implying a subscription price per share of approximately SEK 0.25. The newly issued shares are expected to be delivered on or around 25 March 2025. The newly issued ordinary shares will be admitted to trading on Nasdaq First North Growth Market. The restructuring shares will not be admitted to trading.

Through the new issue, the number of shares in Desenio has increased by 2,832,567,690 shares, from 149,082,510 shares to 2,981,650,200 shares (out of which 1,999,792,790 are restructuring shares), and the share capital has increased by SEK 10,116,313.26, from SEK 532,437.54 to SEK 10,648,750.80. The Debt-for-Equity Swap entails a dilution for existing shareholders of 95% of the number of shares and votes in Desenio.

Issue of Super Senior Bond and restatement of Existing Bonds

The Super Senior Bond has been issued with a total nominal amount of SEK 150 million (under a framework of SEK 250 million). The Existing Bonds have been restated with 25% of the remaining nominal amount and accrued interest, amounting to SEK 251,346,200 (taking into account an issue discount of 5%). The terms and conditions for the Super Senior Bond and the restated Existing Bonds are available on Desenio's website (https://deseniogroup.com/en/investors/bond-issue/).

Advisors

ABG Sundal Collier is acting as financial advisor to Desenio in connection with the Restructuring. Gernandt & Danielsson Advokatbyrå is acting as legal advisor to Desenio in connection with the Restructuring.

For further information, please contact:

Fredrik Palm, CEO, fredrik.palm@deseniogroup.com, +46 70 080 76 37

Johan Roslund, CFO, johan.roslund@deseniogroup.com, +46 73 744 60 87

Johan Hähnel, Head of IR, johan.hahnel@deseniogroup.com, +46 706 05 63 34

About Desenio Group

Desenio Group is the leading e-commerce company within affordable wall art in Europe, with a growing presence in North America. We offer our customers a unique and curated assortment of about 9,000 designs as well as frames and accessories in 37 countries via 44 local websites and are steadily expanding to new markets.

Desenio Group is well positioned to build upon our dynamic growth model, including our proprietary technical platform, industrialized creative processes and efficient customer acquisition approach.

We are headquartered in Stockholm, Sweden, with fulfilment centres in Sweden, Czech Republic and USA. Our share is traded on Nasdaq First North Growth market, under the ticker "DSNO".

Certified Adviser

FNCA Sweden AB is the company's certified adviser.