Regulatory News:

Eurofins (Paris:ERF):

Financial highlights in H1 2025

- Reported revenues of €3,612m increased year-on-year by 5.7% and reached the highest level achieved by Eurofins in any 6-month period in its history.

- Organic revenue growth13 was 3.9% (2.9% excluding adjustment for public working days).

- In what is traditionally the weakest half of the year, adjusted1 EBITDA3 of €810m was 7.0% higher year-on-year vs €757m in H1 2024. The corresponding adjusted EBITDA margin18 of 22.4% and year-on-year improvement of 30bps vs H1 2024 is in line with Eurofins' public objective to improve its profitability above the level achieved in the prior year.

- In the mature scope14 representing €3,361m of revenues (93% of the Group), the adjusted1 EBITDA3 margin was 24.1%, a year-on-year improvement of 70bps and above Eurofins' FY 2027 target of 24%.

- The non-mature scope14 (comprising start-ups and acquisitions in significant restructuring) represented revenues of €251m, a sizable increase vs €189m in H1 2024 due to the first-time inclusion of the acquisition of SYNLAB's clinical diagnostics operations in Spain in Q2 2025. Temporary losses in this scope decreased to €20m vs €26m in H1 2024.

- Net Profit7 amounted to €247m (+12.3% year-on-year vs H1 2024) and Basic EPS8 was €1.20 (+18.4% year-on-year).

- Eurofins' Free Cash Flow to the Firm10 (FCFF), before discretionary investment in owned sites16, was €354m, 3.8% higher than the €341m achieved in H1 2024.

- Net working capital12 intensity improved from 6.3% at the end of H1 2024 to 5.5% at the end of H1 2025. Financial leverage (net debt11 to adjusted1 pro-forma EBITDA3) of 2.1x at the end of H1 2025 remains well within Eurofins' target range of 1.5-2.5x in the mid-term.

- The successful long-term refinancing of hybrid bonds and Schuldschein loans under favourable conditions during H1 2025 reinforced Eurofins' strong balance sheet and extended its debt maturity profile.

Strategic highlights in H1 2025

- Eurofins continued its strategy of focussing on reasonably valued bolt-on deals that will provide appropriate accretion to return on capital employed:

- 22 business combinations were closed that generated FY 2024 pro-forma revenues of over €210m. The businesses were acquired at a cost of €158m, reflecting a sales multiple of 0.75x:

- Companies acquired in H1 2025 include SYNLAB's clinical diagnostics operations in Spain, which achieved revenues of approximately €140m in FY 2024.

- As part of its ongoing programme to build an unmatched global service platform, Eurofins added 30,000 m2 of net surface area to expand its laboratory network.

- Eurofins invested €78m to purchase and develop laboratory sites it has discretionarily chosen to own instead of rent.

- Furthermore, as part of the acquisition of SYNLAB's clinical diagnostics operations in Spain, Eurofins added a 10,000 m2 state-of-the-art laboratory facility in Barcelona.

- The total surface area of owned sites currently amounts to ca. 659,000 m2 or ca. 35% of total net floor area operated by Eurofins.

- Following the very high approval rating of 95.6% for the 18th resolution presented at its Annual Ordinary General Meeting on 24 April 2025, Eurofins plans to complete the acquisition of all related party-owned sites that have been confirmed to be of strategic interest in the second half of 2025.

- The acquisition of these sites will further increase the net floor area owned by Eurofins by ca. 238,000 m2

- Following the acquisition of these sites, annualised rent paid to related parties (€36m in FY 2024) is anticipated to decline to a negligible amount and eventually to zero once the leases on the few, minor remaining related party-owned sites conclude.

- Eurofins plans to finance the acquisition of these sites by issuing long-term debt, while the impact on its financial leverage ratio is expected to be limited to less than 0.2x.

2025 and 2027 Objectives

Eurofins is confirming its objectives for FY 2025 and for the mid-term to FY 2027:

- For FY 2025:

- Eurofins targets mid-single-digit organic growth13 and potential revenues from acquisitions of €250m consolidated at mid-year.

- The adjusted EBITDA margin18 is expected to continue improving over the level in FY 2024 of 22.3%.

- SDI2 at the EBITDA3 level should be slightly lower in value than the level in FY 2024 of €113m.

- Significant investments in digitalisation, completion of the hub and spoke network of state-of-the-art laboratories and start-ups will continue in H2 2025. Nevertheless, Eurofins expects that Free Cash Flow to the Firm10 (FCFF) before investment in owned sites16 will improve over the level in FY 2024 (€954m).

- These objectives assume the same average exchange rates in FY 2025 as in FY 2024. Should it persist through the second half of 2025, the recent strengthening of the Euro vs other currencies (particularly the U.S. Dollar) may have translational effects on Eurofins' financial results reported in Euros.

- In FY 2025, Eurofins aims to achieve self-financing of all its regular financing needs, including net operating capex, investment in owned sites (excluding the purchase of related party-owned sites), acquisitions, interest and coupons on bonds and dividends before share buy-backs.

- In the mid-term to FY 2027:

- Eurofins confirms its long-term average organic growth13 objective of 6.5% p.a. driven by secular growth trends in its end markets as well as its target for potential average revenues from acquisitions of €250m p.a. over the period consolidated at mid-year.

- The adjusted EBITDA margin18 objective for FY 2027 remains 24% and SDI2 at the EBITDA3 level should decline towards about 0.5% of revenues in FY 2027. Progression towards these FY 2027 objectives is likely to be back end loaded as 2025 and 2026 will still see very significant spend on operational expenses related to digitalisation and dilution from acquisitions.

- Further increases in FCFF10, cash conversion and ROCE are expected as Eurofins completes its 5-year (2023-2027) investment programme.

- Eurofins targets to maintain a financial leverage in the range of 1.5-2.5x in the mid-term and intends to gradually bring it down towards the lower end of the range by FY 2027. If needed, potential divestments of non-core ancillary businesses would provide Eurofins with further financial flexibility.

- These objectives assume the same average exchange rates in the mid-term to FY 2027 as in FY 2024. Actual results for each year will depend on the development of individual end markets, exchange rates, the evolution of inflation and the quantum and profitability of M&A, among other factors.

- Capital allocation for strategically important investments remains key to Eurofins' long-term value creation strategy. Priorities for net operating capex in FY 2025 and in the mid-term will continue to include start-ups in high-growth/high-return areas, and the development and deployment of sector-leading proprietary IT solutions. Capital allocation for net operating capex is expected to be ca. €400m p.a.

- Investments to own Eurofins' larger state-of-the-art sites will continue and are assumed to comprise around €200m p.a. over the 2023-2027 period (up to €1bn in total and possibly less, thereof €384m invested as of H1 2025). This objective excludes the planned acquisition of related party-owned sites in H2 2025.

Comments from the CEO, Dr Gilles Martin:

"In the first half of 2025, Eurofins has been able to continue its track record of profitable growth despite continued macroeconomic and geopolitical uncertainty and volatility. At over €3.6bn, semi-annual revenues in, traditionally, the weakest half of the year reached a new record, driven by resilient demand in most of our end markets and regions, contributions from the ramp up of start-ups initiated in the past years and the completion of reasonably valued acquisitions to drive future profitable growth. At the same time, we have been able to further improve our financial performance in all regions thanks to efforts by Eurofins teams to manage pricing, costs and capital expenditures.

In addition to improved financial performance, our financial position has been reinforced with long-term refinancings of hybrid bonds and Schuldschein loans, confirming investor confidence in Eurofins' profitability and cash flow growth trends. With financial leverage at the end of June 2025 at 2.1x, our solid balance sheet has ample capacity to allow us to continue with our strategic investment plans.

Looking forward to the end of 2025, Eurofins' management expects that the business momentum will improve relative to the first half of the year due to the resilience of demand in Life and BioPharma Product Testing and easier prior year comparables in certain ancillary activities in BioPharma and routine clinical testing in France. In terms of profitability, notwithstanding potential currency translation effects, we remain confident in our ability to make improvements to our adjusted EBITDA margins18 and cash generation in 2025 vs 2024, while staying on track to achieve our 2027 financial objectives. Strategically, we remain laser focused on completing our 5-year investment programme in 2027, that will sustainably make Eurofins the most productive, digital, innovative and customer-centric network of laboratories in the end markets and regions we serve, providing an unmatched level of service and quality to our clients and an inspiring, rewarding and sustainable workplace for our teams."

Conference Call

Eurofins will hold a conference call with analysts and investors today at 15:00 CEST to discuss the results and the performance of Eurofins, as well as its outlook, and will be followed by a questions and answers (Q&A) session.

Click here to Join Call >>

From any device, click the link above to join the conference call.

Business Review

The following figures are extracts from the Condensed Interim Consolidated Financial Statements and should be read in conjunction with the Condensed Interim Consolidated Financial Statements and Notes for the period ended 30 June 2025. The Half Year Report 2025 can be found on Eurofins' website at the following link: https://www.eurofins.com/investors/reports-and-presentations/.

Alternative performance measures and separately disclosed items2 are defined at the end of this press release.

Table 1: Half Year 2025 Results Summary

H1 2025 | H1 2024 | +/- Adjusted1 results | +/- Reported results | |||||

In €m except otherwise stated | Adjusted1 results

| Separately disclosed items2 | Reported results | Adjusted1 results

| Separately disclosed items2 | Reported results | ||

Revenues | 3,361 | 251 | 3,612 | 3,230 | 189 | 3,419 | 4% | 6% |

EBITDA3 | 810 | -37 | 773 | 757 | -43 | 714 | 7% | 8% |

EBITAS4 | 531 | -67 | 464 | 497 | -65 | 432 | 7% | 7% |

Net profit7 | 361 | -114 | 247 | 320 | -100 | 220 | 13% | 12% |

Basic EPS8 | 1.83 | -0.63 | 1.20 | 1.55 | -0.54 | 1.01 | 18% | 18% |

Net cash provided by operating activities | 526 | 530 | -1% | |||||

Net capex9 | 251 | 252 | 0% | |||||

Net operating capex | 173 | 190 | -9% | |||||

Net capex for purchase and development of owned sites | 78 | 62 | +26% | |||||

Free Cash Flow to the Firm before investment in owned sites16 | 354 | 341 | +4% | |||||

M&A spend | 158 | 246 | -36% | |||||

Net debt11 | 3,360 | 2,863 | +17% | |||||

Leverage ratio (net debt11/pro-forma adjusted1 EBITDA3 | 2.1x | 1.9x | 0.2x | |||||

Revenues

Reported revenues increased year-on-year to €3,612m in H1 2025 vs €3,419m in H1 2024, supported by resilient organic growth13 of 3.9% (2.9% excluding adjustment for public working days) and acquisitions, which contributed €49m to consolidated revenues in H1 2025. Note that H1 2024 pro-forma revenues include a contribution of €77mfrom acquisitions that were completed, but not consolidated, in FY 2024. In contrast, a year-on-year headwind of 0.7% from foreign currency negatively impacted revenue development.

Table 2: Organic Growth13 Calculation and Revenue Reconciliation

In €m except otherwise stated | |

H1 2024 reported revenues | 3,419 |

H1 2024 acquisitions revenue part not consolidated in H1 2024 at H1 2024 FX | 77 |

H1 2024 revenues of discontinued activities disposals15 | -11 |

H1 2024 pro-forma revenues (at H1 2024 FX rates) | 3,484 |

H1 2025 FX impact on H1 2024 pro-forma revenues | -24 |

= H1 2024 pro-forma revenues (at H1 2025 FX rates) (a) | 3,461 |

H1 2025 organic scope* revenues (at H1 2025 FX rates) (b) | 3,562 |

H1 2025 organic growth13 rate (b/a-1) | 2.9% |

H1 2025 acquisitions revenue part consolidated in H1 2025 at H1 2025 FX | 49 |

H1 2025 revenues of discontinued activities disposals15 | 1 |

H1 2025 reported revenues | 3,612 |

In €m except otherwise stated | |

Q2 2024 reported revenues | 1,766 |

Q2 2024 acquisitions revenue part not consolidated in Q2 2024 at Q2 2024 FX | 27 |

Q2 2024 revenues of discontinued activities disposals15 | -6 |

Q2 2024 pro-forma revenues (at Q2 2024 FX rates) | 1,786 |

Q2 2025 FX impact on Q2 2024 pro-forma revenues | -45 |

= Q2 2024 pro-forma revenues (at Q2 2025 FX rates) (a) | 1,742 |

Q2 2025 organic scope revenues (at Q2 2025 FX rates) (b) | 1,798 |

Q2 2025 organic growth13,* rate (b/a-1) | 3.2% |

Q2 2025acquisitions revenue part consolidated in Q2 2025at Q2 2025FX | 47 |

Q2 2025revenues of discontinued activities disposals15 | 1 |

Q2 2025 reported revenues | 1,845 |

* Organic scope consists of all companies that were part of the Group as of 01/01/2025. This corresponds to the 2024 pro-forma scope.

Table 3: Breakdown of Revenue by Operating Segment

€m | H1 2025 | As of total | H1 2024 | As of total | Y-o-Y variation % | Organic growth13 |

Europe | 1,855 | 51% | 1,748 | 51% | 6.2% | 2.2% |

North America | 1,371 | 38% | 1,311 | 38% | 4.6% | 2.5% |

Rest of the World | 386 | 11% | 360 | 11% | 7.1% | 8.3% |

Total | 3,612 | 100% | 3,419 | 100% | 5.7% | 2.9% |

€m | Q2 2025 | As of total | Q2 2024 | As of total | Y-o-Y variation % | Organic growth13 |

Europe | 962 | 52% | 897 | 51% | 7.2% | 1.6% |

North America | 687 | 37% | 683 | 39% | 0.5% | 4.1% |

Rest of the World | 197 | 11% | 185 | 10% | 6.2% | 8.5% |

Total | 1,845 | 100% | 1,766 | 100% | 4.5% | 3.2% |

Europe

- Reported revenues increased in H1 2025 vs H1 2024 by 6.2%, driven by resilient organic growth13 of 3.3% (2.2% excluding adjustment for public working days) in most areas of activity as well as through acquisitions, most notably SYNLAB's clinical diagnostics operations in Spain.

- Food and Feed Testing in Europe saw solid growth in most countries in the first half of the year, supported by both pricing attainment and volume growth. Profitability improvements were driven by sustained disciplined cost management and further progress on footprint optimisation, in particular the segmentation of operations between European competence centres and national production centres. In the meantime, Eurofins made further progress with the deployment of its eLIMS-NG and its integrated suite of bespoke solutions. The rollout is expected to be completed by the beginning of 2027 and should help to further reduce costs and improve productivity in laboratories.

- The Environment Testing business in Europe has been able to extend its growth trend into the first half of 2025. Its end markets continue to benefit from expanding regulations throughout the continent, including the European Union directive 2024/3019 concerning urban wastewater treatment and the Hazardous Substances Ordinance (GefStoffV) in Germany which requires more stringent asbestos detection. Growth was also supported by commercial excellence initiatives undertaken. Financially, contributions from higher volumes and pricing measures, as well as from cost discipline and automation initiatives, have improved profit margins. Going forward, the completion of the roll-out of next-generation LIMS solutions to replace legacy systems and the reduction of a vast array of costly and less-efficient legacy IT solutions should bring further benefits to Eurofins businesses.

- The market environment for BioPharma Services in Europe in the first half of 2025 continues to be affected by the diverse developments that began in 2024. On the one hand, BioPharma Product Testing and Medical Device Services continue to demonstrate stable growth. Forensics has also grown through the expansion of its service offering in the Netherlands and the integration of the Orchid Cellmark acquisition from last year. On the other hand, organic growth13 in Eurofins businesses involved in clinical studies remains negatively impacted by the large projects that ended in 2024. Demand for CDMO services also continues to face headwinds specific to the European market. Meanwhile, the Genomics business line has seen a return to growth by expanding its addressable market and customer base in genetic services and oligonucleotide production. Likewise, in Agroscience Services, revenues have been stabilised. Despite the challenging growth environment for many of its Biopharma Services companies, Eurofins has been able to improve profit margins through a combination of pricing initiatives and cost adaptation measures including footprint optimisation.

- The Clinical Diagnostics Business in Europe has been broadly stable in the first half of 2025. In France, while the effects of the reimbursement cuts implemented in September 2024 in routine clinical testing continue to affect year-on-year comparisons, volumes increased strongly from a combination of natural market growth, mix enhancement and involvement in public health screening initiatives for sexually transmitted infections. Genetics services, operating from Eurofins laboratories in France, Germany, Spain and Italy, contributed to volume and profit growth through activity enabling more personalised and predictive medicine, with a shift towards 'from genotype to phenotype'. In terms of profitability, volume growth, cost control of personnel expenses and other operational improvements have been able to largely compensate for the pricing impact. Upgrades to and harmonisation of proprietary IT systems have also boosted productivity and improved user experience. In Spain, the closing of the acquisition of SYNLAB's clinical diagnostics operations occurred at the end of March, contributing €34m of consolidated revenue in H1 2025. Integration of this business with Eurofins Megalab is underway.

North America

- Reported revenues increased year-on-year by 4.6%, positively supported by steady organic growth13 of 3.4% (2.5% excluding adjustment for public working days) but negatively affected by foreign exchange headwinds, particularly the depreciation of the U.S. Dollar vs the Euro.

- Food and Feed Testing in North America saw strong growth in the first half of 2025, as continued strength in consumer demand and market share gains drove improved volumes and mix. Eurofins has also seen increased customer interest for its product design and development services. Financially, pricing initiatives, stringent cost control of personnel expenses and disciplined investments have contributed to year-on-year increases in profitability and decreases in capital intensity. Footprint expansion and rationalisation are also proceeding as the opening of several new start-ups addressing meat and produce microbiological testing occur in parallel with the closure of sites to facilitate consolidation of activities.

- Environment Testing in North America experienced solid organic growth13 through H1 2025. Strong momentum in the second quarter of the year compensated for the negative weather-related impacts experienced in the first quarter. Growth was driven by solid market demand for PFAS testing and market share gains. Multiple bolt-on acquisitions were also completed, further expanding Eurofins' footprint whilst providing consolidation synergies. The previously announced and newly built state-of-the-art laboratory in Chicago (IL) was fully commissioned in Q1 2025. Eurofins has also made further investments in sustainability, including solar projects and EV chargers at multiple sites.

- As in 2024, market conditions for Eurofins BioPharma Services in North America have been varied. In BioPharma Product Testing, growth remains solid as Eurofins companies support customers investing in promising candidates in their pipeline. Furthermore, the business is benefiting from its expanded geographic coverage as last year's acquisition, Infinity Laboratories, is integrated into the network. The ramp-up of large investments carried out in CDMO in Canada have also driven organic growth13. Meanwhile, growth in Central and Bioanalytical Laboratories remains restrained due to the lingering impact from the early termination of several highly successful trials in 2024. Growth in these businesses is expected to improve in the latter part of 2025 and into 2026 as prior year comparables ease. Demand also remains constrained in businesses including Discovery Services and Genomics due to muted early-stage spending by biotech clients and reduced government funding for research. This has been partially compensated by increasing demand from projects connected to the development of GLP-1 related therapies. Despite these headwinds, profitability continues improving across most areas of the business, supported by cost savings from personnel cost optimisation and site consolidation.

- In Consumer Products and Technology Testing, the year-on-year development of the Materials and Engineering Science business has been affected by strong one-off AI-related comparables from the first half of 2024.

Rest of the World

- Revenues in Rest of the World increased year-on-year by 7.1%, driven by strong organic growth13 of 8.9% (8.3% excluding adjustment for public working days), but restrained by foreign exchange headwinds related to the appreciation of the Euro vs numerous currencies.

- Food and Feed Testing across Asia experienced significant organic growth13 and a strong increase in profitability. Environment Testing in Asia experienced challenging market conditions in Japan and Taiwan, however these were largely offset by robust growth and improved profitability in Singapore, Thailand, and Korea. In both the Food and Feed and Environment Testing Business Lines, Eurofins continues to optimise footprint. Building expansion projects in Food and Feed Testing laboratories were completed in Mumbai (India) and are in progress in Ho Chi Minh City (Vietnam) and Jakarta (Indonesia). Meanwhile, Consumer Product and Technology Testing businesses have been experiencing demand variability as trade tensions have resulted in fluctuating customer order patterns, particularly in China and South Korea. Despite this, Eurofins has been able to generate growth by expanding business with new and existing customers in Softlines and Hardlines as well as Electrical and Electronics testing.

- The Pacific region generated strong growth for Environment, BioPharma and Food and Feed Testing. Growth as well as efficiency projects resulted in material improvements in profitability. Ahead of anticipated demand generated from Olympic games infrastructure projects, and to accommodate organic growth13, Eurofins is investing in the build-out of its network with a new state-of-the-art laboratory in Brisbane which is scheduled to open in Q1 2026. Eurofins also completed the acquisition of Kalyx, the market leader in AgroScience Field GLP and Seed Trials in Australia and New Zealand.

- In Latin America, Food and Feed Testing continued its resilient growth in Brazil while a new start-up laboratory is being established in Peru. In BioPharma Product Testing, Eurofins Quasfar in Columbia expanded its service offering portfolio to support growing demand domestically and in Latin America for generic drugs. Conversely, muted demand in Environment Testing in Brazil and Food and Feed Testing in Chile have necessitated restructuring to improve profitability.

- In the Middle East, Ajal Laboratories continued to deliver strong growth by winning new tenders for Food and Feed Testing as well as acquiring new customers in the animal health applications space. Eurofins also initiated a start-up laboratory in Saudi Arabia to provide specialty clinical diagnostics for hospitals in collaboration with the local government.

Table 4: Breakdown of Revenue by Area of Activity

€m | H1 2025 | As of total | H1 2024 | As of total | Y-o-Y variation % | Organic growth13 |

Life* | 1,473 | 41% | 1,379 | 40% | 6.8% | 5.7% |

BioPharma** | 1,042 | 29% | 1,000 | 29% | 4.2% | 0.8% |

Diagnostic Services Products*** | 746 | 21% | 690 | 20% | 8.1% | 1.3% |

Consumer Technology Products Testing**** | 351 | 10% | 349 | 10% | 0.5% | 1.5% |

Total | 3,612 | 100% | 3,419 | 100% | 5.7% | 2.9% |

€m | Q2 2025 | As of total | Q2 2024 | As of total | Y-o-Y variation % | Organic growth13 |

Life* | 755 | 41% | 715 | 40% | 5.7% | 6.1% |

BioPharma** | 526 | 29% | 511 | 29% | 2.9% | 1.5% |

Diagnostic Services Products** | 387 | 21% | 356 | 20% | 8.7% | 1.9% |

Consumer Technology Products Testing**** | 177 | 10% | 183 | 10% | -3.5% | -0.3% |

Total | 1,845 | 100% | 1,766 | 100% | 4.5% | 3.2% |

* Consisting of Food and Feed Testing, Agro Testing and Environment Testing

Consisting of BioPharma Services, Agrosciences, Genomics and Forensic Services

*** Consisting of Clinical Diagnostics Testing and In Vitro Diagnostics (IVD) Solutions

Consisting of Consumer Product Testing and Advanced Material Sciences

Infrastructure Programme

In the first six months of 2025, Eurofins increased its net surface area of laboratory, office, and storage space by 30,000 m², resulting in a total net floor area of 1,863,000 m² at the end of June 2025. Through the delivery of building projects, building purchases and acquisitions as part of its strategy to lease less and own more of its strategic sites, Eurofins added 26,000 m² in total surface area of owned sites. Meanwhile, leased surfaces only increased by 4,000 m². In terms of ownership, the proportion of net floor area owned by Eurofins as at 30 June 2025 reached 35.4%, a continued increase compared to the 34.5% owned by Eurofins at the end of 2024, supported by the projects listed below.

In Lidköping, Sweden, a significant project at an existing facility housing Food and Feed Testing and Environment Testing operations was completed, with more than 2,300 m² either renovated or expanded, bringing the size of the Lidköping campus to 9,600 m². This renovation and expansion activity resulted in the addition of added biofuel laboratory capacity, distribution areas, laboratory changing rooms and warehouse space, and also supported the consolidation of several functions previously spread across multiple sites into one single location.

In response to growth in the Japanese Environment Testing market and following the successful commissioning of a new 3,000 m² laboratory in Hamamatsu in 2023, Eurofins completed the purchase of a previously leased 926 m² facility in Hamamatsu to strengthen its presence in this strategic sector. The site houses a PFAS testing laboratory and the newly acquired business Quality Laboratory Environment Center Ltd. This acquisition reinforces Eurofins' long-term commitment to environmental and public health testing in the Japan and the Asia Pacific region.

In March 2025, Eurofins Environment Testing North Central in the U.S. successfully completed the fit-out of a new 4,640 m² facility in Chicago (IL) to consolidate existing operations and provide capacity for future growth. Additionally, some space will be utilised by Eurofins Food and Feed Testing to build out a microbiology testing laboratory. The new facility is equipped with motion sensors for automated lighting, online HVAC monitoring systems, and air curtains at high-traffic doorways to enhance energy efficiency.

In May 2025, Eurofins acquired a previously leased facility outside of London, UK housing Eurofins Selcia, a global contract research provider of integrated drug discovery, medicinal chemistry and 14C radiolabeled compounds. This facility, comprises 3,822 m² of floor area and is situated on an 8,580 m² plot, providing ample space for future expansion.

As part of the acquisition of SYNLAB's clinical diagnostics operations in Spain, Eurofins has integrated a state-of-the-art laboratory in Barcelona into its Clinical Testing network. The 10,000 m² facility features over 5,000 m² of advanced laboratory space and houses one of the country's most powerful automated analytical systems.

For the remainder of 2025 and for 2026, Eurofins is planning to add 157,000 m² of laboratory and operational space through building projects, acquisitions, new leases and consolidation of sites, as well as through the renovation of 33,000 m² of its current sites to bring them to the highest standard.

Financial Review

Adjusted1 EBITDA3 was €810m in H1 2025. The adjusted EBITDA margin18 was 22.4%, an improvement of 30bps vs the 22.1% recorded in H1 2024. The improvement was realised through a combination of pricing adaptations, better capacity utilisation and cost efficiency initiatives.

Table 5: Separately Disclosed Items2

€m | H1 2025 | H1 2024 | |

Mature scope14 | Revenues | 3,361 | 3,230 |

EBITDA3 impact from one-off costs from network expansion, integrations, reorganisations and discontinued operations, and other non-recurring income and costs | -17 | -17 | |

Non-mature scope14 | Revenues | 251 | 189 |

EBITDA3 impact from temporary losses and other costs related to start-ups and acquisitions in significant restructuring | -20 | -26 | |

Total | Revenues | 3,612 | 3,419 |

EBITDA3 impact from Separately Disclosed Items2 | -37 | -43 |

Separately Disclosed Items2 (SDI) at the EBITDA3 level decreased year-on-year to €37m (equivalent to 1.0% of reported revenues, a 20bps decline year-on-year) and comprised:

- One-off costs from network expansion, integrations, reorganisations and discontinued operations, and other non-recurring income and costs in the mature scope14 totalled €17m, equivalent to only 0.5% of the mature scope's14 revenues, and contain significant amounts for severances and moving costs for ongoing restructuration (mainly in Germany and the U.S.).

- Temporary losses and other costs related to start-ups and acquisitions in significant restructuring in the non-mature scope14 totalled €20m, a reduction vs €26m in H1 2024. This decrease was primarily due to improved profitability in many start-up activities such as the Genomics and In Vitro Diagnostics (IVD) business lines.

Reported EBITDA3 improved by 8.3% year-on-year to €773m in H1 2025 vs €714m in H1 2024. In terms of Reported EBITDA3 as a proportion of total revenues, the margin improved year-on-year by 50bps to 21.4% in H1 2025 vs 20.9% in H1 2024.

Table 6: Breakdown of Reported EBITDA3 by Operating Segment

€m | H1 2025 | Rep. EBITDA3 margin % | H1 2024 | Rep. EBITDA3 margin % | Y-o-Y variation % |

Europe | 306 | 16.5% | 292 | 16.7% | 5.0% |

North America | 392 | 28.5% | 356 | 27.1% | 10.0% |

Rest of the World | 96 | 24.8% | 84 | 23.4% | 13.9% |

Other* | -20 | -18 | |||

Total | 773 | 21.4% | 714 | 20.9% | 8.3% |

*Other corresponds to Group service functions

In Europe, the 5% year-on-year increase in reported EBITDA3 resulted from pricing initiatives, volume growth and cost discipline measures. These measures helped to counter the negative impact of tariff cuts in France related to routine clinical testing that took place in September 2024 and the acquisition of SYNLAB's clinical diagnostics operations in Spain.

In North America, solid growth in Food Testing, Environment Testing, and BioPharma Product Testing, alongside controlled personnel and consumables costs, resulted in a 140bps year-on-year increase in reported EBITDA3 margin.

In Rest of the World, the year-on-year expansion of profits (by 13.9%) and reported EBITDA3 margin (by 140bps) resulted from strong volume growth and disciplined cost management.

Depreciation and amortisation (D&A), including expenses related to IFRS 16, increased by 9.9% year-on-year to €310m. As a percentage of revenues, D&A stood at 8.6% of revenues in H1 2025.

Net finance costs amounted to €54m in H1 2025. The decrease vs €69m in H1 2024 resulted from a positive effect on finance income from currency translation on cash pools and reduced finance costs due to less interest paid on debt instruments.

Due to the increase in profitability and a slightly higher tax rate (28.8% in H1 2025 vs 27.0% in H1 2024, as the prior year tax rate was positively impacted by one-offs in North America), the income tax expense increased to €100m in H1 2025 vs €81m in H1 2024.

Reported net profit7 in H1 2025 stood at €247m (6.8% of revenues and 12.3% higher than €220m in H1 2024). When considered in combination with the reduction in basic weighted average shares outstanding (182m in H1 2025 vs 193m in H1 2024), the reported basic EPS8 in H1 2025 was €1.20, an increase of 18.4% vs €1.01 in H1 2024.

Cash Flow Financing

Table 7: Cash Flows Reconciliation

€m | H1 2025 | H1 2024 | Y-o-Y variation | Y-o-Y variation % |

Net Cash provided by operating activities | 526 | 530 | -4 | -1% |

Net capex9 (i) | -251 | -252 | +1 | 0% |

Net operating capex (includes LHI) | -173 | -190 | +17 | -9% |

Net capex for purchase and development of owned sites | -78 | -62 | -16 | +26% |

Free Cash Flow to the Firm before investment in owned sites16 | 354 | 341 | +13 | +4% |

Free Cash Flow to the Firm10 | 276 | 279 | -3 | -1% |

Acquisition of subsidiaries, net (ii) | -158 | -246 | +88 | |

Proceeds from disposals of subsidiaries, net (iii) | 0 | 0 |

| |

Other (iv) | 0 | 14 | -14 | |

Net Cash used in investing activities (i) (ii) (iii) (iv) | -408 | -484 | +76 | +16% |

Net Cash provided by financing activities | 57 | -588 | +645 | |

Net increase (decrease) in Cash and cash equivalents and bank overdrafts | 138 | -540 | ||

Cash and cash equivalents at end of period and bank overdrafts | 751 | 681 |

Net cash provided by operating activities in H1 2025 of €526m was stable vs €530m in H1 2024, as improved profitability was counterbalanced by higher year-on-year outflows for net working capital12 (NWC) variation and cash taxes. Following impacts mainly related to COVID-19, the NWC12 intensity was particularly high at the end of 2023, leading to a one-off lower cash outflow for the change in NWC12 in H1 2024.

In relative terms, Eurofins was able to improve its NWC12 intensity, decreasing it from 6.3% at the end of June 2024 to 5.5% at the end of June 2025. The year-on-year improvement mostly resulted from a decrease in Days of Sales Outstanding (56 in H1 2025 vs 59 in H1 2024).

Cash generation more than adequately financed net capex9 of €251m. The decline in net operating capex of €173m in H1 2025 (4.8% of revenues) vs €190m in H1 2024 (5.5% of revenues) reflects discipline in programmes related to capacity expansion, particularly in areas where growth is more muted at the moment. Meanwhile, Eurofins invested €78m to own and develop its high-throughput laboratory campuses. Free Cash Flow to the Firm10 (FCFF) before investment in owned sites16 was €354m in the reporting period, an improvement vs €341m in the prior year period.

FCFF10 was steady at €276m in H1 2025 vs €279m in H1 2024. Likewise, cash conversion (FCFF10 Reported EBITDA3) of 36% in H1 2025 was relatively constant vs 39% in H1 2024.

During H1 2025, the Group completed 22 business combinations including 11 acquisitions of legal entities and 11 acquisitions of assets. Net cash outflow on acquisitions completed during the period and in previous years (in case of payment of deferred considerations) amounted to €158m.

Net cash provided by financing activities of €57 in H1 2025 was influenced by the following factors:

- As a result of Eurofins' ongoing share buy-back programme, Eurofins allocated €468m to repurchase 9,197,475 of its own shares during H1 2025. In addition, in April 2025, Eurofins disbursed €109m in dividends.

- In March 2025, Eurofins successfully raised €400m in a Euro hybrid bond public issuance. It bears a fixed annual coupon of 5.75% for the first 7 years (until 4 April 2032) with a first call date on 4 January 2032. This new series of bonds has no specified maturity date and is accounted for as 100% equity according to International Financial Reporting Standards (IFRS) and 50% equity with the rating agencies Moody's and Fitch. The proceeds of this issuance are to be used for the refinancing of its €400m hybrid bond issued on 13 November 2017 with a first call date on 13 November 2025 ("2025 Hybrid Bond"). To this end, Eurofins concluded a tender offer in April 2025 for the 2025 Hybrid Bond, for which it received and accepted €194m in valid tenders. Eurofins plans to call the outstanding €206m of the 2025 Hybrid Bond in November 2025.

- In June 2025, Eurofins successfully issued a new €500m Schuldschein loan (the "New SSD") structured in tranches of 5, 7 and 10 years. The proceeds of the New SSD will primarily be used to refinance the €234m in Schuldschein loans, with €59m already repaid in June 2025 and the remainder maturing in July and October 2025, respectively. The remainder of the New SSD will be used for general corporate purposes.

Due to the aforementioned factors, at the end of June 2025, gross debt stood at €4,114m while net debt11 stood at €3,360m. The corresponding leverage (net debt11 to last 12 months proforma adjusted1 EBITDA3) was 2.1x, an increase of 0.2x vs the end of December 2024 and well within Eurofins' 1.5x-2.5x target range. Eurofins has no major refinancing requirements until the outstanding €302m senior Eurobonds become due for repayment on 17 July 2026. Eurofins also possesses a solid overall liquidity position, which includes a cash position of €753m as at 30 June 2025, as well as access to over €1bn of committed, undrawn mid-term (3-5 years) bilateral bank credit lines.

Start-up Programme

Start-ups or green-field laboratory projects are generally pursued in either new markets, in emerging markets in particular, where there are often limited viable acquisition opportunities, or in developed markets where Eurofins transfers technology developed by its R&D and Competence Centres abroad or expands geographically to complete its national hub and spoke laboratory network in an increasing number of countries.

In H1 2025, the Group opened 6 new start-up laboratories and 19 new start-up blood collection points (BCPs). The 325 start-ups and 118 BCPs launched since 2000 have made material contributions to the overall organic growth13 of the Group, accounting for 0.8% out of the 2.9% organic growth13 achieved in H1 2025. Their EBITDA3 margin continues to progress while remaining dilutive to the Group.

Of the 325 start-ups and 118 BCPs the Group has launched since 2000, 61% are located in Europe, 14% in North America and 25% in the Rest of the World, of which a significant number are in high growth regions in Asia. By activity, 33% are in Life, 16% in BioPharma, 43% in Diagnostic Services Products BCPs are accounted for in this area of activity) and 7% are in Consumer Technology Products Testing.

Acquisitions

During H1 2025, the Group completed 22 business combinations consisting of 11 acquisitions of legal entities and 11 acquisitions of assets for a total investment of €158m. Prior to their acquisition, these entities generated revenues of about €210m in 2024 and comprised approximately 1,900 employees.

Divestments

During H1 2025, the Group discontinued some small businesses mainly in Food Testing in Germany and Clinical Diagnostics in the Middle East that contributed consolidated revenues of €1m in 2025 and €7m in 2024. The divestment or discontinuation of these businesses did not result in a material loss on disposal.

Post-Closing Events

Since 1 July 2025, Eurofins has completed 4 small business combinations, one in Europe, one in North America and two in Rest of the World. The total annual revenues of these acquisitions amounted to over €7m in 2024 for an aggregate acquisition price of ca. €9m. These acquisitions employ 90 employees.

Summary financial statements:

Table 8: Summarised Income Statement

H1 2025 | H1 2024 | |

In €m except otherwise stated | Reported | Reported |

Revenues | 3,612 | 3,419 |

Operating costs, net | -2,839 | -2,705 |

EBITDA3 | 773 | 714 |

EBITDA3 Margin | 21.4% | 20.9% |

Depreciation and amortisation | -310 | -282 |

EBITAS4 | 464 | 432 |

Share-based payment charge and acquisition-related expenses, net5 | -62 | -63 |

Gain/(loss) on disposal | -2 | |

EBIT6 | 400 | 369 |

Finance income | 24 | 15 |

Finance costs | -78 | -84 |

Share of profit of associates | 1 | |

Profit before income taxes | 346 | 301 |

Income tax expense | -100 | -81 |

Net profit7 for the year | 247 | 220 |

Attributable to: | ||

Owners of the Company and hybrid capital investors | 247 | 221 |

Non-controlling interests | -1 | |

Earnings per share (basic) in EUR | ||

Total | 1.35 | 1.14 |

Attributable to owners of the Company8 | 1.20 | 1.01 |

Attributable to hybrid capital investors | 0.15 | 0.13 |

Earnings per share (diluted) in EUR | ||

Total | 1.31 | 1.13 |

Attributable to owners of the Company | 1.16 | 1.00 |

Attributable to hybrid capital investors | 0.15 | 0.13 |

Basic weighted average shares outstanding in millions | 182.1 | 193.0 |

Diluted weighted average shares outstanding in millions | 188.5 | 195.2 |

Table 9: Summarised Balance Sheet

30 June

| 31 December 2024 | |

In €m except otherwise stated | Reported | Reported |

Property, plant and equipment | 2,437 | 2,560 |

Goodwill | 4,596 | 4,841 |

Other intangible assets | 711 | 788 |

Investments in associates | 6 | 6 |

Non-current financial assets | 104 | 112 |

Deferred tax assets | 113 | 130 |

Total non-current assets | 7,967 | 8,436 |

Inventories | 146 | 142 |

Trade receivables | 1,069 | 1,094 |

Contract assets | 328 | 306 |

Prepaid expenses and other current assets | 211 | 192 |

Current income tax assets | 110 | 102 |

Derivative financial instruments assets | 1 | 2 |

Cash and cash equivalents | 753 | 614 |

Total current assets | 2,619 | 2,452 |

Total assets | 10,586 | 10,888 |

Share capital | 2 | 2 |

Treasury shares | -223 | -308 |

Hybrid capital | 1,206 | 1,000 |

Other reserves | 1,063 | 1,601 |

Retained earnings | 2,810 | 2,692 |

Currency translation reserve | -223 | 352 |

Total attributable to owners of the Company | 4,635 | 5,339 |

Non-controlling interests | 36 | 46 |

Total shareholders' equity | 4,672 | 5,385 |

Borrowings | 3,575 | 3,131 |

Derivative financial instruments liabilities | 6 | |

Deferred tax liabilities | 100 | 110 |

Amounts due for business acquisitions | 55 | 63 |

Employee benefit obligations | 64 | 66 |

Provisions | 29 | 23 |

Total non-current liabilities | 3,829 | 3,393 |

Borrowings | 538 | 479 |

Interest due on borrowings and earnings due on hybrid capital | 112 | 55 |

Trade accounts payable | 605 | 646 |

Contract liabilities | 176 | 196 |

Current income tax liabilities | 25 | 35 |

Amounts due for business acquisitions | 30 | 46 |

Provisions | 21 | 33 |

Other current liabilities | 577 | 621 |

Total current liabilities | 2,085 | 2,110 |

Total liabilities and shareholders' equity | 10,586 | 10,888 |

Table 10: Summarised Cash Flow Statement

H1 2025 | H1 2024 | |

In €m except otherwise stated | Reported | Reported |

Cash flows from operating activities | ||

Profit before income taxes | 346 | 301 |

Depreciation and amortisation | 310 | 282 |

Share-based payment charge and acquisition-related expenses, net5 | 62 | 63 |

Gain/(loss) on disposal | 2 | |

Finance income and costs, net | 50 | 68 |

Share of profit from associates | -1 | |

Transactions costs and income related to acquisitions | -6 | -4 |

Changes in provisions employee benefit obligations | -8 | -1 |

Other non-cash effects | -1 | |

Change in net working capital12 | -117 | -78 |

Cash generated from operations | 638 | 629 |

Income taxes paid | -112 | -98 |

Net cash provided by operating activities | 526 | 530 |

Cash flows from investing activities | ||

Purchase of property, plant and equipment | -221 | -218 |

Purchase, capitalisation of intangible assets | -34 | -36 |

Proceeds from sale of property, plant and equipment | 5 | 2 |

Net capex9 | -251 | -252 |

Free cash Flow to the Firm10 | 276 | 279 |

Acquisitions of subsidiaries, net | -158 | -246 |

Proceeds from disposals of subsidiaries, net | ||

Disposal/(acquisitions) of investments, financial assets and derivative financial instruments, net | -3 | -1 |

Interest received | 4 | 15 |

Net cash used in investing activities | -408 | -484 |

Cash flows from financing activities | ||

Proceeds from issuance of share capital | ||

Purchase of treasury shares, net of gains | -460 | -30 |

Proceeds from issuance of hybrid capital | 398 | |

Repayment of hybrid capital | -193 | |

Proceeds from borrowings | 669 | 30 |

Repayment of borrowings | -118 | -464 |

Repayment of lease liabilities | -102 | -93 |

Dividends paid to shareholders and non-controlling interests | -109 | -1 |

Earnings paid to hybrid capital investors | -3 | |

Interests and premium paid | -25 | -31 |

Net cash (used in)/provided by financing activities | 57 | -588 |

Net effect of currency translation on cash and cash equivalents and bank overdrafts | -37 | 1 |

Net (decrease)/increase in cash and cash equivalents and bank overdrafts | 138 | -540 |

Cash and cash equivalents and bank overdrafts at beginning of period | 613 | 1,221 |

Cash and cash equivalents and bank overdrafts at end of period | 751 | 681 |

Alternative Performance Measures

The Group is providing in these preliminary unaudited Consolidated Financial Statements certain alternative performance measures (non-GAAP measures).

- Adjusted results reflect the ongoing performance of the mature14 and recurring activities excluding "separately disclosed items".

- Separately disclosed items include one-off costs from network expansion, integration and reorganisation, discontinued operations, other non-recurring income and costs, temporary losses and other costs related to start-ups and acquisitions undergoing significant restructuring, share-based payment charge and acquisition-related expenses, net5, gain and loss on disposal of subsidiaries, net, net finance costs related to borrowing and investing excess cash and one-off financial effects (net of finance income), net finance costs related to hybrid capital and the related tax effects.

- EBITDA Earnings before interest, taxes, depreciation and amortisation, share-based payment charge and acquisition-related expenses, net5 and gain and loss on disposal of subsidiaries, net.

- EBITAS EBITDA3 less depreciation and amortisation.

- Share-based payment charge and acquisition-related expenses, net Share-based payment charge, impairment of goodwill, amortisation of acquired intangible assets, negative goodwill, and transaction costs related to acquisitions as well as income from reversal of such costs and from unused amounts due for business acquisitions.

- EBIT EBITAS4 less share-based payment charge and acquisition-related expenses, net5 and gain and loss on disposal of subsidiaries, net.

- Net Profit Net profit for owners of the Company and hybrid capital investors before non-controlling interests.

- Basic EPS basic earnings per share attributable to owners of the Company.

- Net capex Purchase, capitalisation of intangible assets, purchase of property, plant and equipment less capex trade payables change of the period and proceeds from disposals of such assets.

- Free Cash Flow to the Firm Net cash provided by operating activities, less Net capex.

- Net debt Current and non-current borrowings, less cash and cash equivalents.

- Net working capital Inventories, trade receivables and contract assets, prepaid expenses and other current assets less trade accounts payable, contract liabilities and other current liabilities excluding accrued interest receivable and payable.

- Organic growth for a given period (Q1, Q2, Q3, Half Year, Nine Months or Full Year) non-IFRS measure calculating the growth in revenues during that period between 2 successive years for the same scope of businesses using the same exchange rates (of year Y) but excluding discontinued operations.

For the purpose of organic growth calculation for year Y, the relevant scope used is the scope of businesses that have been consolidated in the Group's income statement from the previous financial year (Y-1). Revenue contribution from companies acquired in the course of Y-1 but not consolidated for the full year are adjusted as if they had been consolidated as of 1st January Y-1. All revenues from businesses acquired since 1st January Y are excluded from the calculation. Also, all revenues from discontinued activities disposals in both the previous financial year (Y-1) and year Y are excluded from the calculation. - Mature scope: excludes start-ups and acquisitions in significant restructuring. A business will generally be considered mature when: i) The Group's systems, structure and processes have been deployed; ii) It has been audited, accredited and qualified and used by the relevant regulatory bodies and the targeted client base; iii) It no longer requires above-average annual capital expenditures, exceptional restructuring or abnormally large costs with respect to current revenues for deploying new Group IT systems. The list of entities classified as mature is reviewed at the beginning of each year and is relevant for the whole year.

Non-mature scope: includes start-ups or acquisitions in significant restructuring. These are companies or business activities established to develop an existing business model, transfer technology or a specific strategy. They are generally greenfield operations, or, in certain cases, newly acquired businesses bought to achieve a target market share in a given geography that are not operating optimally, but that have the potential to operate efficiently and profitably once restructured or reorganised to the Group's model. - Discontinued activities disposals: discontinued operations are a component of the Group's businesses or product lines that have been disposed of, or liquidated; or a specific business unit or a branch of a business unit that has been shut down or terminated, and is reported separately from continued operations.

- FCFF before investment in owned sites: FCFF less net capex9 spent on purchase of land, buildings and investments to purchase, build or modernise owned sites/buildings (excludes laboratory equipment and IT).

- Free Cash Flow to Equity: Free Cash Flow to the Firm10, less disposal/(acquisition) of investments, financial assets and derivative financial instruments, net, and after interests and premium paid net of interest received. Free cash flow to Equity does not take into account the dividends paid to shareholders and non-controlling interests as well as earnings paid to hybrid capital holders.

- Adjusted1 EBITDA3 margin: adjusted1 EBITDA3 divided by reported revenues.

Notes to Editors:

About Eurofins the global leader in bio-analysis

Eurofins is Testing for Life. The Eurofins network of companies believes that it is a global leader in food, environment, pharmaceutical and cosmetic product testing and in discovery pharmacology, forensics, advanced material sciences and agroscience contract research services. It is also one of the market leaders in certain testing and laboratory services for genomics, and in the support of clinical studies, as well as in biopharma contract development and manufacturing. It also has a rapidly developing presence in highly specialised and molecular clinical diagnostic testing and in-vitro diagnostic products.

With over 65,000 staff across a decentralised and entrepreneurial network of more than 950 laboratories in 60 countries, Eurofins offers a portfolio of over 200,000 analytical methods to evaluate the safety, identity, composition, authenticity, origin, traceability and purity of a wide range of products, as well as providing innovative clinical diagnostic testing services and in-vitro diagnostic products.

Eurofins companies' broad range of services are important for the health and safety of people and our planet. The ongoing investment to become fully digital and maintain the best network of state-of-the-art laboratories and equipment supports our objective to provide our customers with high-quality services, innovative solutions and accurate results in the best possible turnaround time (TAT). Eurofins companies are well positioned to support clients' increasingly stringent quality and safety standards and the increasing demands of regulatory authorities as well as the evolving requirements of healthcare practitioners around the world.

Eurofins has grown very strongly since its inception and its strategy is to continue expanding its technology portfolio and its geographic reach. Through R&D and acquisitions, the Group draws on the latest developments in the field of biotechnology and analytical chemistry to offer its clients unique analytical solutions.

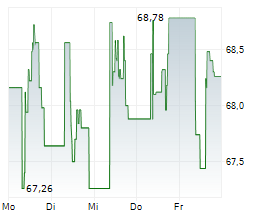

Shares in Eurofins Scientific are listed on the Euronext Paris Stock Exchange (ISIN FR0014000MR3, Reuters EUFI.PA, Bloomberg ERF FP).

Until it has been lawfully made public widely by Eurofins through approved distribution channels, this document contains inside information for the purpose of Regulation (EU) 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, as amended.

Important disclaimer:

This press release contains forward-looking statements and estimates that involve risks and uncertainties. The forward-looking statements and estimates contained herein represent the judgment of Eurofins Scientific's management as of the date of this release. These forward-looking statements are not guarantees for future performance, and the forward-looking events discussed in this release may not occur. Eurofins Scientific disclaims any intent or obligation to update any of these forward-looking statements and estimates. All statements and estimates are made based on the information available to the Company's management as of the date of publication, but no guarantees can be made as to their completeness or validity.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250722519318/en/

Contacts:

For more information, please visit www.eurofins.com or contact:

Investor Relations

Eurofins Scientific SE

Phone: +32 2 766 1620

E-mail: ir@sc.eurofinseu.com