SOLID PERFORMANCE OF AEROSPACE OPERATIONS

Q2 2025 REVENUE OF EUR 3,037K IN LINE WITH THE PREVIOUS QUARTER AND CONFIRMING A CLEAR REBOUND COMPARED TO THE LAST QUARTERS OF 2024

CONSOLIDATED GROSS MARGIN UP TO 42.5%

OPERATING PROFIT OF EUR 284K (9.3% OF REVENUE) IN AN UNSTABLE ECONOMIC AND MONETARY ENVIRONMENT

STRATEGIC DIRECTION CONFIRMED WITH THE INDUSTRIALIZATION OF "ENGINE CONTROL" MODULES

STRONG OUTLOOK SUPPORTED BY A ROBUST AND PROFITABLE INDUSTRIAL MODEL

INVESTOR VIDEO CONFERENCE

TUESDAY, SEPTEMBER 2, 2025 AT 9:30 AM

(Non-audited data)

- Quarterly revenue of EUR 3,037 thousand

- Half-year revenue up 14.1% compared to H2 2024

- High contribution from the aerospace sector, representing 75% of total revenue

- Sharp decline in the medical sector

- Gross margin improvement to 42.5% of consolidated revenue

- Operating profit of 9.3% in an unstable economic environment

- Negative currency effect impacting financial result

- Strong outlook supported by a unique market positioning, high entry barriers and significant progress in "Engine Control" activities

- On track for profitable growth

- Investor videoconference: Tuesday, September 2 at 9:30 AM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires-resultats-semestriels?s=3a5c5139-7421-4633-b5fd-009bc3d4b1fc

Regulatory News:

MEMSCAP (Euronext Paris: MEMS), leading provider of high-accuracy, high-stability pressure sensor solutions for the aerospace and medical markets using MEMS technology (Micro Electro Mechanical Systems), today announced its earnings for the second quarter of 2025 ending June 30, 2025.

Analysis of consolidated revenue

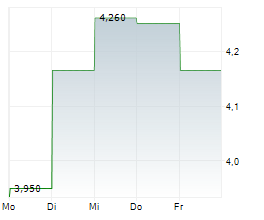

Consolidated revenue from continuing operations (non-audited) for the second quarter of 2025 was EUR 3,037 thousand compared to EUR 3,442 thousand for the second quarter of 2024.

Over the second quarter of 2025, the distribution of consolidated revenue from continuing operations by market segment is as follows:

Market segments Revenue

| Q1 2024

| Q2 2024

| Q2 2024

| H1 2024

| Q1 2025

| Q2 2025

| Q2 2025

| H1 2025

|

Aerospace | 2,536 | 2,363 | 69% | 4,899 | 2,440 | 2,288 | 75% | 4,729 |

Medical | 929 | 735 | 21% | 1,664 | 268 | 390 | 13% | 658 |

Optical communications | 341 | 326 | 9% | 667 | 377 | 340 | 11% | 717 |

Others (Royalties from licensed trademarks) | 27 | 18 | 1% | 45 | 22 | 18 | 1% | 40 |

Total revenue from continuing operations | 3,832 | 3,442 | 100% | 7,275 | 3,107 | 3,037 | 100% | 6,144 |

(Any apparent discrepancies in totals are due to rounding.)

In line with the first quarter of 2025, the Group's consolidated sales for the second quarter of 2025 reflect the continued momentum in aerospace operations, which remain at historically high levels. As the Group's leading market segment, the aerospace sector accounted for 75% of consolidated revenue in the second quarter of 2025.

As previously reported in the first quarter 2025 results, sales in the medical segment continue to be impacted by a major customer undergoing a regulatory compliance upgrade of its systems (-EUR 405 thousand compared to the second quarter of 2024).

Lastly, sales in the optical communications segment showed a slight increase, with quarterly revenue totalling EUR 340 thousand.

These trends resulted in non-audited consolidated revenue of EUR 3,037 thousand for the second quarter of 2025 and EUR 6,144 thousand for the first half of the fiscal year. This half-year revenue reflects a 14.1% increase compared to H2 2024, despite a 15.6% decline compared to H1 2024, which had recorded historically high sales levels.

Analysis of consolidated income statement

MEMSCAP's consolidated earnings for the second quarter of 2025 are given within the following table:

In thousands of euros Non-audited | Q1 2024

| Q2 2024

| H1 2024

| Q1 2025

| Q2 2025

| H1 2025

|

Revenue from continuing operations | 3,832 | 3,442 | 7,275 | 3,107 | 3,037 | 6,144 |

Cost of revenue | (2,298) | (2,041) | (4,339) | (1,830) | (1,747) | (3,577) |

Gross margin | 1,534 | 1,402 | 2,936 | 1,277 | 1,290 | 2 567 |

% of revenue | 40.0% | 40.7% | 40.4% | 41.1% | 42,5% | 41.8% |

Operating expenses | (1,026) | (1,011) | (2,037) | (1,026) | (1,007) | (2,033) |

Operating profit (loss) | 508 | 390 | 899 | 250 | 284 | 534 |

Financial profit (loss) | 109 | 2 | 110 | 47 | (212) | (165) |

Income tax expense | (9) | (9) | (17) | (6) | (0) | (6) |

Net profit (loss) | 608 | 384 | 992 | 292 | 71 | 363 |

* Net of research development grants.

(Any apparent discrepancies in totals are due to rounding.)

The gross margin rate rose to 42.5% of consolidated revenue, compared to 40.7% in the second quarter of 2024. As a result, the gross margin amounted to EUR 1,290 thousand, versus EUR 1,402 thousand for the second quarter of 2024.

Operating expenses, net of research and development grants, remained stable at EUR 1,007 thousand, reflecting the Group's effective control over its structural costs.

Consequently, operating profit from continuing operations stood at EUR 284 thousand (9.3% of consolidated revenue), compared to EUR 390 thousand (11.3%) in the second quarter of 2024.

The evolution of the U.S. dollar impacted the financial result in the second quarter of 2025, leading to a consolidated net profit of EUR 71 thousand, representing 2.3% of consolidated revenue, compared to a net profit of EUR 384 thousand in the second quarter of 2024, which represented 11.1% of consolidated revenue.

MEMSCAP reports non-audited adjusted EBITDA¹ of EUR 236 thousand (7.8% of consolidated revenue) for the second quarter of 2025, impacted by unfavourable foreign exchange effects, compared to EUR 582 thousand (16.9% of consolidated revenue) in the second quarter of 2024. It should be noted that all research and development costs were fully expensed during the period and no capitalization was recorded on the Group's balance sheet.

1 Adjusted EBITDA means operating profit before depreciation, amortisation, and share-based payment charge (IFRS 2) and including foreign exchange gains/losses related to ordinary activities.

Perspectives

Over the first six months of fiscal year 2025, MEMSCAP recorded a sequential increase in revenue compared to the second half of 2024, as anticipated by the management. In a context marked by uncertainty and macroeconomic disruptions, MEMSCAP remains firmly committed to delivering profitable growth, leveraging its key strengths, robust technological barriers, and sustainable business model.

Despite unfavourable foreign exchange effects and a significant decline in sales volumes in the medical segment, the Group achieved solid operating profitability for the period.

In addition, the development of "Engine Control" activities reinforces MEMSCAP's ambition for profitable long-term growth, while the Group continues to focus on strengthening its operational and financial performance.

Shareholders and investors video conference Tuesday, September 2, 2025, at 9:30 AM

Registration link: https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires-resultats-semestriels?s=3a5c5139-7421-4633-b5fd-009bc3d4b1fc

You may submit your questions in advance at: https://memscap.com/en/visio/

First-half 2025 results (including balance sheet and cash flow data): August 29, 2025

About MEMSCAP

MEMSCAP is a leading provider MEMS based pressure sensors, best-in-class in term of precision and stability (very low drift) for two market segments: aerospace and medical.

MEMSCAP also provides variable optical attenuators (VOA) for the optical communications market.

For more information, visit our website at: www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris Memscap ISIN code: FR0010298620 Ticker symbol: MEMS)

View source version on businesswire.com: https://www.businesswire.com/news/home/20250730723048/en/

Contacts:

Yann Cousinet

Chief Financial Officer

Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com