Small business owners are focused on building stronger financial foundations while managing rising costs and policy shifts

CLEVELAND, OH / ACCESS Newswire / September 16, 2025 / Small business owners faced a tough year, battling rising costs and tariff policies. KeyBank's (NYSE:KEY) 2025 Small Business Survey found that approximately one in four (23%) small business owners are stuck in survival mode and aren't focused on long-term planning. Additionally, almost half (46%) of small business owners feel their performance fell short of expectations in 2025.

Still, 40% of small business owners are cautiously planning ahead for their businesses' futures. Another 46% say they are certain they could cover one month of operating expenses if an emergency arose, down just slightly from KeyBank's Fall 2024 Small Business Survey (49%), suggesting that they are preparing for stability and sustainability despite uncertainties.

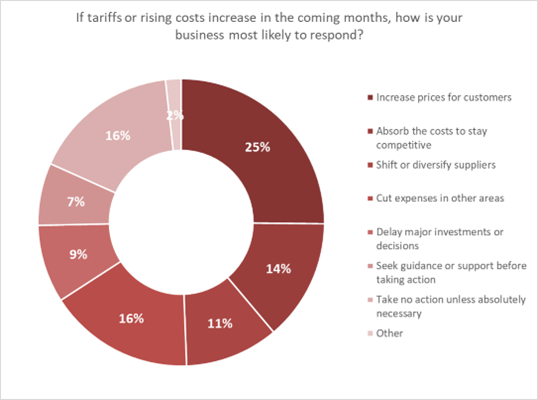

Even with an extra cushion of expenses saved, half (50%) of small business owners say their top concern is inflation and rising costs - far outpacing factors like competition (33%), cash flow (25%) and labor shortages and hiring challenges (22%). In fact, a quarter (25%) of small business owners are increasing prices for customers in light of recent tariffs and rising costs. Cybersecurity also remains a key issue for small business owners, with 41% citing payment fraud as their top concern, followed by phishing and email scams (27%) and identity theft (26%).

With federal legislation changes likely coming in the last few months of 2025, 72% of small business owners are very concerned these changes will have an impact on their operations. But good news: 80% feel confident to make key, informed decisions amid today's economic and policy uncertainty - though they do admit they might be second guessing at times.

"Navigating the current economic environment has proven to be no small feat for small business owners," says Mike Walters, President of Business Banking at KeyBank. "It's reassuring to see small business owners' passion and perseverance, despite the challenges that have come their way. Their ability to adapt-whether through tightening expenses, finding new ways to serve customers, or preparing for regulatory shifts-shows the grit and creativity at the heart of the small business community. It's that determination that allows them to build the foundation needed for long-term growth."

How Small Business Owners are Preparing for What's Ahead

Looking ahead to 2026, business owners are prioritizing the strategies, resources, and self-care that will help shape their resilience.

Seeking professional advice: 21% of small business owners agree they'd feel more secure by having regular conversations with their business bankers, with many looking for guidance on cash flow (33%), financial planning (33%), and tax strategy (31%).

Maintaining personal resilience: 30% of small business owners say they feel more resilient with a good night's sleep - ensuring they balance daily self-care needs with long-term business planning.

"Small business owners are proving that resilience is more than just surviving challenges; it's about planning ahead, leaning on trusted advisors, and making sure they have the clarity and confidence to move forward," said Walters.

Through KeyBank's Certified Cash Flow Advisor Program, business owners can receive structured, yet flexible advice on how to tackle critical cash flow and financial challenges to better optimize operations. For more information on how KeyBank can help your business, visit: KeyBank Small Business.

Methodology

This survey was conducted online with Survey Monkey, including 2,144 respondents, ages 18-99, from across the United States, who own or operate a small-to-medium size business with an annual gross revenue of less than $10 million, completed the survey in July 2025.

ABOUT KEYCORP

In 2025, KeyCorp celebrates its bicentennial, marking 200 years of service to clients and communities from Maine to Alaska. To learn more, visit KeyBank Heritage Center. Headquartered in Cleveland, Ohio, Key is one of the nation's largest bank-based financial services companies, with assets of approximately $185 billion at June 30, 2025.

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank Member FDIC.

###

CFMA #250908-3472128

View additional multimedia and more ESG storytelling from KeyBank on 3blmedia.com.

Contact Info:

Spokesperson: KeyBank

Website: https://www.3blmedia.com/profiles/keybank

Email: info@3blmedia.com

SOURCE: KeyBank

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/one-in-four-small-business-owners-are-in-survival-mode-but-adapting-1074120