TORONTO, ON / ACCESS Newswire / June 25, 2025 / SonicStrategy Inc., the blockchain infrastructure subsidiary of Spetz Inc. (CSE:SPTZ)(OTC:DBKSF), is pleased to announce further expansion of its digital asset position within the Sonic blockchain ecosystem.

The Company has acquired an additional 1,000,000 Sonic (S) tokens on the open market at an average cost of approximately $0.3724 CAD ($0.2711 USD) per token, representing a total investment of $373,000 CAD. This acquisition brings the Company's direct holdings to over 8,200,000 S tokens, reflecting its conviction in Sonic as a next-generation Layer 1 blockchain.

The Company's institutional-grade validator continues to see growing adoption, with total delegated tokens now exceeding 6,740,000 S, up from 3,700,000 just a few days prior (see figure 1 below). Independent Sonic holders continue to delegate to SonicStrategy's validator infrastructure, trusting in its security, uptime, and performance to generate and distribute staking rewards efficiently.

Taken together, SonicStrategy now has exposure to nearly 15,000,000 S tokens, combining direct holdings and third-party validator delegations. This level of engagement underscores the Company's commitment to building sustainable economic infrastructure within the Sonic ecosystem while generating long-term yield for stakeholders.

The Company also continues to hold 3.7 BTC as part of its broader digital asset treasury strategy, and approximately $3,000,000 CAD.

Figure 1 - Screenshot from Sonic Labs Validator Portal showing SonicStrategy's institutional-grade validator (ID #45), with 500,000 S tokens self-staked and 6,741,069.789 S tokens delegated by third-party token holders.

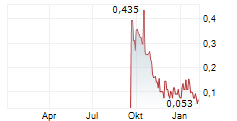

The Company also announces that it has entered into a market making agreement, effective June 5th, 2025, with Independent Trading Group (ITG) Inc., a CIRO member firm based in Toronto, to provide market making services for its common shares traded on the Canadian Securities Exchange with the objective of maintaining a reasonable market and improving the liquidity of the Company's shares. Under the terms of the agreement, Spetz Inc. will pay a monthly service fee of $5,000 CAD. There are no performance obligations contained in the agreement and ITG will not receive shares, options or any other form of equity in the Company as compensation. The agreement is renewable monthly and may be terminated by either party with 30 days' notice. ITG and the Company are arm's-length parties, and ITG and its principals do not currently own or have any interest, directly or indirectly, in the securities of the Company, however, ITG and its clients may acquire an interest in the securities of the Company in the future.

Further updates will be provided as SonicStrategy executes additional capital deployment and staking strategies across the network.

For more information, visit:

SonicStrategy: www.sonicstrategy.io

About Spetz Inc. (dba SonicStrategy)

Spetz Inc. (dba SonicStrategy) (CSE:SPTZ)(OTC PINK:DBKSF) is the parent company of SonicStrategy Inc., a public-market gateway to the Sonic blockchain ecosystem. Spetz provides investors with compliant exposure to staking infrastructure and DeFi strategies across the Sonic network.

Company Contacts:

Investor Relations

Email: Investors@sonicstrategy.io

Mitchell Demeter

Email: mitchell@sonicstrategy.io

Phone: 345-936-9555

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "may", "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur.

The forward-looking information contained in this press release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation or sale in any state, province, territory or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state, province, territory or jurisdiction. None of the securities issued in the Private Placement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act.

We seek Safe Harbor.

SOURCE: Spetz Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/blockchain-and-cryptocurrency/sonicstrategy-approaches-15m-sonic-tokens-staked-and-delegated-with-3-1042901