Original-Research: Serviceware SE - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Serviceware SE

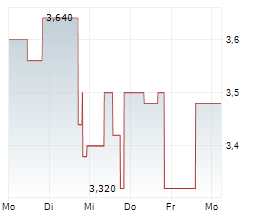

AI drives solid H1 growth On July 25, Serviceware released its H1 2024/2025 financial results and reaffirmed its full-year guidance. Revenue growth was strong at 10.3% yoy (EUR 55.5m), in line with our expectation (+10%). The main drivers were a 30.5% yoy increase in SaaS/Service revenues to EUR 42.8m, driven by continued transition from license to SaaS and strong demand for the AI-native ESM platform. Additional support came from new customer wins across banking, industrial, and education sectors, as well as ongoing international expansion, including further engagement with a Fortune Global 500 client in Asia and the first North American deal via Maryville Consulting. Order backlog rose by 21.3% to EUR 97.8m, providing good revenue visibility. The EBITDA margin improved from 3.2% to 3.4%, in line with our estimate, supported by higher SaaS share and operating leverage, although investments in SaaS transformation and expansion likely limited further improvement. The focus on AI integration and recurring SaaS revenues strengthens the investment case by improving visibility and supporting mid-term profitability potential. We increase our target price to EUR 27.50 (26.50) and confirm our Buy recommendation. You can download the research here: SERVICEWARE_SE_20250728 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2175500 28.07.2025 CET/CEST

© 2025 EQS Group