Original-Research: Serviceware SE - from Quirin Privatbank Kapitalmarktgeschäft

Classification of Quirin Privatbank Kapitalmarktgeschäft to Serviceware SE

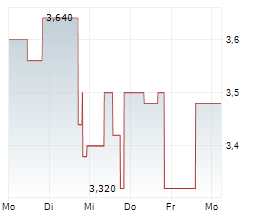

Strong margin improvements On October 24, 2025, Serviceware released its Q3 2024/2025 financial results and confirmed its guidance for FY2024/2025. Revenue growth was strong (+16.6% yoy) and exceeded our expectation by 5.4%. The increase was mainly driven by strong SaaS/Service momentum, which continued to gain share due to the ongoing transition from license to SaaS. Additional support came from product innovation, notably the AI Process Engine, which helped win new customers, and from international expansion, including first projects in North America and Asia and a new sales presence in France. Large enterprise wins also added scale, while the rising order backlog provided further visibility. The EBIT margin improved from 0.4% to 2.3%, clearly above our estimate of 0.4%, benefiting from a higher SaaS mix and operating leverage. Other important points include the growing partner network and a 26.4% increase in backlog to EUR 101.9m. Serviceware confirmed its guidance of 5-15% yoy revenue growth for FY2024/2025, in line with our estimate. We see the investment case supported by strong SaaS dynamics, product innovation, and higher visibility from the backlog. We raise our target price to EUR 28.50 (previously EUR 27.50) and confirm our Buy recommendation. You can download the research here: SERVICEWARE_SE_20251027 For additional information visit our website: https://research.quirinprivatbank.de/ Contact for questions: Quirin Privatbank AG Institutionelles Research Schillerstraße 20 60313 Frankfurt am Main research@quirinprivatbank.de https://research.quirinprivatbank.de/ The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. | ||||||||||||||||||

2219044 27.10.2025 CET/CEST

© 2025 EQS Group