Conroy Gold & Natural Resources Plc - Warrant Exercise

PR Newswire

LONDON, United Kingdom, October 17

PRIOR TO PUBLICATION, THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT WAS DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019/310. WITH THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

17 October 2025

Conroy Gold and Natural Resources plc

(" Conroy" or the " Company")

Warrant Exercise

Holdings in the Company and PCA Dealing

Total Voting Rights

Warrant Exercise

Conroy Gold and Natural Resources plc (AIM: CGNR), the gold exploration and development company focused on Ireland and Finland, announces that the Company has received warrant exercise notices to subscribe for a total of 4,558,258 new ordinary shares of €0.001 each in the Company (" Ordinary Shares") at an exercise price of 9.5 pence per Ordinary Share generating cash proceeds of c.£433,034 for the Company. These warrants were issued as part of the fundraising announced by the Company on 9 October 2024 (the " Warrants"). The remaining 2,697,224 Warrants that remain unexercised have now lapsed.

An application has been made for the 4,558,258 new Ordinary Shares to be admitted to trading on AIM (" Admission") with admission expected to become effective on or around 21 October 2025.

Holdings in the Company and PCA Dealing

Of those who have exercised Warrants, Mr Philip Hannigan (a substantial shareholder in Conroy as defined in the AIM Rules for Companies) will be issued 1,000,000 new Ordinary Shares and, as a consequence, is expected to hold 10,058,445 Ordinary Shares representing 13.07% of the enlarged share capital of the Company on Admission.

Furthermore, the Estate of Professor Richard Conroy (the " Estate") has also exercised warrants over 779,763 Ordinary Shares and as a consequence is expected to hold 5,026,431 Ordinary Shares representing 6.53% of the enlarged share capital of the Company on Admission. In tandem with the exercise of these warrants, an amount of £74,078 is being repaid to the Estate in respect of an outstanding shareholder loan, thereby clearing remaining amounts owing to the Estate not already covered by the arrangements announced by the Company on 28 August 2025 in relation to accrued Directors fees and remuneration.

The exercise of Warrants by the Estate is deemed to be a PCA dealing and the table below provides further details in accordance with the UK Market Abuse Regulation.

Total Voting Rights

On Admission, and for the purposes of the FCA Disclosure Guidance and Transparency Rules, the Company's total issued voting share capital will consist of 76,949,433 Ordinary Shares with one voting right per ordinary share. The above figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company, under the FCA's Disclosure Guidance and Transparency Rules.

About the 'Discs of Gold' project

Conroy's 'Discs of Gold' project in Ireland is defined by two parallel district scale gold trends, extending over c.90km, which are 100 per cent. held under license by the Company, anchored by the Clontibret gold deposit. The Clontibret target area contains a currently defined 517Koz gold resource @ 2.0 g/t Au (320Koz Au Indicated and 197Koz Au Inferred (2017)) which remains open in multiple directions. The Company has identified a further seven gold targets in its license area with the Clay Lake and Creenkill gold targets being of particular interest. Gold occurs in multiple styles in the Company's license area, including free gold, refractory gold in arsenopyrite and gold associated with pyrite and antimony (stibnite), suggesting multiple hydrothermal events seeded the deposit. There are clear geological analogies between the "Discs of Gold" targets and large gold deposits in Southeastern Australia and Atlantic Canada.

For further information please contact:

Conroy Gold and Natural Resources PLC | Tel:+353-1-479-6180 |

John Sherman, Chairman Maureen Jones, Managing Director |

|

Allenby Capital Limited (Nomad) | Tel:+44-20-3328-5656 |

Nick Athanas / Nick Harriss |

|

Peterhouse Capital Limited (Broker) Lucy Williams / Duncan Vasey Lothbury Financial Services | Tel:+44-20-7469-0930 Tel:+44-20-3290-0707 |

Michael Padley |

|

Hall Communications | Tel:+353-1-660-9377 |

Don Hall |

|

Visit the website at: www.conroygold.com

The below notifications made in accordance with the requirements of the UK Market Abuse Regulation provide further detail:

1 | Details of the person discharging managerial responsibilities / person closely associated | |

a) | Name | The Estate of the Professor Richard Conroy (the "Estate") |

2 | Reason for the notification | |

a) | Position/status | The Estate is a person closely associated with Maureen Jones (a PDMR and Managing Director of the Company) by virtue of her being one of the executors of the Estate |

b)

| Initial notification /Amendment | Initial notification |

3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

a) | Name | Conroy Gold and Natural Resources plc |

b) | LEI | 635400YIAKIIDS7JKF64 |

4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

a) | Description of the financial instrument, type of instrument Identification code | Ordinary shares of €0.001 each in Conroy Gold and Natural Resources plc Identification code (ISIN): IE00BZ4BTZ13 |

b) | Nature of the transaction | Exercise of Warrants |

c) | Price(s) and volume(s) | Price: 9.5 pence per share Volume: 779,763 |

d) | Aggregated information - Aggregated volume - Price | See above. |

e) | Date of the transaction | 16 October 2025 |

f) | Place of the transaction | Outside of a trading venue |

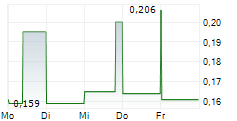

4252048_0.jpeg |