RAPALA VMC CORPORATION, Half year financial report, July 23, 2025 at 3:00 p.m. EEST

January-June (H1) in brief

- Net sales were 125.5 MEUR, up 4% from previous year (120.5). With comparable exchange rates sales were 5% up from previous year.

- Operating profit was 9.1 MEUR (11.2).

- Comparable operating profit* was 8.6 MEUR (6.2).

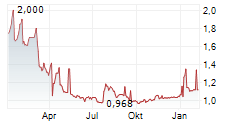

- Earnings per share (non-diluted) was 0.02 EUR (0.07).

- Cash flow from operations was 6.2 MEUR (18.2).

- Inventories were 82.2 MEUR (84.7).

- Short-term outlook: The Group expects 2025 full year comparable operating profit* to increase from 2024.

* Excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability. Other items affecting comparability include material restructuring costs, impairments, gains and losses on business combinations and disposals, insurance compensations and other non-operational items.

President and CEO Cyrille Viellard: "With continued focus on cash generation, our dedicated teams behind our strong brands, driven by product innovation, solid customer service and consistent marketing, achieved an overall sales and profit growth in a volatile international trade environment.

Cashflow remains the number one priority. Excluding working capital impact, cash flow from operations improved from the previous year and was 11.0 MEUR (5.7).

US reciprocal tariffs have disrupted supply chains with stop and go, inventory build ups, as well as occupy a dedicated internal task force to develop solutions to minimize impacts. They remain a matter of the greatest attention and although mitigated do impact gross margins as only partially compensated by customers.

Implementation of strategy to strengthen dedicated brand organizations is going forward. All key brands have dedicated management teams with performance KPIs and accountability for long term strategy definition. Brand focus allows better team accountability, more accurate market segmentation, stronger consumer orientation and in turn long term value creation.

For the second half, we remain cautiously optimistic with favorable winter fishing preorders in North America but uncertainties in tariff impacts on consumer spending as well as gross margins but confirm our ability to improve our comparable profits versus 2024 in the given market conditions."

Key figures

| H1 | H1 | Change | FY | |

| MEUR | 2025 | 2024 | % | 2024 |

| Net sales | 125.5 | 120.5 | 4% | 220.9 |

| Operating profit | 9.1 | 11.2 | -19% | 8.6 |

| % of net sales | 7.3 % | 9.3% | 3.9% | |

| Comparable operating profit * | 8.6 | 6.2 | 39% | 6.2 |

| % of net sales | 6.9% | 5.1% | 2.8% | |

| Cash flow from operations | 6.2 | 18.2 | -66% | 23.4 |

| Gearing % | 39.2 % | 36.9% | 39.8% | |

| EPS, EUR | 0.02 | 0.07 | -71% | -0.07 |

* Excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability. Other items affecting comparability include material restructuring costs, impairments, gains and losses on business combinations and disposals, insurance compensations and other non-operational items.

Rapala Group presents alternative performance measures to reflect the underlying business performance and to enhance comparability between financial periods. Alternative performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS. Definitions and reconciliation of key figures are presented in the financial section of the release.

Market Environment

During the first half of the year, operating environment varied significantly across regions. The North American market remained resilient, supported by stable consumer demand and steady retail activity. In contrast, the European and Asian markets were impacted by increased uncertainty and limited economic visibility, primarily driven by the ongoing global trade disputes. The effects of this market turbulence became more pronounced during the second quarter.

Business Review January-June 2025

The Group's net sales for the year were 4% above the comparison period with reported translation exchange rates. With comparable translation exchange rates, net sales were organically up by 5% from the comparison period.

North America

Sales in North America increased by 12% from the comparison period. With comparable translation exchange rates sales were up by 14%.

Favorable fishing conditions in Autumn 2024, combined with an exceptionally strong winter fishing season in 2024/2025, enabled retailers to reduce their inventories by year-end. This supported robust replenishment sales of winter products in the early part of the year and facilitated a healthy level of spring load-in orders. Sales growth was further driven by the successful launch of the new 13 Fishing branded product range, the continued strong performance of CrushCity soft plastic lures, and the solid momentum of all key brands.

Nordic

Sales in the Nordic market decreased by 4% from the comparison period with reported and comparable translation exchange rates.

The year began with poor snow conditions. This led to exceptionally low replenishment sales of winter sports equipment which had a significant impact on the sales of the region. On a positive note, past organizational changes in the fishing business are yielding positive results, enabling strong operational performance. Product availability remained good and increased sales were achieved in majority of the key brands. However, the summer season started somewhat later than usual, which impacted replenishment sales towards the end of the reporting period.

Rest of Europe

Sales in the Rest of Europe market decreased by 6% from the comparison period with reported and comparable translation exchange rates.

Retailer carryover stock from the previous season impacted the sales in the region. The year began on a positive note, but momentum slowed significantly midway through the reporting period. Consumer activity remained subdued, and retailers continued to exercise extreme caution with replenishment orders. Focus remained on core brands and as a highlight, Okuma brand continued on a growth path.

Rest of the World

With reported translation exchange rates, sales in the Rest of the World market were at prior year level. With comparable translation exchange rates, sales increased by 5% compared to the previous year.

Sales in the Asian markets declined, as ongoing global trade disputes continued to weigh on consumer sentiment and cause foreign exchange volatility. The competition landscape also evolved, with Asian fishing equipment manufacturers increasing their investments in domestic markets, thereby emerging as stronger local competitors. In contrast, Latin American markets performed well, supported by economic recovery and currency stability in key countries. These strengthened consumer confidence and supported the sales of imported products.

External net sales by area

| H1 | H1 | Change | Comparable | FY | |

| MEUR | 2025 | 2024 | % | change % | 2024 |

| North America | 69.0 | 61.4 | 12 % | 14 % | 111.9 |

| Nordic | 12.9 | 13.5 | -4 % | -4 % | 25.8 |

| Rest of Europe | 31.6 | 33.5 | -6 % | -6 % | 58.4 |

| Rest of the World | 12.1 | 12.1 | 0 % | 5 % | 24.8 |

| Total | 125.5 | 120.5 | 4 % | 5 % | 220.9 |

Financial Results and Profitability

Comparable (excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability) operating profit increased by 2.4 MEUR from the comparison period. Reported operating profit decreased by 2.1 MEUR from the comparison period and the items affecting comparability had a positive impact of 0.5 MEUR (5.0) on reported operating profit.

Comparable operating profit margin was 6.9% (5.1) for the first half of 2025. The improved profitability was primarily driven by increased sales in both the winter fishing and open water markets. While tariffs had a negative impact on the cost base, overall profitability strengthened thanks to a structurally lower operating expense level.

Reported operating profit margin was 7.3% (9.3) for the first half. Reported operating profit includes a 0.6 MEUR (-0.2) mark-to-market valuation of operative currency derivatives. Other items affecting comparability, included in the reported operating, profit were -0.2 MEUR (5.0). This amount includes a gain on the disposal of real estate in Finland, as well as a non-cash currency translation loss relating to the closure of the Russian manufacturing operation. Prior year gain comes from the sale and lease back transaction of the Canadian real estate.

Total financial (net) expenses were 4.9 MEUR (4.3) for the first half of the year. Net interest and other financing expenses were 3.5 MEUR (4.5) and (net) foreign exchange losses were 1.3 MEUR (0.2 gain).

Net profit for the first half of the year decreased by 2.5 MEUR and was 2.2 MEUR (4.7) and earnings per share was 0.02 EUR (0.07).

Key figures

| H1 | H1 | Change | FY | |

| MEUR | 2025 | 2024 | % | 2024 |

| Net sales | 125.5 | 120.5 | 4% | 220.9 |

| Operating profit / loss | 9.1 | 11.2 | -19% | 8.6 |

| Comparable operating profit * | 8.6 | 6.2 | 39% | 6.2 |

| Net profit / loss | 2.2 | 4.7 | -53% | 0.4 |

*Excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability. Other items affecting comparability include material restructuring costs, impairments, gains and losses on business combinations and disposals, insurance compensations and other non-operational items.

Bridge calculation of comparable operating profit

| H1 | H1 | Change | FY | |

| MEUR | 2025 | 2024 | % | 2024 |

| Operating profit / loss | 9.1 | 11.2 | -19% | 8.6 |

| Mark-to-market valuations of operative currency derivatives | -0.6 | 0.2 | 0.7 | |

| Other items affecting comparability | 0.2 | -5.2 | -3.1 | |

| Comparable operating profit | 8.6 | 6.2 | 39% | 6.2 |

More detailed bridge of comparable operating profit and definitions and reconciliation of key figures are presented in the financial section of the release.

Financial Position

Cash flow from operations decreased from the previous year and landed at 6.2 MEUR (18.2). Change in net working capital had a negative 4.8 MEUR (positive 12.5 MEUR) impact on cash flow. Excluding working capital impact, cash flow from operations improved from the previous year and was 11.0 MEUR (5.7), following the relentless focus on cash generation and operational efficiencies.

End of the period inventory was 82.2 MEUR (84.7). The change in obsolescence allowance increased inventory value by 0.2 MEUR. Changes in translation exchange rates decreased inventory value by 3.3 MEUR. Organic increase in inventory was 0.5 MEUR. Inventory composition is healthier and includes higher proportion of winter fishing products in response to a stronger orderbook for the upcoming winter season.

Net cash used in investing activities was 0.7 MEUR (positive 5.7). Capital expenditure was 1.8 MEUR (2.7) and disposals 1.1 MEUR (8.7). Expenditure consisted mainly of maintenance of manufacturing capacity and investments in new products. Disposals include proceeds from the sale of real estate in Finland. Prior year disposals include the sale and lease back of the Canadian real estate.

Liquidity position of the Group was good. Undrawn committed long-term credit facilities amounted to 38.0 MEUR. Commercial papers sold under the commercial paper program amounted to 14.0 MEUR (15.0) at the end of the reporting period. Gearing ratio increased and equity-to-assets ratio decreased from last year.

The Group's 106 MEUR senior secured term and revolving credit facilities agreement includes financial covenants based on the available liquidity (minimum 22.5 MEUR), 12m rolling EBITDA (minimum 10 MEUR), net debt to consolidated equity (maximum 100%) and net debt to EBITDA ("leverage ratio"). The financial leverage ratio covenant level is 3.80. Covenants are regularly tested, either quarterly or on the last date of each month. The risk of breaching the covenants would trigger negotiations between the Group and lending banks to resolve the potential covenant breach, and to agree on actions to rectify the situation. In the unlikely event of unresolved covenant breach, the lending banks would have the right to call all or any part of the loans and related interest.

On Q1/2025 and Q2/2025 testing dates, the leverage ratio landed at 3.48 and 2.91. Calculation of the covenants include customary adjustments mainly related to items affecting comparability and asset disposals, and therefore deviate from the reported figures elsewhere in this report. The Group is currently compliant with all financial covenants and expects to comply with future bank requirements as well. The Group's liquidity position remains good, and cash and cash equivalents amounted to 25.4 MEUR at June 30, 2025.

During the reporting period, the Group agreed on an amendment and an extension of 6 months with the lending banks for the 106 MEUR facilities. As of the reporting date, the facilities mature in the second half of 2026, subject to an extension option of 6 months. The Group is preparing to refinance the facilities and the hybrid capital bond during the next 12 months.

The Group equity includes a hybrid loan of 30.0 MEUR issued in November 2023. The accumulated non-recognized interest on hybrid bond were 2.2 MEUR.

Key figures

| H1 | H1 | Change | FY | |

| MEUR | 2025 | 2024 | % | 2024 |

| Cash flow from operations | 6.2 | 18.2 | -66% | 23.4 |

| Net interest-bearing debt at end of period | 58.6 | 59.9 | -2% | 61.8 |

| Gearing % | 39.2% | 36.9% | 39.8% | |

| Equity-to-assets ratio at end of period, % | 52.3% | 52.6% | 53.0% |

Definitions and reconciliation of key figures are presented in the financial section of the release.

Strategy Implementation

The strategic vision of the Group is to become a focused brand and innovation driven sport fishing market leader in selected categories globally in connection to creating outstanding experiences to global fishermen. The strategic plan will be reviewed as part of the strategy update process in Autumn 2025, adapted to reflect changes in the market environment, and updated to cover the period 2026-2028.

Focus remains in strengthening the balance sheet and in continuous increase of sales of owned brands, led by the flagship Rapala brand. Transformation into a brand powerhouse continues through building and enhancing a brand and market focused organization. A brand powerhouse with best-in-class order to delivery platform will ensure our position as a preferred partner for our retail and eCom partners. Manufacturing and sourcing excellence will continue to underpin our operations and strengthen our partnerships with key suppliers. Sustainability remains as a significant cornerstone in everything we do.

The key pillars for our 2025-2027 strategy:

RAPALA VMC EXCELLENCE BUSINESS MODEL - We commit to standardize our global operations in a way that increases visibility and allows our global operations to run in a synchronized manner. Connecting all core management processes is a key in exploring and grasping on to opportunities in the market. Allowing entrepreneurial spirit while maintaining focus on brand value and strong business accountability. Target setting oriented organization with routine processes is the best way to emulate a community of 1451 team members to innovate, make, source, market in the best possible way.

GROWTH AND CASH FLOW - Maximizing the use of existing assets that make us unique: Brands, sales network and retailer partnerships, product development, manufacturing. Extend flagship Rapala brand in new categories and realize distribution synergies on newest brands in the portfolio (Okuma & 13 Fishing). Be stronger where we are strong.

SAFEGUARD MANUFACTURING COMPETITIVE ADVANTAGE - We continue streamlining and improving productivity in Pärnu manufacturing facility following location changes in past years. Ensuring global competitiveness through productivity improvements and continuous maximum utilization is our focus.

FOCUS ON SUPPLY CHAIN EXCELLENCE - More than a third of our revenue comes from manufacturing partners, highlighting a key strategic strength. These partners have a long-standing track record of providing a reliable outsourced manufacturing platform, enabling us to scale efficiently, enhance flexibility, and drive sustainable growth. Their expertise plays a crucial role in our success.

We continue to harmonize ERPs and expand procurement planning tool (Anaplan) vertically and horizontally. This enables faster working capital turn and on-time deliveries to maximize sales opportunities.

MAINTAIN GLOBAL SALES FOOTPRINT - Our extended sales network differentiates us from the competition. In the short-term, focus on operational efficiency and on bringing back the entrepreneurial spirit.

PORTFOLIO MANAGEMENT - Continue proactive consolidation of brands to harmonize brand portfolio. Focus on flagship Rapala brand and evaluate business performance based on brand sales.

Product Development

Rapala's CrushCity soft bait range is looking to have another big year in sales. The 2024 tournament wins by Jacob Wheeler and Dustin Connell have made the 2025 newly launched CrushCity Mooch Minnow already a massive success. This versatile TPE bait works perfectly for the forward-facing sonar applications and has been a tremendous success this year. CrushCity new product introductions including CrushCity Curl in Europe and CrushCity The Jerk and Heavy Hitter in Australia have also been received very well.

2025 is also a big year for Rapala hardbaits. An exciting new topwater lure launch was also greatly fuelled by Jacob Wheeler's success. Precision Xtreme Jowler 127 is a technical topwater lure that has been developed in close cooperation with Jacob Wheeler. Both industry and consumers have been excited about this lure, which is proving to be a commercial success story.

Other important new hardbaits include Gold Miner 30, which is a robust, yet a technical trolling lure for the walleye and zander markets. This trolling workhorse is serving an important market as the consumers have been requesting Rapala's fish catching action in a deep-diving and durable wobbler. Gold Miner checks both boxes and is off to a running start.

Finally, Rapala took a big leap in saltwater fishing by launching a premium trolling lure Sarda. This heavy-duty trolling giant is targeted at the big tuna trolling anglers that appreciate uncompromising quality in a lure that is designed for fast trolling speeds (up to 14 knots).

ICAST 2024 Best in Category winner Sufix Revolve braided line has been a huge PD launch for US in 2025 with support from independent dealers as well as national big box chains. The innovative line is optimized for finesse fishing techniques by maintaining ultra-fine diameters for longer casts and a body structure that reduces wind knots. The PD team worked hand in hand with Jacob Wheeler on Revolve and it's been on all his spinning reels this tournament season.

Rapala VMC's product development pipeline remains strong and strategically aligned for the next three years. Feedback from key retail partners confirms that our new product introductions are among the most compelling in the industry, with our brands continuing to demonstrate exceptional momentum. Supported by world-class marketing efforts, our latest launches are achieving strong sell-through rates, ensuring that our core consumers continue to enjoy successful and innovative fishing experiences with our products.

Personnel and Organization

Average number of personnel was 1 424 (1 345) for the first half of the year. At the end of June, the number of personnel was 1 451 (1 358).

On December 17, 2024, the Board of Directors appointed Cyrille Viellard as the new President and Chief Executive Officer of Rapala VMC Corporation, effective March 7th, 2025. Former President and Chief Executive officer Lars Ollberg continued in his position until March 6, 2025, and then retired after serving the company for over 45 years in various roles.

During the reporting period, the Group continued its journey of organizational stabilization under the leadership of the new President and CEO, following the organizational changes in prior periods. Efforts also progressed in standardizing global operations and enhancing transparency, enabling more synchronized and efficient execution across markets.

Short-term Outlook and Risks

We believe that our renewed strategy will provide added value to our customers and other stakeholders. We will continue to invest in growth and efficiency to strengthen our position as one of the leading companies in the fishing tackle market.

North American consumer demand has remained robust despite rising uncertainties in the global trade environment. So far, our efforts to mitigate the tariff impact on sales and profitability have been successful. Nevertheless, the ongoing tariff situation reduces visibility and continues to create challenges in driving sales and maintaining profitability.

European markets are showing slower consumer spending following the economic and political developments. This is expected to result in lower replenishment sales in H2. Our improved operational efficiency and structurally lower operating expense base are expected to partially offset the impact of the potential sales decline.

Pre-sales for the upcoming 2025/2026 winter fishing season have progressed according to expectations in the North American market. In Nordics, the winter fishing market is expected to remain at prior year level.

Our guidance reflects current market conditions but remains subject to potential trade-related disruptions, including tariffs and regulatory changes, which may impact demand and cost structures.

Consequently, the Group expects 2025 full year comparable operating profit (excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability) to increase from 2024. Short-term risks and uncertainties and the seasonality of the business are described in more detail at the end of this report.

Annual General Meeting

The AGM approved the Board of Director's proposal, according to which no dividend be paid based on the adopted balance sheet for the financial year 2024. The AGM approved that the Board of Directors consists of six members. Emmanuel Viellard, Julia Aubertin, Vesa Luhtanen, Alexander Rosenlew, Pascal Lebard and Johan Berg were re-elected as members of the Board of Directors. A separate stock exchange release on the decisions of the AGM has been given, and up to date information on the Board's authorizations and other decisions of the AGM are available also on the corporate website.

Authorised Public Accountants Firm Deloitte Ltd was elected as the Company's auditor. Deloitte Ltd will also carry out the assurance of the company's sustainability reporting for the financial year 2025 in accordance with the transitional provision of the act amending the Limited Liability Companies Act (1252/2023) and will be imbursed for this task as per its invoice approved by the company.

Helsinki, July 23, 2025

Board of Directors of Rapala VMC Corporation

For further information, please contact:

Cyrille Viellard, President and Chief Executive Officer, +358 9 7562 540

Miikka Tarna, Chief Financial Officer, +358 9 7562 540

Tuomo Leino, Investor Relations, +358 9 7562 540

An audiocast and conference call on the first half year result will be arranged on Thursday July 24, 2025, at 5:00 p.m EEST.

Please join the audiocast by registering using the following link: https://player.videosync.fi/rapala/2025-h1-results. Alternatively please join the teleconference by registering using the following link: https://player.videosync.fi/rapala/2025-h1-results/dial-in.

Financial information and recording of the audiocast will be available at www.rapalavmc.com