The report is available on the company's website:www.sdiptech.se

STABLE CORE OPERATIONS WITH SOLID MARGIN, GOOD CASH FLOW AND STRATEGIC INITIATIVES ACCORDING TO PLAN

THIRD QUARTER 2025 Core operations

- Net sales increased by 9% to SEK 1,102 million (1,012) corresponding to organic growth in the core operations of 5%, excluding currency effects.

- Adjusted EBITA amounted to SEK 235 million (216), corresponding to an adjusted EBITA margin of 21.3% (21.3) an organic growth in the core operations of 2%, excluding currency effects.

- As of the third quarter of 2025, Sdiptech's operations that are part of the long-term strategic direction are reported as "Core operations".

- Businesses that are not in line with the Group's strategic direction have been separated from the core operations to be divested. These are reported separately as "Other operations" and are included in "Group".

THIRD QUARTER 2025 Group

- Net sales increased by 4% to SEK 1,253 million (1,210) corresponding to organic growth of 2%, excluding currency effects.

- EBITA amounted to SEK 245 million (238), corresponding to an EBITA margin of 19.5% (19.6).

- Adjusted EBITA amounted to SEK 242 million (231), corresponding to an adjusted EBITA margin of 19.4% (19.1) an organic decrease of 2%, excluding currency effects.

- Profit before tax for amounted to SEK -378 million (134). Profit after tax amounted to SEK -419 million (91) and earnings per share amounted to SEK -11.14 (2.28). Impairment of goodwill and surplus values resulted in a non-cash impact from a one-off effect of SEK -500 million. Earnings per share excluding impairment amounted to SEK 2.03 (2.28).

- Cash flow from operating activities amounted to SEK 255 million (167), corresponding to a cash conversion of 94% (67), and a free cash flow per share of SEK 5.24 (2.16).

COMMENTS BY THE CEO

In the third quarter, we implemented several key strategic initiatives to ensure a good future development in our core operations. Several main segments show stability and cautious optimism, but a more comprehensive recovery is not expected until 2026.

Development of the core operations

As previously communicated, we now report our core operation separately from businesses outside our strategic focus. The core operations consist of companies with solid underlying market trends, strong margins and niche products that are often complemented by a service offering, resulting in stable recurring revenues.

Our unit in the core operation showed good demand with a sales increase of 8.8 percent, of which 4.5 percent organic excl. currency. Higher sales volumes and completed acquisitions lifted the core operation's adjusted EBITA to SEK 235 million, an increase of 8.6 percent, of which 2.4 percent organic excluding currency. At the same time, several of the profitability measures we initiated in the previous two quarters have had an effect and stabilised profitability despite price pressure and higher costs, which resulted in us being able to maintain an adjusted EBITA margin of a solid 21.3 percent.

Our larger units within Supply Chain & Transportation have started to recover after a weaker first half of the year when uncertainties in the world resulted in several customers postponing their orders. Safety & Security also had a good quarter and several of the smaller units benefiting from strong global trends, such as data centre security and emission control, have continued to grow. In Energy & Electrification, the outcome was varied, with a couple of units driven by continued strong demand for energy efficiency. At the same time, individual units in the business area continued to have tough comparative figures from the previous year. In Water & Bioeconomy, several units have developed well, but the margin was affected by the cost situation in a couple of units within the business area, where we are working on efficiency improvements and price compensation measures.

The Group's cash flow from operating activities was back at satisfactory levels and amounted to SEK 255 million, corresponding to a cash flow generation of 94 percent. This is mainly a result of normalized inventory levels.

Acquisitions and divestments

The work to divest non-core businesses is progressing according to plan and we have extensive dialogues with several stakeholders. The sales of these units aim to streamline our business while freeing up resources in the form of both management capacity and capital for the core operations. As a result, we have carried out an impairment of goodwill and other surplus values of SEK 500 million, which highlights the strong return found in the core operation.

Our acquisition pipeline remains good and discipline in valuation and strict acquisition criteria are guiding. This affects our previously communicated target of acquiring an annual EBITA of approximately SEK 100 million by 2025, which we have adjusted down to approximately SEK 50 million.

Outlooks

We assess the market as stable to cautiously positive in several of our main segments, although a broader recovery does not appear to materialise until 2026. With a focused and well-diversified core business, a clear capital allocation agenda and a focus on organic growth, we are well positioned to continue creating long-term value over time.

During the autumn, we have continued our strategy work, and we look forward to sharing more at our Capital Markets Day on 28 November in Stockholm. We hope that many of you will have the opportunity to participate, and I would like to take this opportunity to extend a warm welcome to you all.

Anders Mattson,

President and CEO

For additional information, please contact:

Bengt Lejdström, CFO, +46 702 74 22 00, bengt.lejdstrom@sdiptech.com

My Lundberg, Head of Sustainability & IR, +46 703 61 18 10, my.lundberg@sdiptech.com

About Us

Sdiptech is a technology group that acquires and develops market-leading niche operations that contribute to creating more sustainable, efficient and safe societies. Sdiptech has approximately SEK 5,000 million in sales and is based in Stockholm.

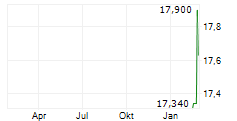

Sdiptech's common shares of series B are traded on Nasdaq Stockholm under the short name SDIP B with ISIN code SE0003756758. Sdiptech's preferred shares are traded under the short name SDIP PREF with ISIN code SE0006758348. Further information is available on the company's website: www.sdiptech.se

This information is information that Sdiptech is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-24 08:00 CEST.