This initiative is part of a long-term strategy for financial consolidation and growth support.

- Oxurion enters negotiations with Atlas Special Opportunities for a new €10 million convertible bond program, in €1 million tranches, convertible with a 10% premium over the 15-day volume-weighted average price (VWAP)

- The proceeds from the issuance are intended to be invested in Bitcoin and Ethereum

- Oxurion aims to leverage this long-term exposure to Bitcoin and Ethereum as an additional value creation lever supporting its core business growth strategy

Leuven, BELGIUM - July 22, 2025 at 8:30 AM CET, Oxurion NV (Euronext Brussels: OXUR), a biopharmaceutical company based in Leuven, announces that it has entered into an indicative agreement (term sheet) with the fund Atlas Special Opportunities to set up a €10 million convertible bond financing programme. This funding is intended to support the implementation of a new treasury investment policy, dedicated to targeted exposure to digital assets.

The company is targeting a closing of the transaction before the end of August 2025, subject to the finalization of contractual documentation and receipt of required approvals. Oxurion's management welcomes this progress. The current subscription agreement remains in place.

Use of Funds and Disbursement Terms

The funds raised under this agreement will be allocated to the strategic acquisition of digital assets (Bitcoin and Ethereum).

The convertible bonds will be issued in the form of ORA (Obligations Remboursables en Actions, or Redeemable Bonds in Shares) with the following characteristics:

- Maturity: twelve (12) months from the date of issuance

- Coupon: 6% annually, plus applicable Euribor

- Issue price: 90% of the nominal value

- Conversion price: 15-day VWAP (Volume Weighted Average Price) plus a 10% premium

- Transaction fees: 3.0% of the total commitment, payable to the investor

- Default clause: In addition to standard events of default, the agreement includes a clause stating that if the company's share price remains below the conversion price for more than a quarter, the investor may terminate the funding commitment

The tranches will be drawn sequentially (10 tranches of €1 million each), provided that 50% of the previous tranche has been converted, unless otherwise agreed between the parties. The proceeds of the issuance will be used to purchase digital assets, which will be pledged for the benefit of the investor.

Notes:

- ORA (Obligations Remboursables en Actions): financial instruments allowing the company to redeem the bonds either in cash or in newly issued shares, as per contract terms.

- VWAP (Volume Weighted Average Price): 15-day average share price weighted by trading volume, used as a reference to set the ORA conversion price.

Release Criteria

Under the indicative agreement, the company may freely unlock part or all of its cryptocurrency holdings, up to a daily limit equivalent to 20% of the average daily trading volume over the past 15 trading days. This option is only available if the VWAP over that period exceeds the fixed conversion price by at least 30%. The fixed conversion price is defined as the 15-day VWAP plus a 10% premium.

This gradual unlocking policy is designed to ensure a sustainable commitment to the company's crypto strategy. It aims to prevent early exit from digital assets by favoring a long-term approach aligned with asset valuation and market conditions.

Illustrative Calculation Example

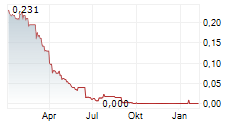

In this example, the 15-day VWAP as of July 23, 2025, is €0.0255. Based on this, the applicable conversion price, including the contractual 10% premium, is €0.02805 (€0.0255 × 1.10).

In the event of a 50% increase in the share price:

If the 15-day VWAP rises by 50%, it would reach €0.03825.

This level would be 36% higher than the €0.02805 conversion price, fulfilling the conditions required for partial release of the assets.

A Project Aligned with Oxurion's Ambitions

The primary goal of this investment strategy is to diversify and strengthen the Group's resources by gradually gaining exposure to Bitcoin and Ethereum. The strategy reflects a long-term positioning on major digital assets, intended to directly or indirectly develop or support the company's core activities.

This investment approach responds to a dual imperative: to secure and optimize available financial resources while actively supporting the group's strategic ambition to become a leading European player in clinical data and biotechnology.

About Oxurion

Oxurion NV (Euronext Brussels: OXUR) is a biopharmaceutical group in transition, combining therapeutic innovation with technologies applied to clinical research. Through its rapidly expanding technology division, Oxurion is building integrated expertise around clinical data, with the ambition to accelerate, secure, and transform the processes involved in developing new treatments.

The Group's headquarters are located in Leuven, Belgium.

More information: www.oxurion.com

Important information about forward-looking statements

Certain statements in this press release may be considered "forward-looking". Such forward-looking statements are based on current expectations, and, accordingly, entail and are influenced by various risks and uncertainties. The Company therefore cannot provide any assurance that such forward-looking statements will materialize and does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or any other reason. Additional information concerning risks and uncertainties affecting the business and other factors that could cause actual results to differ materially from any forward-looking statement is contained in the Company's Annual Report. This press release does not constitute an offer or invitation for the sale or purchase of securities or assets of Oxurion in any jurisdiction. No securities of Oxurion may be offered or sold within the United States without registration under the U.S. Securities Act of 1933, as amended, or in compliance with an exemption therefrom, and in accordance with any applicable U.S. state securities laws.

Additional Disclaimer

The planned investment in digital assets (such as Bitcoin and Ethereum) exposes the company to specific risks related to volatility, regulatory uncertainty, and cybersecurity. These factors may significantly affect the expected performance of the investments.

For further information please contact:

| Oxurion NV Pascal Ghoson Chief Executive Officer Pascal.ghoson@oxurion.com |

- SECURITY MASTER Key: mZqfYchvk2ycnGmaaseXamqVZ2hnyJGZapfGmWOZZsmbnZ9knG1hm8aWZnJklmdu

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-93128-oxurion_pr_allocation-crypto_20250722_en_exe.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free