Company Announcement No. 057-2025 - Interim report (full H1-2025 report).

Financial Highlights H1 2025

- Order intake decreased 3.6% (12 month running) to DKK 267.8m in H1 2025 (H1 2024: DKK 277.9m). A positive outlook on opportunity pipeline gives confidence for the rest of year and into 2026.

- Revenue decreased 11.6% to DKK 123.8m in H1 2025 (H1 2024: 140.0DKKm)

- EBITDA decreased 89% to DKK 1.9 (H1 2024: DKK 17.0) corresponding to an EBITDA margin of 1.5% (H1 2024: 12.1%)

- The outlook for 2025 remains unchanged from updated guidance (Company Announcement No. 056-2025). Revenue is expected to be in the range of DKK 270-290m and EBITDA between DKK 22-27m.

FINANCIAL KEY FIGURES H1 2025

| DKKm | H1 2025 | H1 2024 | Change |

| Order intake (12 month running) | 267.8 | 277.9 | -3,6% |

| Revenue | 123.8 | 140.0 | -11.6% |

| Gross Profit | 53.7 | 65.7 | -18.3% |

| Gross Margin % | 43.4 | 46.9 | |

| EBITDA | 1.9 | 17.0 | -89% |

| EBITDA % | 1.5% | 12.1% | |

| Result after tax | -8.5 | 1.8 | |

| Net working capital | 34.0 | 34.2 | |

| Cash flow from operations | -0.4 | 10.3 | |

| NWC % of revenue (12 months running) | 12.2% | 13.0% | |

| Equity ratio % (net cash) | 15.0% | 19.3% |

MARKET ACTIVITY

In H1 2025, market activity softened, with many projects on hold or experiencing slower ramp-up. Although our project pipeline remains healthy, decision-making remains hesitant in our key markets and projects are being postponed amid lingering, uncertainty around interest rates in European countries and US tariffs. Despite these headwinds, interest for fully integrated indoor-climate solutions (both new builds and refurbishments) remains high, and investments in intelligent fire-safety and natural-ventilation systems continue to accelerate.

Order intake on a 12-month trading basis closed at DKK 267.8 m at the end of June 2025, down from DKK 277.9m a year earlier.

- Since Q2 2025, we've seen a modest slowdown, particularly in product sales where WindowMaster is only indirectly involved, and in key-account product sales.

- Project-sales-where we participate directly as an integrator in building design and implementation-continued to grow and remains the cornerstone of our strategy.

- The UK market underperformed in H1 due to new Building Safety Regulations, which significantly lengthened approval timelines for both renovations and new builds.

- Early data from July and August indicate activity is picking up across all regions, supporting our updated full-year guidance.

Quarterly developments in order intake

FINANCIAL DEVELOPMENTS H1 2025

Revenue

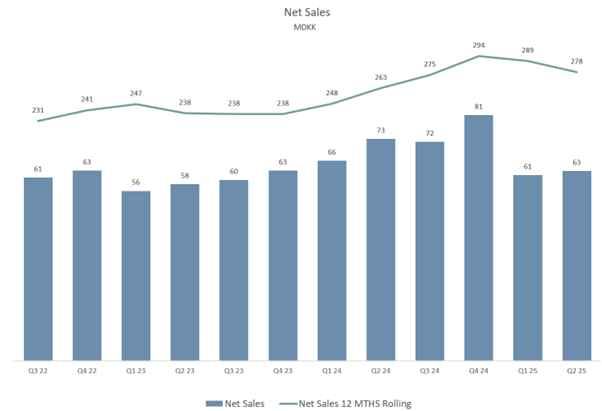

Revenue in H1 amounted to DKK 123.8 (H1 2024: 140.0m) equivalent to a decrease of 11.6%, primarily explained by the decreased revenue from product sales and especially UK project sales (as explained above).

Quarterly developments in Revenue

Gross profit

Gross profit amounted to DKK 53.7m in H1 (H1 2024: DKK 65.7m) equivalent to a gross margin of 43.4% (H1 2024: 46.9 %). There are two effects in the development of Gross Margin - a positive development from customer mix - bringing margin upwards. But there is a negative effect from one off costs (explained below) and continued high level of marketing and other supporting activities. The latter has lowered the overall margin, however this is expected to level out for the rest of year and into 2026 as many of these activities support opportunity pipeline build up for the next years.

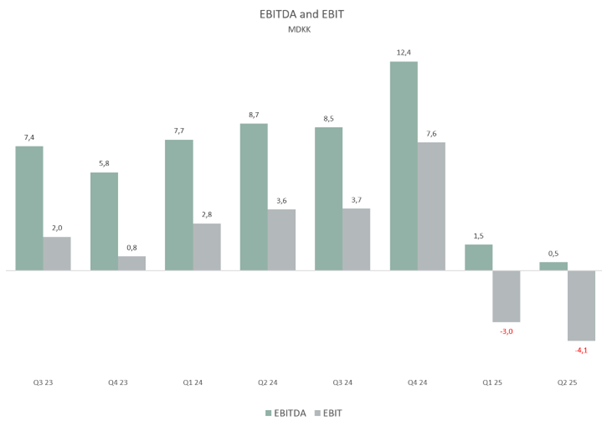

EBITDA

Operating profit (EBITDA) amounted to DKK 1.9m in H1 (H1 2024: DKK 17.0m) equivalent to an EBITDA margin of 1.5% (H1 2024: 12.1%). The decrease in the EBITDA margin is explained by lower volume and less operational leverage and thus a slightly less beneficial utilization of the fixed cost base. Management has for now decided not to adjust the fixed costs base as the drop-in activity is seen as a short/midterm effect. Maintaining a highly skilled labor force is seen as a prerequisite to execute on our Strategy plan "Accelerate Core"- which was also proven to be the right decision back in 2023 as documented by the financial development in the following year 2024. This decision is a base for executing on the potential growth that is foreseen in 2026.

In 1st half of 2025 there were also one-off costs:

IT network breakdown and recovery - 2.5m DKK

Restructuring of tier 2 management positions (double costs) - 1.0m DKK

Part of these costs are not expected in the 2nd half of 2025.

Quarterly development in EBITDA and EBIT

Cash flow and working capital

Cash flow from operating activities in H1 amounted to DKK 3.4m (H1 2024: 16.1m) which relates to lower EBITDA and also increased debtors (due to IT network breakdown). Working capital is expected to recover in 2nd half with a stable cash conversion. Cash flow from investment activities in H1 amounted to DKK -3.9m (H1 2024: -3.3m) and is on a slightly higher level. Investments are linked upgrade of It-network, infrastructure, and firewalls. Also investments in digitalization are ongoing to improve efficiency and process optimizations.

At the end of H1, net working capital amounted to DKK 34.0m (H1 2024: 34.2m). Net working capital as a percentage of revenue (12month running) decreased to 12.2% (H1 2024: 13.0%)

Cash and financial position

Net interest-bearing debt at the end of H1 amounted to DKK 50.4m (H1 2024: 33.6m). The change is primarily related to the purchase of the production facility in Germany and increase in working capital. Access to capital and good banking relationships continue to be a source of competitive advantage.

Financial gearing calculated as NIBD/EBITDA amounted to 2.3 at the end of H1 (12 months EBITDA). (H1 2024: 1.1). The target is to be below 2.0.

At the end of H1, Equity amounted to DKK 23.6m (H1 2024: 27.7), equivalent to an equity ratio of 15.0% (net cash). The target is to be above 30%.

Pay out of dividend of DKKm 6 in May 2025 contributes to the current level.

Risks

WindowMaster is exposed to market risks including currency risks, interest risks, credit risks and commodity price risks as part of its ongoing operations and investment activities. As a supplier to the global construction industry, the company is also exposed to cyclical market developments and a potential economic slowdown.

The key commercial risks relate to the company's ability to effectively manage the anticipated growth. This involves attracting sufficient and skilled employees and safeguarding the level of competencies and market knowledge within the company. Additionally, the company is dependent on consistent and timely delivery of materials from suppliers to the assembly facility in Herford, Germany.

Unforeseen events such as geo-political uncertainty and development in inflation/interest rates may impact developments in the remainder of the year.

CONFERENCE CALL

WindowMaster invites investors to participate in a live video event on 15 August 2025 at 13:00-13.30 CET. The company's CEO, Erik Boyter, and CFO Steen Overgaard Sørensen will present the company's half year report in English. (Register at: WindowMaster - H1 2025 interim report - Inderes)

FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements. Words such as 'believe', 'expect', 'may', 'will', 'plan', 'strategy', 'prospect', 'foresee', 'estimate', 'project', 'anticipate', 'can', 'intend', 'outlook', 'guidance', 'target' and other words and terms of similar meaning in connection with any discussion of future operating or financial performance identify forward-looking statements. Statements regarding the future are subject to risks and uncertainties that may result in considerable deviations from the outlook set forth. Furthermore, some of these expectations are based on assumptions regarding future events which may prove incorrect.

For further information:

CEO, Erik Boyter

M: +45 4567 0300

Mail: ir@windowmaster.com

WindowMaster International A/S

Skelstedet 13

2950 Vedbæk

Denmark

Certified Advisor

Grant Thornton

Jesper Skaarup Vestergaard

M: +45 3179 9000

Stockholmsgade 45, 2100 Copenhagen Ø, Denmark