WASHINGTON (dpa-AFX) - Warner Bros. Discovery, Inc. (WBD) announced Wednesday that its Board of Directors has unanimously determined that the amended Paramount Skydance Corp. (PSKY) tender offer is not in the best interests of WBD and its shareholders and does not meet the criteria of a 'Superior Proposal' under the terms of WBD's merger agreement with Netflix, Inc. (NFLX) announced on December 5, 2025.

The board noted that the value is insufficient given the significant costs, risks and uncertainties involved. There is also a heightened risk of failure to close compared to Netflix combination.

The Board unanimously reiterates its recommendation in support of the Netflix combination and recommends that WBD shareholders reject PSKY's offer.

Separately, Netflix has welcomed WBD Board of Directors' continued commitment to the merger agreement between Netflix and WBD, and its unanimous recommendation that stockholders reject the revised offer from PSKY, announced December 22, 2025.

After a comprehensive and rigorous review process with its independent financial and legal advisors, the WBD Board reaffirmed its conclusion that the transaction with Netflix is in the best interests of WBD stockholders.

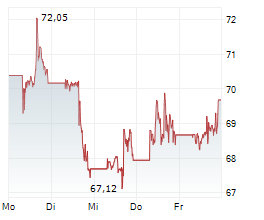

Under the terms of the agreement announced December 5, 2025, Netflix will acquire Warner Bros., including its film and television studios, HBO Max and HBO, in a cash-and-stock transaction valued at $27.75 per WBD share, with a total enterprise value of approximately $82.7 billion (equity value of $72.0 billion).

The financing structure is not subject to review by the Committee on Foreign Investment in the United States (CFIUS). The transaction preserves the planned separation of WBD's Global Linear Networks business, Discovery Global, which is expected to be completed in Q3 2026.

Netflix remains committed to working closely with WBD, regulators, and all stakeholders to ensure a smooth and successful transaction. As previously disclosed, the transaction is expected to close in 12-18 months from the date that Netflix and WBD originally entered into their merger agreement.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News