Regulatory News:

Latecoere (the Company "), a Tier 1 supplier to major international aircraft manufacturers, announces the completion of a reserved capital increase for the benefit of employees and corporate officers of the group, amounting, including the issue premium, to approximately €1.1 million (the Capital Increase

This Capital Increase is part of the profit-sharing plan implemented in 2023 and is based on the authorizations of the Company's General Meeting held on December 30, 2024.

Terms of the issue

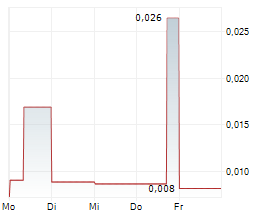

Latecoere issued 73,333,328 new shares at a unit subscription price of 0.015 euros as part of the Capital Increase.

The total amount of the Capital Increase (including issue premium) amounts to approximately 1.1 million euros (of which approximately 733,333 euros in nominal amount and 366,666 euros in issue premium).

This capital increase without preferential subscription rights benefits to persons belonging to a category of persons meeting specific characteristics, namely certain managers of Latecoere Group 1. The Capital Increase was launched on April 16, 2025 by decision of the Chief Executive Officer, acting on subdelegation of the Board of Directors of March 19, 2025, acting itself on the basis of the delegation granted by the General Meeting on December 30, 2024 (34th resolution

Five managers of Latecoere group subscribed to the Capital Increase (the Beneficiaries "), including Mr. Nick Sanders, Chairman of the Board of Directors, and Mr. André-Hubert Roussel, Chief Executive Officer of Latecoere Group.

The new shares carry current dividend rights and are treated as the same as the existing shares. They are admitted to trading on Euronext Paris on the same trading line as the existing shares.

Use of the proceeds of the issue

The proceeds of the Capital Increase will be allocated to the general needs of Latecoere Group.

Impact of the Capital Increase on the distribution of capital

Following the Capital Increase, the Company's share capital is increased from 126,198,047.26 euros to 126,931,380.54 euros, and the number of shares in the Company is increased from 12,619,804,726 shares to 12,693,138,054 shares with a nominal value of 0.01 euros each. The change in the distribution of capital and the dilutive impact for shareholders are therefore not significant.

Risk factors

The main risk factors linked to the Capital Increase are as follows for subscribers:

risk of total or partial loss of the capital invested;

the resale of securities is not guaranteed and depends on existing market conditions;

Return on investment depends on the performance of the Company.

The main risk factors associated with Latecoere are described in section 2 of the Company's 2023 Universal Registration Document filed on December 6, 2024 with the AMF and available at the following link: https://www.latecoere.aero/app/uploads/2024/12/Document-denregistrement-universel-2023.pdf

Shareholders' agreement

The Beneficiaries have adhered to the non-concerting shareholders' agreement with Searchlight Capital Partners, the main clauses of which have already been the subject of a specific publication in accordance with Article L. 233-11 of the French Commercial Code (AMF Publication No. 222C0929 of April 26, 2022)

No prospectus

Pursuant to Article 1, §4 b) and §5 a) of Regulation (EU) 2017/1129, the issue does not give rise to the establishment of a prospectus.

Free allocation of preference shares

In the context of the subscription to the Capital Increase, the Beneficiaries will be allocated free preference shares of the Company, subject where applicable to an acquisition and retention period as well as a presence condition.

The principle of this allocation was decided by the Board of Directors at its meeting of March 19, 2025, by virtue of the authorization granted by the General Meeting of December 30, 2024 under the terms of its 38th resolution.

About Latecoere

Tier 1 to the world's leading OEMs (Airbus, BAE Systems, Boeing, Bombardier, Dassault Aviation, Embraer, Honda Aircraft Company, Lockheed Martin, RTX, Thales), Latecoere serves aerospace with innovative solutions for a sustainable world. The Group operates in all segments of the aerospace industry (commercial, regional, business, defense and space) in three business areas:

- Aerostructures Europe and Americas: doors, fuselage, wings and empennage, rods;

- Interconnection Systems: wiring, avionic racks, on-board systems;

- Special Products and Services: customer services, on-board equipment, electronic systems.

As of December 31, 2024, the Group employed 5,400 people in 14 countries. Latecoere is listed on Euronext Paris Compartment B, ISIN Code: FR001400JY13 Reuters: AEP.PA Bloomberg: AT.FP

1Members of the salaried staff and/or corporate officers of the Company and/or of the companies it controls within the meaning of Article L. 233-3 of the French Commercial Code.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250506032120/en/

Contacts:

Thierry Mahé Media Relations

+33 (0)6 60 69 63 85

LatecoereGroupCommunication@latecoere.aero

Investor Relations

mandataires-ag-latecoere@latecoere.aero