QUARTERLY REVENUE REBOUNDS TO 3,107 THOUSAND AFTER DECLINES IN Q3 AND Q4 2024

STRONG MOMENTUM IN AEROSPACE ACTIVITIES, WITH QUARTERLY SALES REACHING THE SECOND-HIGHEST LEVEL IN THE GROUP'S HISTORY

CONSOLIDATED GROSS MARGIN INCREASES TO 41.1%

SUSTAINABLE PROFITABILITY MAINTAINED IN AN UNSTABLE ECONOMIC ENVIRONMENT

ADJUSTED EBITDA1 OF 502 THOUSAND (16.2% OF REVENUE)

QUARTERLY NET PROFIT OF 292 THOUSAND (9.4% OF REVENUE)

DEVELOPMENT OF "ENGINE CONTROL" ACTIVITIES SUPPORTS THE GROUP'S PROFITABLE GROWTH AMBITIONS

INVESTOR VIDEOCONFERENCE MONDAY, MAY 5 AT 11:30 AM

(Non-audited data)

- Quarterly revenue of 3,107 thousand

- Sustained profitability despite a disrupted macroeconomic environment

- Positive adjusted EBITDA1 of 502 thousand (16.2% of revenue)

- Consolidated net profit of 292 thousand (9.4% of revenue)

- Investor videoconference: Monday, May 5 at 11:30 AM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires-0505?s=ac1079d2-a3ba-41f9-b347-9387db242ceb

Regulatory News:

MEMSCAP (Euronext Paris: MEMS), leading provider of high-accuracy, high-stability pressure sensor solutions for the aerospace and medical markets using MEMS technology (Micro Electro Mechanical Systems), today announced its earnings for the first quarter of 2025 ending March 31, 2025.

Analysis of consolidated revenue

The distribution of consolidated revenue from continuing operations (non-audited) by market segment for the first quarter of 2025 is as follows:

Market segments Revenue

| Q1 2024 | Q1 2024

| Q1 2025 | Q1 2025

|

Aerospace | 2,536 | 66% | 2,440 | 79% |

Medical | 929 | 24% | 268 | 9% |

Optical communications | 341 | 9% | 377 | 12% |

Others (Royalties from licensed trademarks) | 27 | 1% | 22 | 1% |

Total revenue from continuing operations | 3,832 | 100% | 3,107 | 100% |

(Any apparent discrepancies in totals are due to rounding.) | ||||

The first quarter of 2025 reflects the strength of sales in the aerospace sector. Revenue for this segment reached the second highest level ever recorded for a quarter, almost matching that of the first quarter of 2024, which remains the Group's highest-ever quarterly revenue. This performance is particularly noteworthy given the continued instability of both the macroeconomic and sector-specific environments. Compared to the fourth quarter of 2024 (€ 1,727 thousand), revenue increased by 41.3%. In the first quarter of 2025, the aerospace sector accounted for 79% of the Group's total sales.

Sales in the medical sector, however, were impacted by a major customer undergoing a regulatory compliance update of its systems.

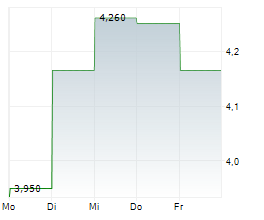

These developments resulted in consolidated Group revenue of €3,107 thousand for the first quarter of 2025, representing a decline of 18.9% compared to the first quarter of 2024, and an increase of 12.6% compared to the fourth quarter of 2024.

Analysis of consolidated income statement

MEMSCAP's consolidated earnings (non-audited) for the first quarter of 2025 are given within the following table:

In thousands of euros Non-audited | Q1 2024

| Q4 2024

| Q1 2025

|

Revenue from continuing operations | 3,832 | 2,759 | 3,107 |

Cost of revenue | (2,298) | (1,811) | (1,830) |

Gross margin | 1,534 | 948 | 1,277 |

% of revenue | 40.0% | 34.4% | 41.1% |

Operating expenses | (1,026) | (885) | (1,026) |

Operating profit (loss) | 508 | 64 | 250 |

Financial profit (loss) | 109 | 142 | 47 |

Income tax expense | (9) | (1) | (6) |

Net profit (loss) | 608 | 204 | 292 |

* Net of research development grants. (Any apparent discrepancies in totals are due to rounding.) | |||

The gross margin rate stands at 41.1% of consolidated revenue, compared to 40.0% in the first quarter of 2024. As a result, gross margin amounts to 1,277 thousand compared to 1,534 thousand for the first quarter of 2024.

Operating expenses, net of grants, remain stable at 1,026 thousand compared to the first quarter of 2024, reflecting the Group's effective control over its structural costs.

Consequently, operating profit from continuing operations amounts to 250 thousand (8.1% of consolidated revenue), compared to an operating profit of 508 thousand (13.3% of consolidated revenue) for the first quarter of 2024.

The financial result for the first quarter of 2025 continues to benefit from a favourable foreign exchange effect and amounts to 47 thousand for the quarter. The tax expense recognized in the first quarters of both 2024 and 2025 corresponds to the change in deferred tax assets. This expense has no impact on the Group's cash flow.

The consolidated net profit after tax amounts to 292 thousand (9.4% of consolidated revenue) for the first quarter of 2025, compared to a net profit of 608 thousand (15.9% of consolidated revenue) for the first quarter of 2024 and 204 thousand (7.4% of consolidated revenue) for the fourth quarter of 2024.

MEMSCAP reports an adjusted EBITDA¹ (unaudited) of 502 thousand (16.2% of consolidated revenue) for the first quarter of 2025, compared to 827 thousand (21.6% of consolidated revenue) for the first quarter of 2024 and 369 thousand (13.4% of consolidated revenue) for the fourth quarter of 2024. It should also be noted that research and development expenses have been fully expensed and have not been capitalized on the Group's balance sheet.

1 Adjusted EBITDA means operating profit before depreciation, amortisation, and share-based payment charge (IFRS 2) and including foreign exchange gains/losses related to ordinary activities.

Perspectives

MEMSCAP is showing growth compared to the previous two declining quarters. In a macroeconomic environment characterized by cautious market sentiment and ongoing disruptions in the aerospace sector, MEMSCAP's corporate project remains more committed than ever to delivering profitable growth, leveraging its major strengths, solid technological barriers, and a sustainable business model. The development of the "Engine Control" activities further supports the Group's ambitions for profitable growth in the coming years.

In addition, the Group continues to work on strengthening its operational and financial performance.

Shareholders and investors video conference Monday, May 5, 2025, at 11:30 AM

Thank you for registering and sending your questions in advance using the following link:

https://memscap.com/fr/visio/

MEMSCAP general shareholders' meeting: June 3, 2025.

Q2 2025 earnings: July 30, 2025.

About MEMSCAP

MEMSCAP is a leading provider MEMS based pressure sensors, best-in-class in term of precision and stability (very low drift) for two market segments: aerospace and medical.

MEMSCAP also provides variable optical attenuators (VOA) for the optical communications market.

For more information, visit our website at: www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris Memscap ISIN code: FR0010298620 Ticker symbol: MEMS)

View source version on businesswire.com: https://www.businesswire.com/news/home/20250429698935/en/

Contacts:

Yann Cousinet

Chief Financial Officer

Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com