Suresnes, 7 October 2025

BOOSTHEAT (FR001400OS22 / ALBOO) has released a very promising initial assessment of the expansion of its strategy announced last July with the launch of a Bitcoin Treasury Company business.

As announced, BOOSTHEAT has decided to build up a cash reserve and has chosen to launch a Bitcoin acquisition and accumulation activity (Bitcoin Treasury Company) within its subsidiary Bitcoin Hold France, wholly owned by BOOSTHEAT.

Thus, as of 3 October 2025, the value of the portfolio held by Bitcoin Hold France amounts to €358,105[1], representing a 43% increase on the initial allocation of €250,000 made on 11 July.

As a reminder, funds drawn down from the credit facility (€350,000 raised between July and October) are allocated primarily to this policy of building up cash reserves, with the balance used to cover the company's current needs, particularly in the context of its debt reduction policy. As a result, at the end of September 2025, BOOSTHEAT had repaid all of its social security and tax liabilities recorded in the accounts at the end of 2024, while significantly reducing its monthly cash requirements.

The Company will provide a further update at the end of October when it publishes its half-year results for 2025.

Risk factors:

The public's attention is drawn to the risk factors relating to the Company and its business, described in the 2024 Annual Financial Report available on the Company's website. The occurrence of some or all these risks could have an adverse effect on the Company's business, financial situation, results, development or prospects. On the date of the last Financial Report, the Company carried out a specific review of its liquidity risk and considered that it was able to meet its future maturities over the next 12 months, thanks to the use of this financing facility.

In addition, investors are invited to consider the risks specific to the new Bitcoin Treasury Company business announced by the Company on 10 July 2025.

Risk factors specific to Bitcoin Treasury Company's business:

The price of Bitcoin may be subject to sharp fluctuations, which may result in a rapid and/or significant depreciation of the digital assets held by the Company (and/or its subsidiaries). In addition, the liquidity of Bitcoin may be affected by sudden market fluctuations, regulatory restrictions and/or malfunctions of exchange platforms, making it more difficult to sell assets when cash is needed.

In addition, the regulatory and tax framework applicable to digital assets is likely to change rapidly and may differ from one jurisdiction to another. Changes in legislation and/or decisions by market authorities could therefore have an adverse impact on the holding and/or use of digital assets (including Bitcoin) by the Company (and/or its subsidiaries).

Finally, the holding of digital assets (including Bitcoin) may require the implementation of strict security measures (secure digital wallets, private keys, cold storage protocols). Any security breach, loss of access to private keys or computer attack could result in the total or partial loss of the digital assets held by the Company (and/or its subsidiaries).

* * *

Find all the information about BOOSTHEAT at

www.boostheat-group.com

ABOUT BOOSTHEAT AND BITCOIN HOLD FRANCE

Founded in 2011, BOOSTHEAT is a player in the energy efficiency sector. The Company's mission is to accelerate the ecological transition by integrating its technology into energy-intensive applications. BOOSTHEAT has designed and developed a patented thermal compressor that significantly optimises energy consumption, thereby promoting the rational and appropriate use of resources.

The Company has also created a Bitcoin Treasury Company business within its subsidiary Bitcoin Hold France for the purpose of acquiring and accumulating Bitcoin.

BOOSTHEAT is listed on Euronext Growth in Paris (ISIN: FR001400OS22).

I CONTACTS

ACTUS finance & communication - Jérôme FABREGUETTES LEIB

Investor Relations

Tel.: 01 53 67 36 78 /boostheat@actus.fr

ACTUS finance & communication - Anne-Charlotte DUDICOURT

Press Relations

Tel.: 06 24 03 26 52 /acdudicourt@actus.fr

Warning:

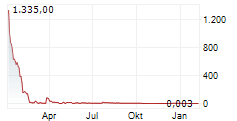

BOOSTHEAT has set up financing in the form of OCEANE-BSA bonds with Impact Tech Turnaround Opportunities (ITTO), which, after receiving the shares resulting from the repayment or exercise of these instruments, does not intend to remain a shareholder of the Company.

The shares resulting from the redemption or exercise of the aforementioned securities will generally be sold on the market within a very short period of time, which may create significant downward pressure on the share price.

Shareholders may suffer a loss of their invested capital due to a significant decrease in the value of the Company's shares, as well as significant dilution due to the large number of securities issued to Impact Tech Turnaround Opportunities (ITTO).

Investors are advised to exercise caution before deciding to invest in the securities of the Company admitted to trading that carries out such dilutive financing transactions, particularly when they are carried out on a successive basis. The Company notes that this dilutive financing transaction is not the first it has carried out.

[1] Portfolio consisting of 3.44 Bitcoin valued on the basis of a reference price of €104,100.40 on Friday, 3 October 2025.

- SECURITY MASTER Key: xm5wlpRnlWicnW5yYp5qaZWYm2thx2Sba2qaxGNvlcibb5qVxmZhapnHZnJlmWpm

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-94450-alboo_cp_point_bitcoin_eng_vdef.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free