Commercial activities remain strong, including CellTolerance launch

Recently approved safeguard proceeding yielding productive creditor and investor discussions aimed at strengthening Mauna Kea's long-term financial position

Currently in exclusive negotiations phase with a leading strategic partner for a potential licensing agreement

Extension of cash runway with the renewal of the PACEO with Vester Finance

Regulatory News:

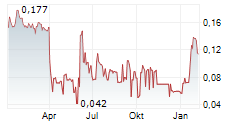

Mauna Kea Technologies (Euronext Growth: ALMKT), inventor of Cellvizio, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today reported its financial results for the full year 2024 and provides a business update.

Commenting on the results,Sacha Loiseau, Ph.D., Chairman and CEO of Mauna Kea Technologies observed: "2024 was perhaps the most challenging period in Mauna Kea's history. The year was marked by the complete absence of orders and payments from our JV in China as well as reimbursement cuts in the United States, which slowed commercial activity. However, I also believe this moment marked a turning point for the company. In fact, in response to these challenges, we made significant operational progress improving our gross margin by 12 percentage points, cutting the monthly cash burn by over a third, and delivering a full-year EBITDA (loss) above expectations, despite a sharp revenue decline. These improvements reflect disciplined, value-driven leadership across all areas of the company. At the same time, we're investing prudently for long-term growth, including the launch of CellTolerance, but also with significant progress on our core GI indications, new AI capabilities, and positive momentum on the reimbursement front in France. Finally, our ongoing safeguard proceedings are a means to strengthen our financial structure and already enabled us to engage in constructive discussions with both creditors and strategic partners. These efforts aim to provide the company with a solid foundation for future growth. The stakes have never been higher and I remain confident that the unwavering contribution of the Mauna Kea team will allow our company to emerge better equipped to unlock the full potential of the Cellvizio platform."

Main Operational Highlights

Despite a strong start to the year, Mauna Kea Technologies faced two significant external headwinds: the slow activity of its joint venture in China and a reduction in Medicare reimbursement rates in the United States.

In China, Tasly Pharmaceuticals announced in August 2024 a change of reference shareholder and therefore of control, which considerably disrupted the joint venture's activities. This disruption resulted in the loss of minimum contractual orders and additional budgeted licensing revenue, leading to a shortfall exceeding €2m. This acquisition of a controlling stake in Tasly by China Resources Sanjiu Medical Pharmaceutical was finalized at the end of March 2025, bringing new leadership and changes to the JV's Board. A Board meeting is scheduled for the end of April, during which both parties will discuss all possible options for the future of the collaboration. In the meantime, Mauna Kea has continued to make progress on its own regulatory process for its Cellvizio Gen 3 platform in China, with a much-awaited clearance anticipated this year. The Gen 3 platform is not included in the current contract with the JV and the Company is considering all its options going forward to ensure the commercialization of Cellvizio can resume and be widely available in China.

In the United States, reimbursement for upper endoscopy procedures with Cellvizio was reduced due to inaccuracies in how hospitals reported procedure costs to the Centers for Medicare Medicaid Services (CMS). Although procedure volumes remained stable compared to 2023, and representing a 48% increase over 2022, this pricing adjustment negatively impacted revenues. The Company responded swiftly, initiating comprehensive measures to support hospitals in accurately reporting procedure costs and actively engaging with CMS, supported by advocacy from the medical community, to expedite a reimbursement adjustment as early as possible.

Amid these macroeconomic pressures, Mauna Kea successfully launched CellTolerance, a new brand addressing the significantly larger food intolerance market. With Irritable Bowel Syndrome (IBS) affecting an estimated 10% to 20% of the global population, this market represents a potential annual revenue opportunity exceeding €6 billion. Launched in Q3 2024, the CellTolerance program introduces a direct-to-consumer, cash-pay model that requires additional resource deployment and a phased rollout, leading to a longer implementation timeline in its initial stage. Nonetheless, interest from healthcare providers has been robust.

In Europe, Mauna Kea achieved a major milestone as the European Society of Gastrointestinal Endoscopy (ESGE) included Cellvizio in its best-practice guidelines for the characterization of pancreatic cysts. This endorsement, underpinned by compelling clinical data and support from the medical community, has initiated a pathway toward reimbursement. Notably, France's Haute Autorité de Santé (HAS) has re-initiated a formal evaluation process for potential reimbursement in France.

Main Financial Highlights

(in €k) IFRS | FY 2024 | FY 2023 | Change | |

€k |

| |||

Total sales | 7,655 | 10,480 | -2,825 | -27% |

Gross margin (% of sales1 | 78% | 66% |

| +12 pts |

EBITDA2 | (4,453) | (3,876) | -577 | +15% |

Current operating income | (6,049) | (5,686) | -363 | +6% |

Net profit (loss) | (10,404) | (3,727) | -6,677 | +179% |

Throughout the year, the Company implemented rigorous cost-control initiatives aimed at reducing its break-even point and accelerating progress toward profitability, thanks to which the Company was able to offset nearly 90% of the revenue decline over the period. As a result of these disciplined measures, the Company contained its operating loss to €6.0m, compared to €5.7m in the previous year, despite a €2.8m decline in revenue over the same period.

After Operating Income, items above net profit were primarily impacted by non-cash items, including capitalized interest on loans and the accounting implications of the EIB loan restructuring, in addition to the share of losses from the joint venture in China. The year-over-year variation is mainly attributable to a one-time capital gain recognized in 2023 from the transfer of patents to the joint venture.

In terms of cash flow, the company has significantly reduced its operating cash burn by more than 25% to €539K per month (vs. €719K in 2023)3 thanks to cost reduction measures and rigorous cash management.

As of April 22, 2025, cash and cash equivalents stood at €1.7m, compared to €2.0m as of December 31, 2024, providing the Group with a cash runway through July 2025, including the PACEO renewal with Vester Finance (see below).

Outlook

Improving the Group's financial profile remains the top priority. The positive financial trajectory initiated in 2022 in term of loss reduction is expected to continue. Indeed, the safeguard proceedings initiated on March 31, 2025, is set to significantly enhance the Group's financial structure through a significant debt restructuring, creating a foundation to attract new financial partners and support long-term growth.

On the commercial front, the Group plans to expand the deployment of CellTolerance across its key markets in Europe and the United States, while also establishing local partnerships in additional geographies. The pipeline of commercial opportunities is expanding rapidly and is expected to support a tripling of revenue from this indication in 2025.

In parallel, the pancreatic cysts application is expected to benefit from sustained momentum following its inclusion in the European guidelines, which is already driving reimbursement discussions across Europe-particularly in France. Additional visibility is anticipated from the upcoming results of the CLIMB study, conducted on 500 patients in the United States.

Lastly, as part of the ongoing strategic process, the Group is engaged in several discussions aimed at securing strategic partnerships, including a potential licensing agreement in a broader indication with a major industry player. One or more of these strategic agreements are expected to materialize in 2025.

Renewal of the PACEO equity line with Vester Finance

In the current context, maintaining a reserve of equity financing proved essential. The Company today renewed its PACEO line with Vester Finance, its long-standing partner, which has committed to subscribe for up to 11,000,000 shares in the Company, under the same terms and conditions as the previous transaction, which is due to expire shortly4. Mauna Kea Technologies will receive €300k upon signing, which will enable it to extend its financial visibility. This renewal was decided by the Company's Board of Directors, in accordance with the 18th resolution of the Shareholders' Meeting of June 6, 20245 and did not result in the preparation of a prospectus subject to AMF approval. In the event that this financing facility is used in full, a shareholder holding 1.00% of Mauna Kea Technologies' share capital prior to its implementation would see its stake fall to 0.86% of the share capital on an undiluted basis6

Going concern

The funding requirement over the next twelve months is estimated by the Company at €5m. At this stage, the Company considers that the risk of not securing the necessary financing to continue its operations in the coming months remains moderate. Based on these elements, the Board of Directors has adopted the going concern assumption. However, the outcome of these discussions, whether they involve licensing agreements or financing solutions, is not guaranteed. This represents a material uncertainty that may cast significant doubt on the Company's ability to continue as a going concern.

Consolidated Financial Statements

The Board of Directors approved the consolidated financial statements on April 22, 2025. The consolidated financial statements have been audited and the Statutory Auditors' report is in the process of being issued. Mauna Kea's comprehensive audited financial statements will be available in due course on www.maunakeatech.com.

Details of FY 2024 Results

Consolidated income statement for the full year 2024

(in €k) IFRS | FY 2024 | FY 2023 | Change | |

€k |

| |||

Product sales | 5,647 | 6,218 | -571 | -9% |

Licensing sales | 2,008 | 4,262 | -2,254 | -53% |

Total sales | 7,655 | 10,480 | -2,825 | -27% |

Other revenue | 760 | 547 | +213 | +39% |

Total revenue | 8,415 | 11,027 | -2 612 | -24% |

Cost of sales | (1,215) | (2,118) | -903 | -43% |

Research Development expenses | (3,550) | (3,860) | +310 | -8% |

Sales Marketing expenses | (4,705) | (5,618) | +913 | -16% |

General Administrative expenses | (4,445) | (5,004) | +559 | -11% |

Share-based payments | (549) | (113) | -436 | +386% |

Current operating income (loss) | (6,049) | (5,686) | -363 | +6% |

Non-current operating income | (34) | 6,918 | -6,952 | -100% |

Operating income | (6,083) | 1,231 | -7,314 |

|

Share of equity affiliates | (1,683) | (2,528) | +845 | -33% |

Financial result | (2,638) | (1,956) | -682 | +35% |

Income taxes | (475) | +475 | -100% | |

Net profit | (10,404) | (3,727) | -6,677 | +179% |

Total sales

Total Group sales amounted to €7.7m, representing a 27% decline year-over-year, primarily attributable to the absence of licensing revenue from the joint venture in China. In 2023, this revenue stream included a one-off payment of $2.5m. The anticipated offset through product sales to the JV and additional milestone payments did not materialize, despite contractual obligations, due to the suspension of the JV's activities following a change in control of Tasly's ownership during 2024.

In addition, product sales were impacted by adverse pricing conditions in the United States, stemming from a temporary reduction in Medicare reimbursement rates.

Other revenue

Other revenue totaled €0.8m, representing a 39% year-over-year increase. This growth reflects a higher research tax credit, driven by increased investment in R&D, particularly in artificial intelligence (AI) initiatives focused on the development of proprietary dataset solutions.

Cost of goods sold

Cost of goods sold came to €1.2m, reflecting a total gross margin of 78% over sales excluding license, an increase by 12 pts compared to 66% recorded last year. This strong gross margin reflects the end of the depreciation period for old generation Cellvizio systems mainly used under PPU and rents, and a one-off accounting impact.

Research and development expenses

Research and development costs were down by 5% over the period at €3.6m, primarily driven by changes in headcount during the year.

Sales and marketing expenses

Sales and marketing expenses declined by 16% over the period, totaling €4.7m. This reduction reflects the impact of cost-saving initiatives and a downsizing of the sales team, which was reduced from eight to five representatives by the end of 2024, primarily due to unsolicited departures.

General and administrative expenses

General and administrative expenses decreased by 11% over the period, totaling €4.4m. This reduction reflects the Group's disciplined cost-cutting efforts, despite a one-off increase in legal fees associated with the renegotiation of bank loan maturities, particularly with the EIB. The decline also results from the absence of variable remuneration for members of the Executive Committee and a voluntary base salary reduction by the Chairman and Chief Executive Officer.

Share-based payments

In line with its commitment to align employee interests with those of shareholders and to incentivize performance, the Group continued to grant stock options and free shares to its employees in 2024. The total expense related to these grants amounted to €549K, compared with €113K in 2023. The lower cost in the prior year reflected the significant cancellation of instruments following the departure of U.S.-based employees amid the Group's strategic reorientation.

Current Operating Income (loss)

The Group's current operating loss increased slightly by 6% to €6.0m, compared to €5.7m in 2023. The implementation of rigorous cost-saving plans and a significant reduction in operating expenses enabled the Company to offset nearly 90% of the revenue decline over the period.

Operating Income (loss)

The Group recorded an operating loss of €6.1m in 2024, compared to an operating profit of €1.2m in 2023. The prior year's result was favorably impacted by a €6.9m capital gain from the sale of patents to the joint venture in China.

Net Profit

Net profit came to a loss of €10.4m in 2024, compared with a loss of €3.7m in 2023.

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio®, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio® platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer can be found at the end of this document.

Disclaimer

This press release contains forward-looking statements about Mauna Kea Technologies and its business. All statements other than statements of historical fact included in this press release, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 3 of Mauna Kea Technologies' 2022 Universal Registration Document filed with the Autorité des marchés financiers (AMF) on June 28, 2023 under number D-23-0545, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

1 Excluding license revenue

2 EBITDA corresponds to current operating income before depreciation and amortization

3 Cash variation excluding financing operations and payments from Tasly JV

4 See press release dated July 25, 2024. Available balance of 1,100,000 potential shares

5 Delegation of capital increase with cancellation of shareholders' preferential subscription rights in favor of a category of persons meeting certain characteristics

6 Based on the 70,202,127 shares comprising the share capital as of March 31, 2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20250424847856/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu