Thwaites (Daniel) Plc - Half-year Financial Report

PR Newswire

LONDON, United Kingdom, November 11

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2025

CHAIRMAN'S STATEMENT

Overview

The Company has delivered a strong performance over the last six months, a period in which we have incurred the significant increase in employment costs as a result of the October 2024 budget and weak consumer confidence due to the government preparing the ground for further tax changes later in the year.

Results

Turnover for the half year was £66.7m, which is a 5% increase compared to turnover last year of £63.5m.

An operating profit of £10.1m for the half year compares to £9.4m last year, the increase largely due to the combined performance of Langdale Chase Hotel, returns on recent investments in our properties and price increases which we have tried to keep to a minimum.

Interest rates have reduced from 4.5% to 4.0% during the period which has lowered our interest costs by £0.2m compared to last year. However, inflation has remained higher than the Bank of England's target so it seems that in the short to medium term rates will remain slightly higher for longer than the expectation at the beginning of the year. This has had a small positive impact on the mark to market fair value of our interest rate swaps, resulting in a decrease in the provision of £0.1m at the half year (2024: £0.2m), and this positive movement is shown in our profit and loss account.

Net debt on 30 September 2025 was £66.7m (2024: £71.2m); a decrease of £4.5m compared to last year, and down £4.7m from £71.4m on 31 March 2025. The business has comfortable headroom against total banking facilities of £82m and is trading well within it banking covenants.

Pubs and Inns

The pubs got off to a good start due to a long dry and sunny period throughout the spring and into the summer. However, the early gains reversed as both the weather and consumer confidence deteriorated such that beer volumes for the half year were down year on year by 1%.

The inns performed strongly due to the acquisition of The Buck Inn in Malham in March 2025 and significant refurbishments at the Bulls Head, Earlswood, Royal Oak, Keswick and Toll House, Lancaster. Sales were up 8% on last year, and with the benefit of a clear focus on cost control profits increased by 15%.

Hotels & Spas

The hotels performance benefitted from further growth in sales at Langdale Chase, which reopened in November 2023 after a full refurbishment, and sales for the period were up 30% on last year. Total sales for the hotels increased by 7% year on year.

Langdale Chase continues to receive a great deal of positive press and customer feedback and we are a Condé Nast Traveller Readers' Choice winner.

Awards

We were delighted to be awarded the AA Hotel Group of the year which is testimony to the hard work and dedication of our teams across the business and in our hotels and inns.

We were also placed first in the Hospitality Awards Learning and Development category, well-deserved recognition of the progress we have made in creating development pathways through our business and helping individuals to grow and progress.

Acquisitions, developments and disposals

We have made no acquisitions during the period although we acquired the Blue Bell Cider House in Earlswood on 7 October 2025.

We have continued to invest in our properties, investing £6.2m in the period.

We continue to divest of pubs that no longer suit our requirements or are no longer viable due to the significant increases in operating costs and sold four pubs in the period. We received total proceeds from these disposals of £1.8m, making a profit of £0.1m on disposal.

Earnings per Share and Share buyback

Earnings per share for the period is 11.3p per share, an increase of 9% compared to 10.4p per share in 2024. The increase is due the increase in operating profit during the period.

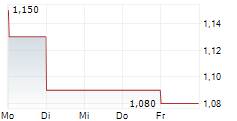

We were able to buy back 1,627,500 of our shares in the period for an average price of 87.3p, which have been cancelled leaving 57,200,000 shares in issue.

Dividend

The Board recommends an interim dividend of 0.95p per share (2024: 0.90p) to be paid on 9 January 2026 to shareholders on the register on 12 December 2025.

Summary and Outlook

This is an excellent set of results given the circumstances, which flow predominantly from investments made in previous periods under different circumstances and a lower tax regime.

We have faced into the additional National Insurance rates and higher National Minimum Wage placed on the sector from April this year by restructuring teams in the managed properties, implementing operational changes to try and absorb increased costs and selectively increasing prices whilst mindful of value, it has been a challenge and one to which our teams have responded stoically.

It is extremely unhelpful that for the second summer in a row the government has encouraged a running commentary on additional tax rises in the media, which has again damaged business and consumer confidence and suppressed growth.

The tax burden on community pubs has reached its limit, particularly for landlords running smaller tenanted community pubs. There is no scope for further increases in any tax on them and in the budget due on 26 November we and the rest of the industry have asked for business rates to be cut to alleviate the overtaxed position in which pubs find themselves.

Our trading performance is holding up, although it is patchy and unpredictable across the different parts of the business, dependent on weather, school holidays and special occasions. We are benefitting from the diversification of the business as well as the strategy pursued in recent years to position ourselves into more premium, experiential and health orientated markets; there is no doubt that this has been helpful.

The business has, for the moment, reduced its level of bank debt and investment and we have phased our investment programme to the latter part of this year to allow us to respond to whatever decisions are taken in the Autumn budget.

We have a well invested, well positioned business with opportunities to invest, grow and create new employment; however, we can only have confidence to do this if we have a stable and trustworthy fiscal and political framework to work with.

Richard Bailey

Chairman

11 November 2025

Profit and Loss Account for the six months ended 30 September 2025

Unaudited | Unaudited | Audited | |

6 months ended 30 September 2025 £'m

| 6 months ended 30 September 2024 £'m | 12 months ended 31 March 2025 £'m | |

Turnover |

66.7 | 63.5 | 120.6 |

|

|

| |

Operating profit before property disposals | 10.0 | 9.4 | 11.8

|

Property disposals | 0.1 ______ | - ______ | 0.4 ______ |

Operating profit Net interest payable Gain on interest rate swaps measured at fair value | 10.1

(2.5)

0.1 | 9.4 (2.7) 0.2 | 12.2 (5.3) 1.2 |

Finance income on pension asset |

0.6

| 0.7 | 1.7 |

______ | ______ | ______ | |

Profit on ordinary activitiesbefore taxation | 8.3 | 7.6 | 9.8 |

|

| ||

Taxation | (1.7) | (1.5) | (2.2) |

______ | ______ | ______ | |

Profit on ordinary activities after taxation |

6.6 | 6.1 | 7.6 |

| ______ | ______ | ______ |

Earnings per share |

11.3 p | 10.4 p | 12.9 p |

Balance Sheet as at 30 September 2025

Unaudited | Unaudited | Audited | |

| 30 September 2025 £'m

| 30 September 2024 £'m | 31 March 2025 £'m

|

Fixed assets Tangible assets Investments

|

321.2 0.8 ______ | 315.3 0.9 ______ | 319.9 0.8 ______ |

| 322.0 | 316.2 | 320.7 |

Current assets |

|

| |

Stocks | 0.9 | 1.0 | 0.9 |

Trade and other debtors | 7.8 | 7.7 | 7.3 |

Cash at bank and in hand | 4.3 | 1.8 | 2.6 |

______ | ______ | ______ | |

13.0 | 10.5 | 10.8 | |

Creditors due within one year |

| ||

Trade and other creditors | (24.1) | (20.5) | (20.8) |

Loan capital and bank overdraft | (30.5) | - | (33.5) |

______ | ______ | ______ | |

| (54.6) | (20.5) | (54.3) |

Net current liabilities |

(41.6) | (10.0) | (43.5) |

______ | ______ | ______ | |

Total assets less current liabilities | 280.4 | 306.2 | 277.2 |

| |||

Creditors due after one yearLoan capital Deferred tax Interest rate swaps |

(40.5) (11.5) (1.6) | (73.0) (10.7) (2.6) | (40.5) (11.3) (1.7) |

______ | ______ | ______ | |

Net assets excluding pension asset | (53.6)

226.8 | (86.3) 219.9 | (53.5) 223.7 |

|

| ||

Pension asset | 30.3 | 35.6 | 29.7 |

______ | ______ | ______ | |

Net assets including pension asset | 257.1 | 255.5 | 253.4 |

______ | ______ | ______ | |

| |||

Capital and reserves |

| ||

Called up share capital Capital redemption reserve | 14.3 1.5 | 14.7 1.1 | 14.7 1.1 |

Revaluation reserve | 79.9 | 78.6 | 80.1 |

Profit and loss account | 161.4 | 161.1 | 157.5 |

______ | ______ | ______ | |

Equity shareholders' funds | 257.1 | 255.5 | 253.4 |

______ | ______ | ______ | |

|

NOTES:-

1. Basis of preparation

These interim accounts, which have not been audited, have been prepared using the accounting policies set out in the Annual Report and Accounts for the year ended 31 March 2025.

2. Taxation

The taxation charge is based on the estimated tax rate for the year.

DT Interim Report September 2025 |