RAPALA VMC CORPORATION, Other information disclosed according to the rules of the Exchange, July 23, 2025 at 03:05 p.m. EEST

The Board of Directors of Rapala VMC Corporation has resolved to establish a new share-based incentive plan for key employees of the group. The purpose of the plan is to align the interests of the company's shareholders and key employees to increase the company's value in the long-term, to commit key employees to implement the company's strategy, objectives and long-term interests and to offer them a competitive incentive plan based on earning and accumulating the company's shares.

The Performance Share Plan 2025-2029 consists of three performance periods, covering the financial years 2025-2027, 2026-2028 and 2027-2029 respectively. The Board of Directors will resolve annually on the commencement and details of a performance period. In the plan, the target group has an opportunity to earn Rapala VMC's shares based on performance. The participants are able to increase their personal earning opportunity by investing in Rapala VMC's shares.

For the performance period 2025-2027 the plan's target group consists of approximately 60 key employees, including the members of the Management Team and the CEO. The performance criteria of the first performance period 2025-2027 are tied to Leverage, EBIT and Total Shareholder Return. The potential rewards from the plan will be paid after the end of each performance period.

The value of the rewards to be paid on the basis of the period 2025-2027 corresponds to a maximum total of 544,000 shares of Rapala VMC, including also the proportion to be paid in cash. The potential reward will be paid partly in Rapala VMC shares and partly in cash. The cash proportion of the reward is intended to cover taxes and statutory social security contributions arising from the reward to the key employee. As a rule, no reward will be paid if the key employee's employment or director contract terminates before the reward payment.

The Management Team member must hold 50 per cent of the received shares, until the value of the Management Team member's total shareholding in Rapala VMC equals to 50 per cent of their annual base salary for the calendar year preceding the payment of the reward. Respectively, the CEO must hold 50 per cent of the received shares, until the value of the CEO's total shareholding in Rapala VMC equals to 100 per cent of the CEO's annual base salary for the preceding calendar year. Such number of Rapala VMC shares must be held as long as the membership in the Management Team or the position as the CEO continues.

Rapala VMC Corporation

Board of Directors

Additional Information

For additional information, please contact: Tuomo Leino, Investor Relations (tel. +358 9 7562 540)

About Rapala VMC Corporation

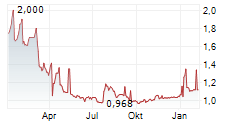

Rapala VMC Group is the world's leading fishing tackle company with a largest distribution network in the industry. The Group is a global market leader in fishing lures, treble hooks and fishing related knives and tools. The main manufacturing facilities are in Finland, France, Estonia, and the UK. The Group's brand portfolio includes leading brands in the industry such as Rapala, VMC, Sufix, 13Fishing as well as Okuma in Europe. The Group, with net sales of EUR 221 million in 2024, employs some 1 400 people in approximately 40 countries. Rapala VMC Corporation's share is listed and traded on the Nasdaq Helsinki stock exchange since 1998.

www.rapalavmc.com