Business driven by double-digit increase in recurring revenue and ARR from subscriptions, negatively impacted by delays in closing perpetual licence sales

Quarterly activity

- Consolidated revenue: $11.5m (-19% vs. Q1 2024)

- Recurring revenue from subscriptions: $4.6m (+10% vs. Q1 2024)

- Continued growth in ARR from subscriptions: $18.5m (+12% vs. Q1 2024)

2025 targets confirmed

- Another year of double-digit growth in ARR from subscriptions

- Target of an EBITDA-to-revenue ratio of nearly 10%

Regulatory News:

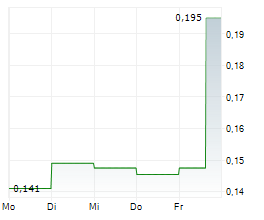

Verimatrix (Euronext Paris: VMX, FR0010291245), a leading provider of security solutions for a safer connected world, is publishing its revenue for the first quarter of the 2025 financial year (1 January to 31 March).

"In an uncertain market environment, Verimatrix's sales performance in the first quarter of the year shows mixed trends. On the one hand, recurring revenue and annual recurring revenue (annualised value of contracts) from subscriptions rose again by 10% and 12% respectively, in line with the Group's target for the full year. On the other hand, business activity related to the sale of perpetual licences, non-recurring revenue, was again impacted by a sharp slowdown in decision-making by our customers and prospective customers. In line with our previously stated strategic priorities, this trend means that we must continue the sale of software solutions that generate recurring revenue, with the sole aim of further consolidating our position as a key player in cybersecurity. Beyond our long-standing presence in telecoms and media, we are actively broadening our network of distributor partners, resellers and integrators internationally in order to diversify our customer base and win big accounts that offer value added. This strategic expansion will serve as a key growth driver and help us to secure our stated targets for the end of 2025"says Amedeo D'Angelo, Chairman and Chief Executive Officer of Verimatrix.

Jean-François Labadie, Chief Financial Officer, will host a webcast today at 6 p.m. to comment on the revenue generated in Q1 2025.

To join the webcast, click on the following link: Q1 2025 revenue

To join the webcast, audio only, call the following number:

France: +33 (0)4 88 80 09 30

Phone Conference ID: 597 126 953#

- Revenue driven by recurring revenue from subscriptions

Verimatrix made consolidated revenue of $11.5 million in the first quarter of 2025, down 19% in relation to the same period in 2024. This change in business volume was particularly due to the deferral of a few perpetual licence orders that had initially been planned for the end of 2024, but which are now set to be signed in full by the end of the first half of 2025, alongside strong trends in recurring activity.

(in US$ millions) | Q1 2025 | Q1 2024 | Chg. | |

Recurring revenue | 8.6 | 8.5 | +1% | |

of which subscriptions | 4.6 | 4.2 | +10% | |

of which maintenance | 4.0 | 4.3 | -8% | |

Non-recurring revenue | 2.9 | 5.7 | -49% | |

Total revenue | 11.5 | 14.2 | -19% | |

ARR | 33.2 | 32.3 | +3% | |

of which subscriptions | 18.5 | 16.5 | +12% | |

of which maintenance | 14.7 | 15.8 | -7% |

Recurring revenue

Driven by steady growth in ARR from subscriptions over the past few years, recurring revenue from subscriptions continued to grow, showing a further increase of 10% in the first quarter of 2025 to $4.6 million compared with $4.2 million in the same period of 2024. It benefited in particular from the start of new contracts, mainly with telecoms operators.

After factoring in an 8% decrease in maintenance revenue over the quarter, total recurring revenue grew by a slight 1% to $8.6 million compared with $8.5 million in the same period of 2024. This represents 75% of the Group's total revenue for the quarter.

Non-recurring revenue

Activity for the quarter was impacted, as previously indicated by the Group, by the deferral of a few contracts negotiated with Latino-American, European and Indian media operators. This first part of the year was particularly penalised by a slowdown in activity in Brazil and Argentina, countries that are currently in the throes of a difficult economic environment and high monetary volatility, causing prospective customers of the Group to put off decisions on the purchasing of perpetual licences.

Non-recurring revenue fell by a substantial 49% in the first quarter in relation to the same period of the previous year, coming out at $2.9 million.

Annual recurring revenue (ARR)

Total ARR came to $33.2 million at 31 March 2025, up 3% on 31 March 2024.

In line with the Group's announced targets for 2025, ARR from subscriptions over the quarter grew by 12% to $18.5 million compared with $16.5 million at 31 March 2024. Business activity remained very dynamic, particularly in Europe and the Middle East, driven primarily by the quality and effectiveness of the Group's anti-piracy software solutions. In the Middle East, the Group continued to develop its customer base, gaining new contracts with regional banking operators. Also, in Argentina, the Group won a major three-year contract for the supply of subscription-based security solutions to a leading telecoms operator.

- 2025 targets confirmed

The security solutions developed by Verimatrix help companies to comply with and meet the strictest regulatory standards such as those in the media and entertainment, sports content, telecommunications, finance and healthcare sectors. In addition to these sectors in which the Group has been established for some time, Verimatrix continues to seal new partnerships internationally with distributors, resellers and integrators of cybersecurity solutions. Each of these partnerships bring opportunities for the Group to diversify its customer base while ensuring sales for all of its solutions to major accounts.

For full-year 2025, the Group confirms it expects to see double-digit growth in ARR from subscriptions in relation to 2024. The Group is also targeting a further improvement in EBITDA to close to 10% of revenue, underpinned by growth in revenue and a closely managed cost structure, the majority of which are fixed costs.

Next events in 2025:

General Shareholders' Meeting: 12 June

Q2 revenue and H1 2025 results: 28 July (after market)

About VERIMATRIX

VERIMATRIX (Euronext Paris: VMX) is contributing to making the connected world safer through its user-friendly security solutions. The Group protects content, applications and smart objects by providing intuitive, unconstrained and fully user-oriented security. The leading players in the market trust VERIMATRIX to protect their content, including premium films, sports streaming, sensitive financial and medical data, and the mobile applications essential to their business. VERIMATRIX ensures a relationship of trust that its customers count on to deliver quality content and service to millions of consumers worldwide. VERIMATRIX supports its partners, bringing them faster access to the market and helping them to develop their business, safeguard their revenue and win new customers. Find out more at www.verimatrix.com.

Forward-looking statements

This press release contains certain forward-looking statements concerning Verimatrix. Although Verimatrix believes its expectations to be based on reasonable assumptions, they do not constitute guarantees of future performance. Accordingly, the Company's actual results may differ materially from those anticipated in these forward-looking statements owing to a number of risks and uncertainties.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250424562894/en/

Contacts:

Investor contacts:

Jean-François Labadie

Chief Financial Officer

finance@verimatrix.com

Sébastien Berret

SEITOSEI.ACTIFIN

sebastien.berret@seitosei-actifin.com

Média contacts:

USA

Matthew Zintel,

Public Relations

matthew.zintel@zintelpr.com

EUROPE

Michael Scholze

SEITOSEI.ACTIFIN

Michael.scholze@seitosei-actifin.com