Q-linea AB (publ) (OMX: QLINEA) today shared a Company and Market update.

Key messages

- Q2 instrument placements: Five newly-contracted units were placed, bringing the total to 14 YTD (2024: 4, Q1 2025: 5, Q2 2025 to date: 5)

- On track to achieve 30-40 ASTar placements by end-2025; targeting an additional 60-90 placements in 2026

- Commercial evaluations expanding across EMEA (France, Austria, Slovenia, UAE, Saudi Arabia) and US

- Five major US institutions to present ASTar-related posters at ASM (American Society for Microbiology) 2025, including Quest, Baylor Scott & White, Memorial Sloan Kettering Cancer Center, PennState University and George Washington University

- Capital raise successfully closed in May with >90% participation, netting approx. 250 MSEK post-transaction costs

Italy | Crossing the Chasm

Italy continues to lead in adoption with three new hospital contracts and five ASTar placements in Q2. This includes a tender win at Policlinico di Milano, a leading medical facility in Lombardia. Our attention is now turning to supporting the adoption into routine use across an increasingly robust installed base. A key milestone is expected in July 2025 with a decision on the Tuscan ESTAR tender (covering nine labs), which could elevate total routine rapid AST sites in Italy to 20 - 25, approaching the 10 - 15 per cent penetration point that typically precedes mass-market adoption.

Notably, Q-linea signed its first "direct-to-validation" contract, bypassing an in-lab evaluation-an indicator of growing trust in the brand and underlying technology. Early deployment feedback is robust, with sites reporting measurable clinical and operational value. ASTar is establishing leadership in Italy, being especially well-suited for the main microbiology testing hubs.

US | Customers are getting hands-on with ASTar

The quarter has been busy for the team with five new commercial evaluations initiated and two evaluations completed. We now have five active contracting processes ongoing following successful evaluations, several of which have multi-site and/or multi-ASTar dimensions. Deployment preparations continue with our large national reference laboratory customer with prioritization of six systems to begin using ASTar.

External pilot initiatives are exploring the use of ASTar in gram-negative isolate testing for research purposes with encouraging early results.

Global | Expanding commercial reach

Active and planned evaluation processes have begun in France, Austria, Slovenia, UAE, and Saudi Arabia. Agile commercial models are being explored in our expansion markets to enable faster market entry with minimal internal overhead.

Responding to strong interest from customers and partners at ESCMID (European Society of Clinical Microbiology and Infectious Diseases) in April, we have initiated conversations on bringing ASTar to India and other markets in Asia. I was also able to listen to hospital and lab managers in Canada during the CACMID (Canadian Association for Clinical Microbiology and Infectious Diseases) conference in Calgary. These markets have longer lead times, but it is noteworthy that Q-linea is being approached by experienced players with a keen interest to support local market access and distribution activities.

Competitive landscape | Market differentiation is emerging

Q-linea is benefiting from rising interest in rapid AST, as are other players. In addition to 14 contracted ASTar units globally, GradienTech has up to six instruments in routine clinical use in Europe and BioMérieux recently announced its first US commercial contract for the REVEAL rapid AST system.

Customer criteria for platform selection are solidifying and ASTar is uniquely well-placed to serve the market across a range of workflow, clinical performance and economic attributes. Conversely, technologies that were designed against alternative customer needs are experiencing challenges. Our team reports that the Accelerate Pheno and Selux NGP platforms are in commercial pause to regroup, the former under Chapter 11 in the US.

In parallel, several announcements of grants or capital raises for investment in future rapid AST solutions underscore the belief in the potential of a market estimated at SEK 6 - 9 billion. We anticipate the market will continue to focus down on the platforms and technologies that best meet the complex needs of the modern microbiology laboratory.

Clinical evidence | ASTar users are speaking for themselves

We are proud that seven posters at the US ASM Microbe 2025 conference this month will feature ASTar. Five of these are published by ASTar users in the US, including Quest Diagnostics, a leading national reference laboratory, Memorial Sloan Kettering Cancer Center in New York, Baylor Scott & White, a 50+ hospital IDN (Integrated Delivery Network) based in Texas, and leading east coast academic medical centres Pennsylvania State University and George Washington University. This is an unprecedented body of independent research in rapid AST.

Additional LIFETIMES study data presented by the Q-linea scientific team will show time-to-optimised-therapy 1.3 days (>30 hours) faster than current standard of care. Previous studies have demonstrated that ASTar delivers actionable results 34 - 40 hours sooner than standard of care and the new data confirm clinical teams act on these results, modifying treatment for 29 per cent of patients.

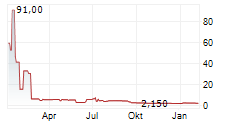

Financial update | Successful exercise of warrants from Unit Rights Issue

Over 90 per cent of shareholders exercised their warrants in May, providing Q-linea with 59.5 MSEK (before transaction costs). The warrant exercise concludes a 260 MSEK equity raise (initial proceeds for units was 204 MSEK and warrant exercise 59,5 MSEK) during 2025, that provides Q-linea with resources to continue to deliver on our growth plan.

We continue to explore non-dilutive funding opportunities to support ongoing commercialisation and future product innovation.

Thank you for your continued support.

Best regards,

Stuart Gander, on behalf of the Q-linea team

President & CEO

For more information, please contact:

Stuart Gander, President & CEO, Q-linea

Stuart.Gander@qlinea.com

+1 857 409 7463

Christer Samuelsson, CFO /IR, Q-linea AB

Christer.Samuelsson@qlinea.com

+46 (0) 70-600 15 20

About Q-linea

Q-linea's rapid AST system, ASTar®, accelerates and simplifies the time-sensitive workflows faced during the treatment of patients with bloodstream infections and sepsis. Hospitals use ASTar to vastly reduce the time to optimal antimicrobial therapies and ensure that patients receive the correct treatments sooner - when time matters most. We are helping to create sustainable healthcare, now and in the future, and safeguard the effectiveness of antibiotics for generations to come.

Q-linea is headquartered in Uppsala, Sweden and has regional offices in Italy and the USA, with partnerships worldwide.

ASTar Instrument and ASTar BC G- Consumable kit are CE-IVD marked and FDA 510(k) cleared. For more information, please visit www.qlinea.com