Conroy Gold & Natural Resources Plc - LAUNCH OF NON-BROKERED PRIVATE PLACEMENT TO RAISE UP TO £1.5m

PR Newswire

LONDON, United Kingdom, September 12

PRIOR TO PUBLICATION, THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT WAS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019/310. WITH THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

12 September 2025

Conroy Gold and Natural Resources plc

("Conroy Gold" or the "Company")

LAUNCH OF NON-BROKERED PRIVATE PLACEMENT

TO RAISE UP TO £1.5 MILLION

Highlights

- Up to £1.5 million proposed to be raised from new and existing investors

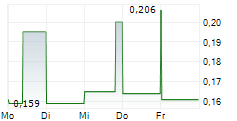

- Placing price of 10p per Ordinary Share, 6.2% premium to 10-day VWAP

- Shares to have a restriction period ending four months from issue

- Net proceeds to be used by the Company to accelerate exploration on its Irish exploration assets and for general working capital purposes

Details

Conroy Gold and Natural Resources plc (AIM: CGNR), the gold exploration and development company focused on Ireland and Finland, announces that it is undertaking a non-brokered private placement (the "Proposed Fundraise") to raise gross proceeds of, in aggregate, up to £1.5m from the issue of the Company's ordinary shares of €0.001 ("Ordinary Shares") at a price of £0.10 (the "Issue Price") per Unit.

Each Unit will consist of one new Ordinary Share ("Fundraise Share") and one warrant to purchase a further new Ordinary Share (the "Warrant"). The Issue Price represents a premium to the 10-day Volume Weighted Average Price ("VWAP") of the Company's ordinary shares, and a discount of 11.1% to the mid-market closing price per ordinary share on 11 September 2025.

Each Warrant shall entitle the holder to purchase one new Ordinary Share (each, a "Warrant Share") at a price of £0.17 per Ordinary Share at any time on or before that date which is 2 years after the closing date of the Proposed Fundraise.

Eligible investors located in the United Kingdom or Ireland who wish to participate in the Proposed Fundraise should contact the Company's UK broker, Peterhouse Capital Limited, on the contact details set out below. Eligible UK investors will be those who are (a) persons having professional experience in matters relating to investments and as described in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Financial Promotion Order") and/or (b) high net worth companies, unincorporated associations, partnerships or trusts or their respective directors, officers or employees as described in Article 49(2) of the Financial Promotion Order and/or (c) existing members of the Company as described in Article 43(2) of the Financial Promotion Order.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or any state securities laws and may not be offered or sold in the "United States" or to "U.S. persons" (as such terms are defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

The Fundraise Shares to be issued directly in respect of the Units or indirectly as a result of Warrant exercise will be subject to a restricted or 'locked-in' period ending four months after the issue of the Units.

The Proposed Fundraise is scheduled to close on or around 22 September 2025 and is subject to certain conditions including, but not limited to, receipt of all necessary regulatory approvals and admission of the Fundraise Shares to trading on AIM.

A further announcement on the Proposed Fundraise will be released in due course.

Further Background

The Company has decided to raise these funds via a non-brokered private placement with a view to bringing on board a number of long-term value investors, predominately from North America, that the Company believes could contribute to the success of Conroy and its "Discs of Gold" project.

The Company intends to use the net proceeds from the Proposed Fundraise for further geological work on the Company's assets in Ireland, to continue with its activities in securing material asset-level investment, and for general working capital purposes.

Mr. John Sherman, the Company's Chairman, commented:

"The Board is pleased to announce the fundraise which, at a price of 10 pence per share echoes the confidence in the "Discs" project shown by the terms of the May convertible loan fundraising and the recent support from current and former Directors to restructure amounts owed to them by the Company into success-linked instruments.This funding will enable the Company to progress with carefully targeted development work on the "Discs" project, while supporting ongoing discussions with potential strategic joint-venture partners and other asset-level investors."

About the 'Discs of Gold' project

Conroy Gold's 'Discs of Gold' project in Ireland is defined by two parallel district scale gold trends, extending over c.90km, which are 100 per cent. held under license by the Company, and anchored by the Clontibret gold deposit. The Clontibret target area contains a currently defined 517Koz gold resource @ 2.0 g/t Au (320Koz Au Indicated and 197Koz Au Inferred (2017)) which remains open in multiple directions. The Company has identified a further seven gold targets in its license area with the Clay Lake and Creenkill gold targets being of particular interest. Gold occurs in multiple styles in the Company's license area, including free gold, refractory gold in arsenopyrite and gold associated with pyrite and antimony (stibnite), suggesting multiple hydrothermal events seeded the deposit. There are clear geological analogies between the "Discs of Gold" targets and large gold deposits in Southeastern Australia and Atlantic Canada.

For further information please contact:

Conroy Gold and Natural Resources PLC | Tel: +353-1-479-6180 |

John Sherman, Chairman Maureen Jones, Managing Director |

|

Allenby Capital Limited (Nomad) | Tel: +44-20-3328-5656 |

Nick Athanas / Nick Harriss |

|

Peterhouse Capital Limited (Broker) Lucy Williams / Duncan Vasey Lothbury Financial Services | Tel: +44-20-7469-0930

Tel: +44-20-3290-0707 |

Michael Padley |

|

Hall Communications | Tel: +353-1-660-9377 |

Don Hall |

|

Visit the website at: www.conroygold.com

4233439_0.jpeg |