New Diamond Drill Highlights Demonstrate Continuity of High Grade and Waste Block Conversion to High-grade Domains in Northeast Powerline

AX-25-660 - 1.85 g/t Au over 26.9m including 5.91 g/t Au over 3.5m,

within 62.0m at 0.93 g/t Au

AX-25-664 - 3.36 g/t Au over 5.0m within 19.5m at 1.12 g/t Au

and 6.00 g/t Au over 2.0 m within 1.35 g/t Au over 27.0m,

AX-25-667 - 6.03 g/t Au over 1.5m and 5.22 g/t Au over 1.4m

within 17.9m at 1.34 g/t Au

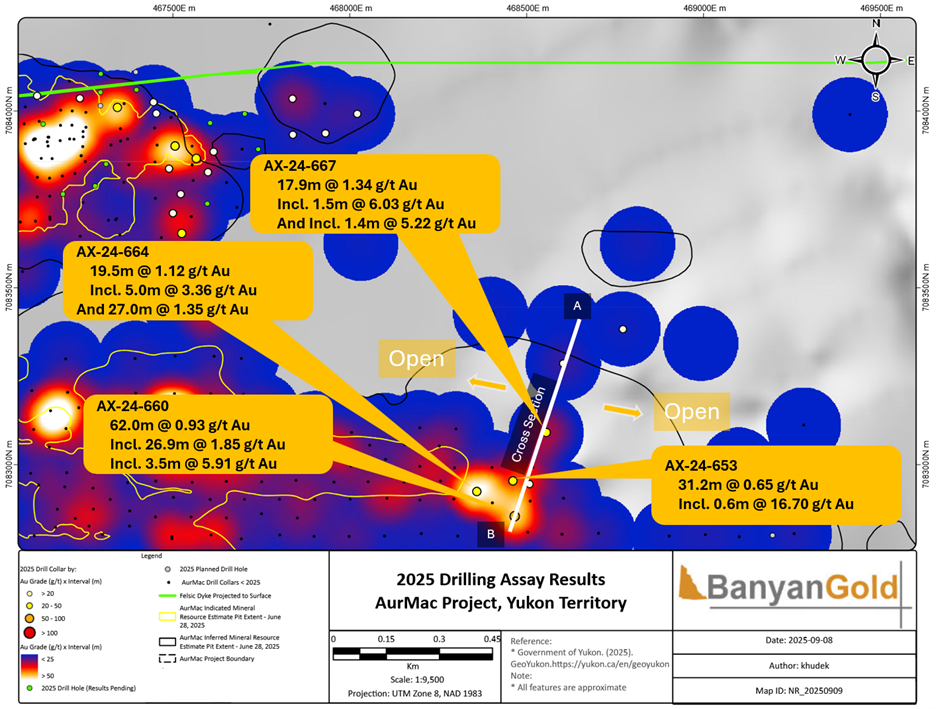

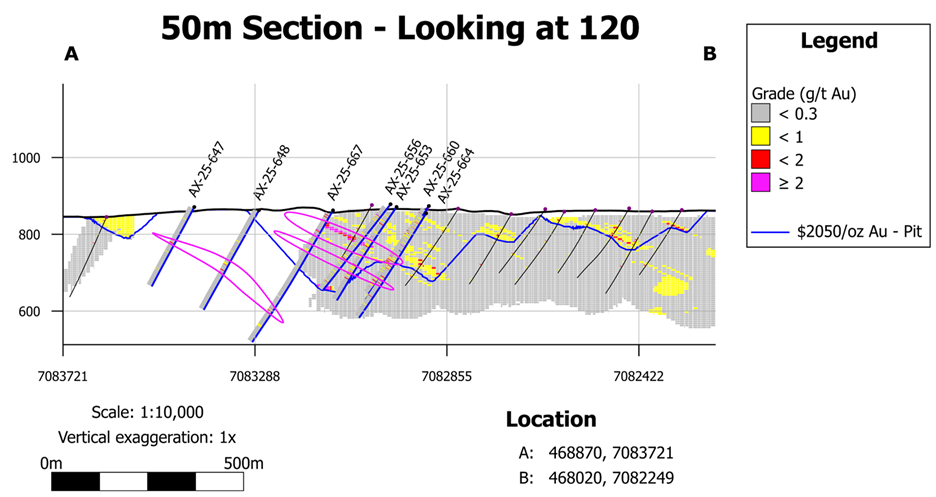

VANCOUVER, BC / ACCESS Newswire / September 15, 2025 / Banyan Gold Corp. (the "Company" or "Banyan") (TSX-V:BYN)(OTCQB:BYAGF) is pleased to announce it has intersected multiple instances of visible gold in sheeted veins at the Powerline deposit ("Powerline") at its AurMac Project ("AurMac") in the prolific Tombstone Belt, Yukon, Canada. High-grade Gold ("Au") in drillholes AX-25-660, 664, and 667 highlight the potential for further high-grade gold intervals in Powerline and confirm new 3D modelling mineralized domains. These holes also highlight the potential infill drilling to convert waste blocks to ore blocks with improved continuity of high-grade mineralized domains extending beyond the current Mineral Resource Estimate ("MRE") (see Table 3 below) conceptual pit boundary (Figure 1; Tables 1 and 2). To date, over 29,000m (127 holes) have been drilled by the Company this year on the AurMac Project, with drilling currently ongoing.

"These results advance our target of defining 5 million ounces of plus 1 g/t. Specifically, these holes from the Powerline deposit are focused on converting waste blocks that fall within the footprint of the conceptual pit where the mineralized domains are only truncated based on a lack of drilling," said Tara Christie, President and CEO. "Guided by our reinterpretation of the geologic controls of mineralization in Powerline, used to delineated 1.42 Moz of Indicated Mineral Resources at 0.95 g/t (46.4 M tonnes) and 3.13 Moz of Inferred Mineral Resources at an average gold grade of 0.98 g/t (99.2 M tonnes), at the 0.55 g/t gold cut off (see News Release of July 8, 2025). The Powerline deposit boundaries remain open in all directions."

Duncan Mackay, Vice President of Exploration, continued, "Building on our success from last year in redeveloping our geologic model and achieving nearly one-to-one conversion ratio for inferred to indicated in our MRE, we are further refining our model utilizing structural data from oriented drill core and geochemical data (bolstered by our onsite XRF). Specific mineralized domains can be traced in Powerline adding continuity to high-grade zones, converting waste blocks in the current MRE (Figure 2) and flattening and deepening the conceptual pit floor."

Table 1: Significant diamond drillhole assay intercepts for Powerline in this release

HOLE NUMBER | From (m) | To (m) | Au Interval (m) | Au Interval (g/t) |

AX-25-648 | 98.5 | 100.6 | 2.1 | 0.62 |

and | 130.0 | 131.2 | 1.2 | 0.34 |

and | 163.3 | 192.9 | 29.6 | 0.34 |

including | 186.0 | 192.9 | 6.9 | 0.72 |

AX-25-653 | 34.0 | 36.0 | 2.0 | 0.54 |

and | 49.0 | 63.0 | 14.0 | 0.32 |

and | 85.8 | 91.8 | 6.0 | 0.36 |

and | 104.3 | 135.5 | 31.2 | 0.65 |

including | 104.3 | 104.9 | 0.6 | 16.70 |

and | 147.5 | 152.5 | 5.0 | 0.31 |

and | 164.5 | 168.6 | 4.1 | 0.40 |

and | 192.6 | 237.5 | 44.9 | 0.37 |

AX-25-656 | 44.3 | 62.0 | 17.7 | 0.43 |

and | 107.0 | 121.3 | 14.3 | 0.30 |

and | 141.3 | 149.4 | 8.1 | 0.21 |

and | 178.6 | 195.5 | 16.9 | 0.35 |

and | 210.7 | 212.7 | 2.0 | 0.31 |

and | 236.7 | 253.8 | 17.1 | 0.24 |

and | 269.8 | 282.8 | 13.0 | 0.26 |

AX-25-660 | 29.0 | 37.0 | 8.0 | 0.32 |

and | 54.5 | 57.5 | 3.0 | 0.62 |

and | 75.5 | 110.0 | 34.5 | 0.29 |

and | 157.0 | 219.0 | 62.0 | 0.93 |

Including | 163.6 | 190.5 | 26.9 | 1.85 |

including | 163.6 | 167.1 | 3.5 | 5.91 |

including | 163.6 | 164.3 | 0.7 | 15.40 |

including | 166.6 | 167.1 | 0.5 | 21.50 |

and including | 182.6 | 184.1 | 1.5 | 9.00 |

and | 244.5 | 272.7 | 28.2 | 0.32 |

including | 272.3 | 272.7 | 0.4 | 4.36 |

AX-25-664 | 19.5 | 39.0 | 19.5 | 1.12 |

including | 31.4 | 36.4 | 5.0 | 3.36 |

including | 31.4 | 31.9 | 0.5 | 6.30 |

including | 34.9 | 36.4 | 1.5 | 8.53 |

and | 49.5 | 59.9 | 10.4 | 0.76 |

including | 51.0 | 52.0 | 1.0 | 6.04 |

and | 70.0 | 108.3 | 38.3 | 0.28 |

and | 138.5 | 158.5 | 20.0 | 0.32 |

and | 170.5 | 181.0 | 10.5 | 0.60 |

and | 205.0 | 232.0 | 27.0 | 1.35 |

including | 217.0 | 219.0 | 2.0 | 6.00 |

and including | 230.3 | 232.0 | 1.7 | 10.40 |

and | 267.0 | 268.3 | 1.3 | 1.34 |

and | 293.0 | 295.0 | 2.0 | 0.35 |

AX-25-667 | 18.0 | 25.5 | 7.5 | 0.57 |

and | 64.5 | 82.4 | 17.9 | 1.34 |

including | 64.5 | 66.0 | 1.5 | 6.03 |

including | 81.0 | 82.4 | 1.4 | 5.22 |

and | 97.0 | 98.5 | 1.5 | 0.32 |

and | 105.5 | 105.8 | 0.3 | 1.15 |

and | 123.0 | 128.8 | 5.8 | 0.36 |

and | 178.7 | 179.8 | 1.1 | 0.44 |

and | 308.3 | 322.0 | 13.7 | 0.43 |

and | 360.8 | 366.1 | 5.3 | 0.73 |

*True widths are estimated to be 90% of drill interval

Table 2: Collar Locations for drill holes in this release

HOLE ID | Easting (m) | Northing (m) | Elevation (m) | Depth (m) | Azimuth | Dip |

AX-25-648 | 468603 | 7083286 | 869 | 306.3 | 0 | -60 |

AX-25-653 | 468461 | 7082954 | 879 | 301.8 | 0 | -55 |

AX-25-660 | 468466 | 7082854 | 877 | 289.8 | 0 | -55 |

AX-25-656 | 468508 | 7082945 | 889 | 300.2 | 0 | -55 |

AX-25-664 | 468359 | 7082924 | 854 | 333.0 | 0 | -55 |

AX-25-667 | 468555 | 7083091 | 865 | 412.1 | 0 | -60 |

Analytical Method and Quality Assurance/Quality Control Measures

All diamond drill core was systematically logged and photographed by Banyan geology personnel. All core samples (HTW and NTW diameter) were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas's Analytical laboratory in Vancouver, B.C. for pulverization and final chemical analysis.

Core splits reported in this news release were analysed by Bureau Veritas of Vancouver, B.C., utilizing the four-acid digestion ICP-ES 35-element MA-300 or ICP-ES/MS 59-element MA-250 analytical package with FA-450 50-gram Fire Assay with AAS finish for gold on all samples. Samples returning >10 g/t Au were reanalysed by fire assay with gravimetric finish on a 50g sample (FA-550). High-grade samples with documented visible gold are also analysed using metallic screen fire assay (FS-652). Bureau Veritas is an accredited lab following ISO/IEC 17025:2017 SCC File Number 15895. A robust system of standards, ¼ core duplicates and blanks has been implemented in the 2025 exploration drilling program and is monitored as chemical assay data becomes available.

Qualified Persons

Duncan Mackay, M.Sc., P.Geo., is a "Qualified Person" as ?defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has reviewed and approved the content of this news release in respect of all disclosure other than the MRE.? Mr. Mackay is Vice President Exploration for Banyan and has verified the data disclosed in this news release, including the sampling, ??analytical and test data underlying the information.

Upcoming Events

GCFF Conference, Vancouver, September 20, 2025

121 Mining Investment Hong Kong, September 24-25, 2025

121 Mining Investment Global Online, October 14-15, 2025

About Banyan

Banyan's primary asset, the AurMac Project is located in the Traditional Territory of First Nation of Na-Cho Nyäk Dun, in Canada's Yukon Territory. The current Mineral Resource Estimate ("MRE") for the AurMac Project has an effective date of June 28, 2025 and comprises an Indicated Mineral Resource of 2.274 million ?ounces of gold ("Au") (112.5 M tonnes at 0.63 g/t) and an Inferred Mineral Resource of 5.453 Moz of Au (280.6 M tonnes at 0.60 g/t ) (as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition ?Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43-101). The 215.3 square kilometres ("sq km") AurMac Project lies 40 kilometres from Mayo, Yukon. The AurMac Project is transected by the main Yukon highway and benefits from a 3-phase powerline, existing power station and cell phone coverage.

Table 3: Pit-Constrained Indicated and Inferred Mineral Resources - AurMac Project

Deposit | Gold Cut-Off (g/t) | Tonnage | Average Gold Grade (g/t) | Contained Gold (Moz) |

Indicated MRE |

| |||

Airstrip | 0.30 | 27.7 | 0.69 | 0.611 |

Powerline | 0.30 | 84.8 | 0.61 | 1.663 |

Total Combined Indicated MRE | 0.30 | 112.5 | 0.63 | 2.274 |

Inferred MRE |

| |||

Airstrip | 0.30 | 10.1 | 0.75 | 0.245 |

Powerline | 0.30 | 270.4 | 0.60 | 5.208 |

Total Combined Inferred MRE | 0.30 | 280.6 | 0.60 | 5.453 |

Notes to Table 1:

The effective date for the MRE is June 28, 2025 and was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent "Qualified Person" within the meaning of NI 43-101.

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature ?and there has been insufficient exploration to define these Inferred Mineral Resources as an ?Indicated Mineral Resource.

Mineral Resources are reported at a cut-off grade of 0.30 g/t gold for all deposits, using a US$/CAN$ exchange rate of 0.73 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$2,050/ounce, US$2.50/t mining cost, US$10.00/t processing cost, US$2.00/t G+A, 90% gold recoveries, and 45° pit slopes.1

The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN" and is quoted on the OTCQB Venture Market under the symbol "BYAGF". For more information, please visit the corporate website at or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs and the Company's plans and timing for the closing the 100% acquisition of the McQuesten and Aurex properties. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend(s)", "believe", "potential" and "continue" or the negative thereof or similar variations, Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the potential for resource expansion; ability to define 5M oz of Au @ 1 g/t, mineral resource estimates; mineral recoveries and anticipated mining costs. Factors that could cause actual results to differ materially from such forward-looking information include uncertainties inherent in resource estimates, continuity and extent of mineralization, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

1The gold price and cost assumptions are consistent with current pricing assumptions and costs and, in particular, with those employed for recent technical reports for similar pit-constrained Yukon gold projects.

SOURCE: Banyan Gold Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/banyans-recent-drillholes-demonstrate-continuity-of-high-grade-with-1.85-g%2ft-au-o-1073068