Suresnes, 31 October 2025

BOOSTHEAT (FR001400OS22 / ALBOO) announces its half-year results for 2025 and the availability of its half-year financial report for 2025 on its website.

Stéphane Lederman, CEO of BOOSTHEAT, said: "We set ourselves the dual objective of finding a way to maximise the value of BOOSTHEAT's assets while building up financial assets through a Bitcoin Treasury Company policy. To achieve this dual objective, we needed to reduce the company's current expenses and financial liabilities. We have made progress on all these objectives since the beginning of the year."

I OPERATING LOSS DIVIDED BY 6

During the first half of 2025, BOOSTHEAT reduced its operating expenses to €226,000 compared to €1,426,000 in the first half of 2024, representing a more than sixfold reduction in the company's current requirements. The half-year operating result was therefore -€219,000, compared with -€1,407,000 a year earlier.

Net income, impacted by exceptional expenses of €13,927,000 mainly related to the accounting treatment of conversion penalties on the financing agreement with no impact on the Company's cash position, amounted to €14,132,000 compared with €1,359,000 in the first half of 2024.

I A FINANCIAL LIABILITY IN THE PROCESS OF SETTLEMENT

At the same time, liabilities not recorded under the continuation plan were significantly reduced thanks to funds drawn down from the credit facility (€700,000 gross between January and June 2025). Trade payables were halved, falling from €1,291,000 to €663,000, and debts to social security organisations were also reduced by 25%, falling from €773,000 to €577,000, and are now virtually zero.

Equity of €-16,758,000, inherited from the former operating activity, is largely offset by €14,253,000 in other equity consisting mainly of debts recorded under the safeguard plan and not intended to be repaid in cash. Cash and cash equivalents at the end of June 2025 amounted to €149,000 before the implementation of the Bitcoin Treasury Company activity.

I A NEW FINANCING LINE SIGNED

As announced in early July 2025, BOOSTHEAT decided to build up a cash reserve and chose to launch a Bitcoin acquisition and accumulation activity (Bitcoin Treasury Company) within its subsidiary Bitcoin Hold France, wholly owned by BOOSTHEAT.

Thus, as of 24 October 2025, the value of the portfolio held by Bitcoin Hold France amounts to €326,804.[1], representing a 43% increase on the initial allocation of €250,000 made on 11 July.

As a reminder, funds drawn down from the credit facility (€350,000 gross between July and October) are allocated primarily to this policy of building up cash reserves, with the balance used to cover the company's day-to-day needs, particularly in the context of its debt reduction policy.

* * *

Risk factors:

The public's attention is drawn to the risk factors relating to the Company and its business, described in the 2024 Annual Financial Report available on the Company's website. The occurrence of some or all these risks could have an adverse effect on the Company's business, financial situation, results, development or prospects. On the date of the last Financial Report, the Company carried out a specific review of its liquidity risk and considered that it was able to meet its future maturities over the next 12 months, thanks to the use of this financing facility.

In addition, investors are invited to consider the risks specific to the new Bitcoin Treasury Company business announced by the Company on 10 July 2025.

Risk factors specific to Bitcoin Treasury Company's business:

The price of Bitcoin may be subject to sharp fluctuations, which may result in a rapid and/or significant depreciation of the digital assets held by the Company (and/or its subsidiaries). In addition, the liquidity of Bitcoin may be affected by sudden market fluctuations, regulatory restrictions and/or malfunctions of exchange platforms, making it more difficult to sell assets when cash is needed.

In addition, the regulatory and tax framework applicable to digital assets is likely to change rapidly and may differ from one jurisdiction to another. Changes in legislation and/or decisions by market authorities could therefore have an adverse impact on the holding and/or use of digital assets (including Bitcoin) by the Company (and/or its subsidiaries).

Finally, the holding of digital assets (including Bitcoin) may require the implementation of strict security measures (secure digital wallets, private keys, cold storage protocols). Any security breach, loss of access to private keys or computer attack could result in the total or partial loss of the digital assets held by the Company (and/or its subsidiaries).

* * *

Find all the information about BOOSTHEAT at

www.boostheat-group.com

ABOUT BOOSTHEAT AND BITCOIN HOLD FRANCE

Founded in 2011, BOOSTHEAT is a player in the energy efficiency sector. The Company's mission is to accelerate the ecological transition by integrating its technology into energy-intensive applications. BOOSTHEAT has designed and developed a patented thermal compressor that significantly optimises energy consumption, thereby promoting the rational and appropriate use of resources.

The Company has also created a Bitcoin Treasury Company business within its subsidiary Bitcoin Hold France for the purpose of acquiring and accumulating Bitcoin.

BOOSTHEAT is listed on Euronext Growth in Paris (ISIN: FR001400OS22).

I CONTACTS

ACTUS finance & communication - Jérôme FABREGUETTES LEIB

Investor Relations

Tel.: 01 53 67 36 78 / boostheat@actus.fr

ACTUS finance & communication - Anne-Charlotte DUDICOURT

Press Relations

Tel.: 06 24 03 26 52 / acdudicourt@actus.fr

Warning:

BOOSTHEAT has set up financing in the form of OCEANE-BSA bonds with Impact Tech Turnaround Opportunities (ITTO), which, after receiving the shares resulting from the repayment or exercise of these instruments, does not intend to remain a shareholder of the Company.

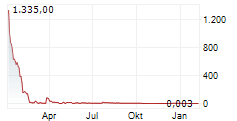

The shares resulting from the redemption or exercise of the aforementioned securities will generally be sold on the market within a very short period of time, which may create significant downward pressure on the share price.

Shareholders may suffer a loss of their invested capital due to a significant decrease in the value of the Company's shares, as well as significant dilution due to the large number of securities issued to Impact Tech Turnaround Opportunities (ITTO).

Investors are advised to exercise caution before deciding to invest in the securities of the Company admitted to trading that carries out such dilutive financing transactions, particularly when they are carried out on a successive basis. The Company notes that this dilutive financing transaction is not the first it has carried out.

[1] Portefeuille constitué de 3,44 Bitcoin valorisé sur la base d'un cours de référence de 95 001,19 € le vendredi 24 octobre 2025

- SECURITY MASTER Key: mmlpkpRqk5yXm2+fY5mXm5OVmmdllGDGapKcl2Sbk5vGZ2lhnW+VaZmbZnJlnmxn

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-94971-alboo_cp_rs_2025_veng.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free