Toronto, Ontario--(Newsfile Corp. - November 24, 2025) - Green Canada Corporation ("GCC" or the "Company"), a 54.3% owned subsidiary of PTX Metals Inc. (TSXV: PTX) ("PTX") and a uranium exploration company with a portfolio of projects located in the Athabasca Basin, Saskatchewan, the Thelon Basin, Nunavut, and the Otish Basin in Quebec, is pleased to announce that it has entered into a binding letter of intent (the "RTO LOI") dated November 13, 2025 with MAACKK Capital Corp. ("MAACKK") pursuant to which GCC and MAACKK intend to complete a transaction that would result in a reverse take-over of MAACKK by the shareholders of GCC (the "Proposed RTO"). Closing of the Proposed RTO will be subject to, among other things, requisite regulatory approval for the listing of the resulting issuer of the Proposed RTO (the "Resulting Issuer") on the Canadian Securities Exchange or such other stock exchange as may be mutually agreed upon by the parties (the "Exchange").

In connection with the Proposed RTO, GCC has also entered into a binding letter of intent (the "Mineral Rights LOI") dated as of November 13, 2025 with Basin Energy Limited (ASX: BSN) ("BSN") and BSN's wholly owned subsidiary Basin Energy Marshall Corp. ("BSN Sub") in respect of GCC's proposed acquisition of BSN Sub's 100% interest in the mineral claims known as the "Marshall Project" located in Saskatchewan, Canada (the "Proposed Mineral Rights Acquisition").

In connection with the Mineral Rights LOI, GCC, BSN, BSN Sub and CanAlaska Uranium Ltd. (TSXV: CVV) ("CVV") entered into a binding term sheet agreement (the "Operator and Exclusivity Right Term Sheet Agreement") in connection with (A) the appointment of CVV as the operator of the Marshall Project (the "Operator") to carry out the Initial Work Program (as defined below) and (B) the granting by CVV and BSN to GCC of a 9-month exclusivity right to conduct due diligence and, if satisfactory, negotiate the terms of an earn-in option to acquire up to a 51% interest in the North Millennium Joint Venture Project of CVV and BSN (the "NMX Exclusive Right").

Greg Ferron, Chief Executive Officer of PTX and a director of GCC, commented: "This acquisition brings GCC a flagship asset in the Athabasca Basin leveraging the exploration work and expertise completed by two experienced teams; CanAlaska and Basin. In addition, I would like to welcome new members of the Board bringing significant uranium experience, including Rick Mazur as the Proposed Executive Chairman of the Resulting Issuer."

Terms of the Proposed RTO

Under the Proposed RTO, MAACKK will acquire all of the issued and outstanding shares of GCC by way of an amalgamation (the "Amalgamation") between GCC and a wholly owned subsidiary of MAACKK to be incorporated in the same jurisdiction as GCC, and the amalgamated entity ("Amalco") will become a wholly owned subsidiary of MAACKK. Pursuant to the Amalgamation, the shareholders of Amalco will receive common shares in the capital of MAACKK, resulting in a reverse-take-over of MAACKK. The structure of the Proposed RTO may be revised to accommodate tax considerations, accounting treatments and applicable legal and regulatory requirements.

It is proposed that a concurrent non-brokered private placement will be completed by GCC for aggregate gross proceeds of $2,500,000 (the "Concurrent Financing") on or prior to the closing of the Proposed RTO. The pricing and terms of the Concurrent Financing will be determined by GCC and its advisors in the context of prevailing market conditions and will be completed in tranches. GCC and MAACKK have agreed that prior to the closing of the Proposed RTO and after giving effect to the Debt Settlement (as defined below), MAACKK will consolidate all of its issued and outstanding common shares on a 6.25 to 1 basis (the "Consolidation"). Pursuant to the terms of the RTO LOI, at the time of closing of the Proposed RTO, after giving effect to the Amalgamation, each common share of Amalco will be exchanged for one common share of the Resulting Issuer (the "Resulting Issuer Shares").

Completion of the Proposed RTO will require, among other things, approval of the shareholders of GCC at a special meeting to be convened in due course to consider and approve all matters necessary to implement and complete the Proposed RTO. While the Proposed RTO does not require the approval of the shareholders of MAACKK, pursuant to the terms of the RTO LOI, GCC may request MAACKK to hold a shareholders' meeting and seek shareholders' approval to: (a) the Consolidation, (b) change its name to such name as may be requested by GCC and subject to applicable legal requirements, (c) elect the new directors of the Resulting Issuer, (d) rectify the past corporate actions of MAACKK, and (e) approve such other matters as may be reasonably requested by GCC (collectively, the "Meeting Matters"). The name change, if applicable, will take effect upon or after the closing of the Proposed RTO.

PTX holds approximately 54.3% of GCC's issued and outstanding common shares on a non-diluted basis. Upon completion of the Proposed RTO, PTX and other GCC shareholders will receive the Resulting Issuer Shares in exchange for the shares they currently hold in GCC. PTX currently holds 18,166,666 common shares of GCC. The total number of Resulting Issuer Shares will be determined based on the pricing of the Concurrent Financing, and will include PTX's shareholdings following completion of the Amalgamation. No finder's fees are expected to be paid in connection with the Proposed RTO. The Proposed RTO is an Arm's Length Transaction under the policies of the TSX Venture Exchange (the "TSXV").

Closing of the Proposed RTO is subject to completion and execution of all definitive transaction documents (including accuracy of representations and warranties, compliance with covenants and satisfaction of customary conditions), completion of the Concurrent Financing, completion of a debt settlement by MAACKK to eliminate all outstanding indebtedness prior to closing (the "Debt Settlement"), execution of the mineral claims purchase agreement and other associated agreements in connection with the Proposed Mineral Rights Acquisition (the "Mineral Claims Purchase Agreement") and the granting of NMX Exclusive Right by CVV and BSN to GCC, and the satisfaction (or waiver) of all closing conditions therein (which conditions do not include the closing of the Proposed RTO), and receipt of all requisite approvals and consents for the Proposed RTO including, but not limited to, (i) approval by the board of directors of each of PTX, GCC and MAACKK, (ii) approval of the Proposed RTO by the shareholders of GCC, (iii) approval of the Meeting Matters by the shareholders of MAACKK, if required by GCC, and (iv) conditional approval of the Proposed RTO and listing of Resulting Issuer Shares on the Exchange.

Upon completion of the Proposed RTO, the current directors and officers of MAACKK will resign and it is anticipated that the board of directors of the Resulting Issuer will be reconstituted to consist of the following directors: Richard J. Mazur, Greg Ferron, Jean-David Moore, Olivier Crottaz and a representative of BSN with Rhys Davies as Geological Advisor.

The following sets out the names and backgrounds of all persons who are expected to be the directors and officers of the Resulting Issuer upon closing of the Proposed RTO:

Richard (Rick) Mazur, Director & Executive Chairman

Mr. Richard Mazur is a corporate executive and registered geoscientist (P.Geo.) with over 45 years of Canadian and international experience in the exploration and mining industry as a project geologist, financial analyst and senior executive on uranium, gold, diamonds, base metals, and industrial minerals projects. Mr. Mazur was the Founder and former CEO of Forum Energy Metals from 2004 to August 2025, a uranium and critical minerals exploration company in Saskatchewan and Nunavut (now Geiger Energy). He is also a Director of Big Ridge Gold Corp., a gold development company in Newfoundland, Impact Silver Corp., a silver production company in Mexico and Midnight Sun Mining Corp., a copper exploration company in Zambia. Mr. Mazur graduated with a B.Sc. in Geology from the University of Toronto in 1975 and obtained an MBA from Queen's University in 1985.

Greg Ferron, Director & President

Mr. Ferron has 20 years of mining industry, capital markets and corporate development experience. He has held senior level roles at Laramide Resources Ltd., Treasury Metals Inc., Fancamp Exploration, Omai Gold Mines, TMX Group and Scotiabank. Mr. Ferron has diverse merger and acquisitions experience and corporate financing , including Laramide's Westwater ISR project acquisition and as CEO of Treasury Metals (now NexGold Mining Corp) led the Goldlund project acquisition, creating one of Canada's largest gold developers.

Jean-David Moore, Director

Mr. Moore has been a consultant and an advisor to several mineral exploration and development companies for over twenty years. He is a prominent investor in the junior mining space, and holds significant stakes in over 50 resource companies throughout Canada.

At present, Mr. Moore is a director of Opus One Gold Corp., Bullion Gold Resources Corp., Dios Exploration Inc., Fokus Mining Corp., Caprock Mining Corp. and PTX Metals Inc. Previously, he also served as a director of Vanstar Mining Resources Inc., which was acquired by Iamgold Corp. in February 2024.

Olivier Crottaz, Director

Mr. Crottaz is a Certified European Financial Analyst (CEFA) and also holds Swiss Federal Certificates as "Analyste Financier et Gestionnaire de Fortunes diplômé" and "Expert diplômé en Finance et Investissements". He started his carrier at UBS in 1991 as portfolio manager and tactical asset allocator. In 1998, he joined Credit Suisse Fides as Senior Financial Advisor and head of department. Following Credit Suisse, he managed his owns independent asset managing company. He is now a consultant and board member of Swiss private companies.

Rhys Davies, Geological Advisor

Rhys Davies is a Geologist with diverse commodity experience in mineral exploration across Australia, Europe, Middle East, North Africa and North America. Mr. Davies is a Member of the Australian Institute of Geoscientists (MAIG); Registered Professional Geoscientist (RPGeo) in the field of Mineral Exploration; and, a Fellow of the Geological Society of London (FGS). Mr Davies holds an MGeol (Hons) Degree in Geology from University of Leicester and MSc in Nuclear Decommissioning and Waste Management from University of Birmingham. Rhys is currently the Vice President, Exploration for Laramide Resources, a uranium exploration and development company in Australia, Kazakhstan and the United States.

Proposed Mineral Rights Acquisition

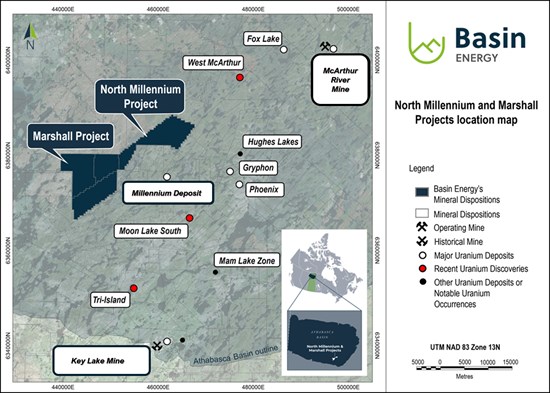

Figure 1: Location of Marshall and North Millennium uranium projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/275630_5414d4c3844798b7_001full.jpg

As a condition to the closing the Proposed RTO, GCC is required to complete the acquisition of 100% of BSN Sub's interest in the Marshall Project pursuant to the terms of the Mineral Claims Purchase Agreement. In addition, pursuant to the terms of the Operator and Exclusivity Right Term Sheet Agreement, upon closing of the Proposed RTO, CVV and BSN will grant a 9-month exclusivity right to GCC to conduct due diligence and, if satisfactory, negotiate the terms of an earn-in option to acquire up to a 51% interest in the North Millennium Joint Venture Project of CVV and BSN (Figure 1).

The Marshall Project and the adjacent North Millennium project areas are situated 11 km west of Cameco's 69.9% owned Millennium deposit and 20 km southwest of CanAlaska's Pike zone discovery on the West McArthur project in the Athabasca Basin of northern Saskatchewan. The Key Lake-McArthur Road is 23 km to the South-East with winter access to the property either by winter road from the Millennium deposit to Friesen Lake, 4 km east of the property, or by a winter road from Key Lake to McIntyre Lake, 4 km south of the property.

Both projects lie at or near the boundary between the Mudjatik and the Wollaston domains. These are underlain by sandstone and siltstones of the Clampitt-Dunlop Formation of the Manitou Falls Group. The depth to basement is estimated from 700 to 900 metres, with only three outcrops mapped locally.

From 1978 to 2009, mineral exploration focussed on lake sediment geochemistry, sandstone boulder geochemistry, airborne magnetic and electromagnetic surveys (e.g. INPUT, ZTEM, and VTEM), as well as ground geophysical magnetic and electromagnetic surveys. To date, no drill investigations have been undertaken within either project area. In 2024, BSN completed Stepwise Moving Loop Transient Electromagnetic (SWML-TEM) surveys by Discovery International Geophysics Inc. on the Marshall and North Millennium projects. The SWML-TEM survey for Marshall covered 49.1 line-km of TEM coverage along 1 survey line with 17 loops. The SWML-TEM survey for North Millennium covered 33.8 line-km of TEM along 3 survey lines, with 12 loops. Recommendations for the Marshall project are to carry out a first-pass diamond drill program for unconformity-related uranium mineralization testing the conductivity targets defined during the SWML-TEM survey.1

The Marshall Project centres on a magnetic low consistent with the presence of a metasedimentary basin. A Northeast - Southwest trending magnetic conductor separates this low into two sub-basins. Elevated ZTEM conductivity over the southern sub-basin and associated VTEM anomaly implies of a prospective blind sandstone conductor and prospective drill target.

The North Millennium project is underlain by 700 - 900 m of Athabasca Basin sandstone. Basement assemblages beneath the sandstone cover consist of Wollaston-Mudjatik Domain transition rocks. In the adjacent McTavish property where geophysical conductors have been drill-tested, prominent alteration zones have been identified with intersections of up to 0.13% U3O8 recorded2, together with anomalous Ni, Co, Cu, and Zn assays. It should be noted that information disclosed from adjacent properties is not necessarily indicative to the mineralization on the property.

Northeast trending conductors within the North Millennium project are offset by a prominent north-south trending lineament which can be linked to the Millennium deposit. This structural feature is interpreted as a continuation of the Mother Fault, which forms the main conduit for ore-bearing fluids, which led to the formation of the Millennium deposit.

In consideration for the Proposed Mineral Rights Acquisition, GCC will pay BSN a total purchase price consisting of (A) C$600,000 payable in cash in four equal annual installments; (B) C$300,000 payable in Resulting Issuer Shares, issuable in three equal annual installments based on the 5-day Volume-Weighted Average Price of the Resulting Issuer Shares on the business day immediately preceding the date of issuance of such Resulting Issuer Shares; and (C) such number of Resulting Issuer Shares as is equal to 9.99% of the total issued and outstanding Resulting Issuer Shares on a non-diluted basis after giving effect to the Concurrent Financing at the time of closing of the Proposed RTO.

BSN will retain a right of first refusal on any sale of the Marshall Project by GCC for a period of three (3) years following the closing date of the Proposed Mineral Rights Acquisition. In addition, BSN will retain a repurchase right to acquire from GCC a 25% interest in the Marshall Project for C$1,000,000 for a period commencing on the closing date and ending on the earlier of: (A) the date that is five (5) years from the closing date or (b) the date on which GCC has incurred total exploration expenditures of C$10,000,000 on the Marshall Project.

Pursuant to the terms of the Mineral Rights LOI, GCC is required to fund exploration expenditures for an initial work program (the "Initial Work Program") on the Marshall Project to be carried out within twenty-four (24) months from the closing date (the "Initial Exploration Period"). The Initial Work Program will have a budget in an amount that is the greater of (a) C$1,500,000, and (b) the minimum amount required to maintain the mineral claims comprising the Marshall Project in good standing under applicable governmental regulations (the "Initial Exploration Expenditures").

Operator and Exclusivity Right Term Sheet Agreement

Pursuant to the terms of the Operator and Exclusivity Right Term Sheet Agreement, the parties agreed that CVV will act as the Operator of the Marshall Project to carry out the Initial Work Program. GCC will pay CVV an operator fee equal to twenty percent (20%) of the Initial Exploration Expenditures for its services performed in connection with the Initial Work Program.

As consideration for the NMX Exclusive Right, GCC will issue 600,000 Resulting Issuer Shares to CVV and 400,000 Resulting Issuer Shares to BSN upon closing of the Proposed RTO.

About GCC

Green Canada Corporation is a Canadian uranium and critical minerals exploration and development company with a portfolio of mineral properties focused on unconformity-style uranium deposits in the Athabasca Basin of Saskatchewan, the Baker and Amer Basins in Nunavut and the Otish Basin in Quebec.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is Rhys Davies, MSc., RP. Geo., Contract Geological Advisor for PTX Metals and Green Canada Corporation., who has reviewed and approved its contents.

For further information on Green Canada, please contact:

Rick Mazur

Phone: 778-772-3100

Email: mazur@miradorgold.com

About PTX Metals Inc.

PTX is a minerals exploration Company focused on high-quality critical mineral projects, including two flagship projects situated in northern Ontario, a mining jurisdiction renowned for its abundance of mineral resources and investment opportunities. The corporate objective is to advance the exploration programs towards proving the potential of each asset, which includes the W2 Copper Nickel PGE Project and South Timmins Gold Joint Venture Project.

PTX's portfolio of assets offers investors exposure to some of the world's most valuable metals including gold, as well as essential critical minerals for the clean energy transition: copper, PGE, nickel, uranium and rare metals. PTX's portfolio of assts was strategically acquired for their geologically favorable attributes, and proximity to established mining companies. PTX mineral exploration programs are designed by a team of expert geologists with extensive career knowledge gained from their tenure working for global mining companies in northern Ontario and around the world.

PTX is based in Toronto, Canada, with a primary listing on the TSXV under the symbol PTX. The Company is also listed in Frankfurt under the symbol 9PF and on the OTCQB in the United States as PANXF.

For additional information on PTX, please visit the Company's website at https://ptxmetals.com/.

For further information on PTX Metals, please contact:

Greg Ferron, President and Chief Executive Officer

Phone: 416-270-5042

Email: gferron@ptxmetals.com

About MAACKK Capital Corp.

MAACKK is an investment company. MAACKK is an unlisted reporting issuer and does not currently own any operating assets. For the year-ended December 31, 2024, MAACKK reported an audited Net Loss and Comprehensive Loss of $8,995. For the nine-months ended September 30, 2025, MAACKK reported an unaudited Net Loss and Comprehensive Loss of $1,902. At December 31, 2024, MAACKK had a working capital deficit of $150,748 based on its audited financial statements. At September 30, 2025, MAACKK had a working capital deficit of $152,650 based on its unaudited financial statements. Prior to closing, MAACKK will eliminate its debt through the Debt Settlement described above.

For further information, please contact:

Peter Cheung, Chief Executive Officer and Chief Financial Officer MAACKK Capital Corp.

Email: peter.cheung@spotlightinvestments.com

About Basin Energy Limited

Basin Energy (ASX: BSN) is a green energy metals exploration and development company with an interest in three highly prospective projects positioned in the southeast corner and margins of the world-renowned Athabasca Basin in Canada and has recently entered an agreement to acquire a significant portfolio of Green Energy Metals exploration assets located in Scandinavia.

For further information, please contact:

Pete Moorhouse, Managing Director

Phone: +61 7 3667 7449

Email: pete.m@basinenergy.com.au

About CanAlaska Uranium Ltd.

CanAlaska is a leading explorer of uranium in the Athabasca Basin of Saskatchewan, Canada. With a project generator model, the Company has built a large portfolio of uranium projects in the Athabasca Basin. CanAlaska owns numerous uranium properties, totaling approximately 500,000 hectares, with clearly defined targets in the Athabasca Basin covering both basement and unconformity uranium deposit potential. The Company has recently concentrated on the West McArthur high-grade uranium expansion with targets in 2024 leading to significant success at Pike Zone. Fully financed for the ongoing 2025 drill season, CanAlaska is focused on uranium deposit discovery and delineation in a safe and secure jurisdiction. The Company has the right team in place with a track record of discovery and projects that are located next to critical mine and mill infrastructure. The Company's head office is in Saskatoon, Saskatchewan, Canada with a satellite office in Vancouver, BC, Canada.

For further information, please contact:

Cory Belyk, P.Geo., FGC CEO, President and Director

Phone: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The Canadian Securities Exchange has not approved nor disapproved the contents of this press release.

Completion of each of the Proposed RTO and Proposed Mineral Rights Acquisition are subject to a number of conditions set forth herein, including but not limited to, the requisite board, shareholder and regulatory approvals. Where applicable, the Proposed RTO and Proposed Mineral Rights Acquisition cannot close until all requisite approvals are obtained. There can be no assurance that the Proposed RTO and Proposed Mineral Rights Acquisition will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or listing statement to be prepared in connection with the Proposed RTO or the Proposed Mineral Rights Acquisition, any information released or received with respect to the transactions may not be accurate or complete and should not be relied upon.

No stock exchange has in any way passed upon the merits of the Proposed RTO or the Proposed Mineral Rights Acquisition and has neither approved nor disapproved the contents of this news release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the Proposed RTO; the terms and conditions of the Proposed Mineral Rights Acquisition; the terms and conditions of the proposed Concurrent Financing; and the business and operations of the Resulting Issuer after completion of the Proposed RTO. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the results of operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company, PTX, BSN and MAACKK disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

1 Basin Energy ASX release dated 02/07/2024 "Unconformity Uranium Drill Targets Identified From 2024 Geophysical Data"

2 CanAlaska TSX-V release dated 29/01/2010 "CanAlaska Uranium and Kodiak start drilling at McTavish uranium project"

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275630

SOURCE: PTX Metals Inc.