ROUYN-NORANDA, Quebec, Sept. 02, 2025 (GLOBE NEWSWIRE) -- GLOBEX MINING ENTERPRISES INC. (GMX - Toronto Stock Exchange, G1MN - Frankfurt, Stuttgart, Berlin, Munich, Tradegate, Lang & Schwarz, LS Exchange, TTMzero, Düsseldorf and Quotrix Düsseldorf Stock Exchanges and GLBXF - OTCQX International in the US) is pleased to inform shareholders that it has purchased 50% interest in the Blackcliff Gold Mine Property from Altai Resources Inc. for a cash consideration of one hundred and forty-two thousand dollars ($142,000). Globex now owns 100% interest in the property which consists of six claims totalling 127.6 hectares located in Malartic Township, Quebec.

The property is within the same geological units and adjoins to the west of the former Camflo Gold Mine property which had a reported resource of 8,862,240 tonnes grading 5.78 g/t Au (Source Sigeom). The property is also about 6 kms northeast of Agnico Eagle Mines Ltd.'s Canadian Malartic Mine. By 1986, 6 years before closure, Camflo had produced 46 tonnes of gold. From a strategic point of view, the property is only 22 kilometres (13.6 miles) east of Globex's 100% owned Central Cadillac - Wood- Ironwood Gold Mines property.

The Blackcliff Gold Deposit was discovered in 1944 and since then a number of mostly relatively shallow drill campaigns have been undertaken on the property in addition to stripping and in 1947, a 84 m (275 ft) shaft and two levels at 38 m (124 ft) and 76m (149 ft) with a 50 m (164 ft) drift on the first level and a 51 m (167 ft) drift on the second level.

In 1987-88 Essor Exploration reopened the underground workings and mapped and sampled the drifts. They also mapped outcrops in proximity of the shaft. This was followed by a 12 hole, 3,050 metre diamond drill program. The drilling and underground sampling allowed Essor to better interpret the mineralization and present a resource evaluation on veins 1, 2 and 3 out of the 14 known veins.

A resource as listed below was interpreted on the 3 veins, using a dilution factor of 20%, a minimum grade of 3.43 g/t Au and a maximum grade of 34.29 g/t Au over a minimum horizontal width of 1.5 m. The resource calculation predates NI-43-101 regulations and is considered historical in nature.

| Vein | Probable Resource | Possible Resource |

| Vein 1 | 13,277 t @ 8.14 g/t Au | 3,062 t @ 2.42 g/t Au |

| Vein 2 | 180,820 t @ 7.83 g/t Au | 23,230 t @ 4.66 g/t Au and 18,383 t @ 2.52 g/t Au |

| Vein 3 | 16,273 t @ 4.61 g/t Au | 19,766 t @ 2.44 g/t Au |

Source Sigeom File 48392, Rapport de Forage 1987-1988 et Calcul des resources, Propriété Abior (now Blackcliff) presented to Exploration Essor inc., Le 2 mai, 1988, Par Isabelle Cadieux, M.Sc.A., géologue and Guy Parent, M.Sc., géologue, St-Michel Geoconseil inc. Rouyn-Noranda, Quebec.

The 1988 non-NI 43-101 resource was followed up in 1989 by another non NI43-101 conformable resource estimate undertaken by Jean-Pierre Labelle, geologist for Essor. Mr. Labelle reinterpreted the distribution of the vein structures 1, 2 and 3 into four veins 11, 12, 13 and 17 and calculated a probable resource of 135,406 t grading 6.89 g/t Au and a possible resource of 120,566 t grading 6.50 g/t Au for a total of 255,972 t grading 6.71 g/t Au.

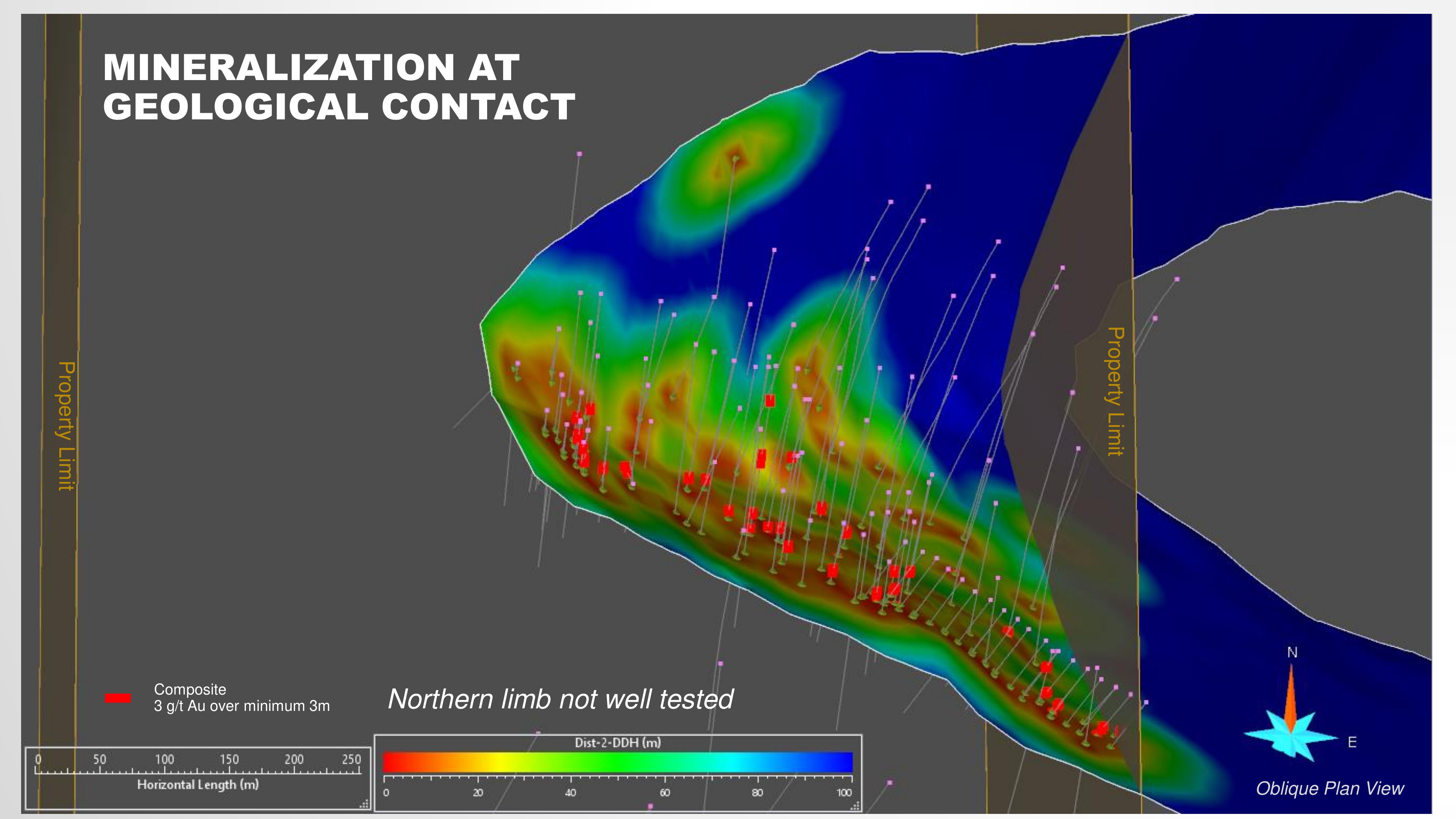

The work by Essor and other historical exploration as well as limited follow up exploration by C2C Inc. and the Altai/Globex partnership outlined a fold structure with gold values, for the most part, confined to the south limb and nose of a large fold. While it is geologically different, it is structurally similar in part to Globex's wholly owned Ironwood Gold Deposit where the gold concentration is related to the nose of a fold. 3D modelling has allowed Globex to identify areas worthy of drill follow-up including:

| Vein # 1 | Depth extension of an intercept of 9.89 g/t Au over 3.0m |

| Vein # 2 | Depth extension of an intercept of 6.10 g/t Au over 9.1m |

| Vein # 3 | Limited lateral continuity with from the intercept of 40.48 g/t Au over 3.05m |

| Vein # 4 | Depth extension to the west with an intercept of 6.43 g/t Au over 3.0m |

| Vein # 5 | Limited up dip extension of the intercept of 7.71 g/t Au over 5.6m |

| Vein # 6 | Limited lateral continuity of the intercept of 4.12 g/t Au over 3.0m |

| Vein # 7 | Depth extension of the intercept of 18.46 g/t Au over 3.0m |

It is important to note that most of the drilling undertaken by various parties since 1944 was shallow in nature with little effort spent on drilling below 300 metres providing Globex with good exploration potential to depth. Globex will evaluate the potential of this property in light of now controlling 100% of Blackcliff and current strong gold prices and formulate an exploration plan to test the size potential of the Blackcliff gold zone.

Blackcliff Fold Structure: Gold intersections principally along the South Limb and Fold Nose.

This press release was written by Jack Stoch, P. Geo., Executive Chairman and CEO of Globex in his capacity as a Qualified Person (Q.P.) under NI 43-101.

| We Seek Safe Harbour. | Foreign Private Issuer 12g3 - 2(b) |

| CUSIP Number 379900 50 9 LEI 529900XYUKGG3LF9PY95 | |

| For further information, contact: | |

| Jack Stoch, P.Geo., Acc.Dir. Executive Chairman & CEO Globex Mining Enterprises Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada J9X 2J1 | Tel.: 819.797.5242 Fax: 819.797.1470 info@globexmining.com www.globexmining.com |

Forward-Looking Statements: Except for historical information, this news release may contain certain "forward-looking statements". These statements may involve a number of known and unknown risks and uncertainties and other factors that may cause the actual results, level of activity and performance to be materially different from the expectations and projections of Globex Mining Enterprises Inc. ("Globex"). No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Globex will derive therefrom. A more detailed discussion of the risks is available in the "Annual Information Form" filed by Globex on SEDARplus.ca.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/950c5363-5587-46fb-a25f-df3e8e8d0033