We focus, simplify and improve.

Dear shareholders,

This report covers the period before I joined Albert as interim CEO in April. My view of the quarter is based on internal reporting and a detailed handover from the previous management.

A mixed start to 2025

The first quarter of 2025 was shaped by both progress and headwinds. We delivered a clear improvement in EBITDA, which came in at -6.7 million SEK compared to -12.8 million SEK in Q1 last year, a 48% improvement. This reflects reduced personnel expenses, but also lower direct sales expenses as a result of sales not reaching expected levels. Net revenue declined by 7% year-on-year to 38.6 million SEK (41.6), largely due to lower B2B sales in the period. Strawbees' important U.S. business was affected by uncertainty regarding federal cost cuts in the beginning of the year, followed by the introduction of import tariffs in the second quarter, which has led to postponed investment decisions. Within Sumdog, which primarily operates in the UK, the volumes from partner sales did not reach our expectations.

Strength in core metrics

That said, several developments point in the right direction. Our annual recurring revenue (ARR) base grew 6% year-on-year, reaching 136.7 million SEK and revenues from non-subscription sales over the past four quarters grew by 10% to 35.8 million SEK compared to the previous year. B2C ARR increased as subscriber growth and campaign performance remained solid. Gross margin improved and operating cash flow strengthened to 14.5 million SEK, nearly doubling year-on-year. We ended the quarter with 55 million SEK in cash and cash equivalents.

Focused path forward

Our focus remains firmly on the financial targets we have previously communicated:

- To achieve positive EBITDA in 2025

- To reach positive cash flow in 2026 with existing funds

- To build a foundation for long-term, profitable growth

We are simplifying our operations with profitability as our top priority. In Q2, we are reviewing our product portfolio, sharpening our commercial execution, and allocating investments even more selectively. Our focus is on initiatives that support short-term results, including scaling Albert Junior and reversing the negative trend in our B2B business for Sumdog in the UK and Strawbees in the US.

Confidence in our future

It is both inspiring and meaningful to lead a company that makes a real difference in children's learning every day. Albert has a strong foundation to build on, with a clear purpose, strong brands, and a skilled and dedicated team.

I look forward to continuing to develop the business together, achieving our goals, and driving growth and profitability forward.

Gothenburg, May 2025

Fredrik Bengtsson, CEO

1 January- 31 March

- Annual recurring revenue (ARR) from subscriptions were 136,745k (129,334k) SEK, which is an increase of 6% compared to the previous year.

- Revenue from non-subscription products over the past four quarters amounted to 35,788k (32,582k) SEK, representing an increase of 10% compared to the previous year.

- Invoiced sales for the quarter were 60,602k (63,133k) SEK, a decrease of 4% compared to the previous year.

- Net revenue amounted to 38,595k (41,602k) SEK, a decrease of 7% compared to the same period last year.

- EBITDA amounted to -6,665k (-12,766k) SEK.

- EBITA amounted to -10,056k (-16,361k) SEK.

- The result after financial items amounted to -21,256k (28,411k) SEK.

- The result for the period amounted to -20,311k (-27,147k) SEK.

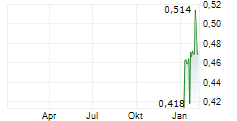

- Earnings per share amounted to -0.81 (-1.08) SEK, before and after dilution.

- Cash flow from current operations amounted to 14,492k (7,751k) SEK.

- Cash and cash equivalents at the end of the period amounted to 55,365k (86,082k) SEK.

Significant events in the first quarter of 2025

- We launched Albert Junior in the Czech Republic - a continued step in our plan towards sustainable growth. As part of this, we continue to monitor and optimise our growth markets, actively working with business models, pricing strategies, and customer acquisition to secure long-term success.

Significant events after the end of the period

- In April, Albert announced the appointment of Fredrik Bengtsson as interim CEO, effective 22 April 2025. Fredrik Bengtsson succeeds Jonas Mårtensson, who left the Albert Group on the same day.

- In early April, the United States decided to increase tariffs on products, which has had a negative impact on sales within the B2B operations of Strawbees AB. The effect is considered material for the period and may continue to impact sales in the coming quarters.

For additional information, please contact:

Fredrik Bengtsson, CEO

Mobile: +46 (0) 723 28 01 44

Email: fredrik@hejalbert.se

For additional information, please contact:

Katarina Strivall, CFO

Mobile: +46 (0) 706 840074

Email: katarina.strivall@hejalbert.se

About eEducation Albert AB (publ)

The Albert Group develops and sells edtech products for schools and consumers. The company was founded in 2015 with the goal of democratizing education and providing every child the opportunity to reach their full potential. The product portfolio includes educational apps, educational videos, and physical learning products under the brands Albert, Jaramba, Holy Owly, Film & Skola, Strawbees, and Sumdog. Since the products were launched, they have helped more than ten million children make learning engaging and personalized. The company is headquartered in Gothenburg, Sweden, and operates actively in several countries in Europe, the USA, and Asia. Albert is listed on Nasdaq First North Growth Market with the ticker symbol ALBERT. The Company's Certified Adviser is DNB Carnegie Investment Bank AB, +46 (0) 73 856 42 65, certifiedadviser@carnegie.se.

Read more at investors.hejalbert.se

This information is information that eEducation Albert is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-05-16 07:30 CEST.