Acuity RM Group Plc - Holdings in Company and Director Dealing

PR Newswire

LONDON, United Kingdom, January 15

15 January 2026

Acuity RM Group plc

("Acuity" or the "Company")

Holdings in Company and Director Dealing

Acuity (AIM: ACRM), the software provider which supplies the award-winning STREAM cyber security risk management software platform for the Governance, Risk and Compliance market, together with associated consultancy services, updates the market on a change in shareholding.

Ridgecrest plc, a former investment company which held 12,190,065 shares in Acuity, representing 5.09% of the Company's issued share capital, was placed into Members Voluntary Liquidation in September 2024 to distribute its assets to its members. That distribution has now completed. As a result, Ridgecrest plc no longer has a notifiable stake in Acuity, and the ex-Ridgecrest shareholders have each received shares in Acuity pro-rata to the size of their Ridgecrest stake.

As part of this distribution, Nicholas Clark, a director of Acuity, has received 2,712 shares in Acuity, taking his family holding to 11,938,712, representing 4.98% of the Company's issued share capital.

Angus Forrest, Chairman of Acuity, said "We're pleased to welcome these new shareholders and look forward to reporting on our progress in 2026."

For further information please contact: | |

Acuity RM Group plc | acuityrmgroup.com |

Angus Forrest | +44 (0) 20 3582 0566 |

Zeus Capital (NOMAD & Broker) | zeuscapital.co.uk |

Mike Coe / James Bavister | +44 (0) 20 3829 5000 |

AlbR Capital (Joint broker) | albrcapital.com |

Lucy Williams / Duncan Vasey | +44 (0) 20 7469 0936 |

Clear Capital Markets (Joint broker) | clearcapitalmarkets.co.uk |

Bob Roberts | +44 (0) 20 3869 6080 |

Note to Editors

Acuity RM Group plc (AIM: ACRM), is an established provider of risk management services. Its award-winning STREAM software platform which collects and analyses data to improve business decisions and management is used by clients operating in markets including government, defence, broadcasting, utilities, manufacturing and healthcare.

The Company is focused on delivering long term, sustainable growth in shareholder value from organic growth and complementary acquisitions.

PDMR Notification

The below notification is made in accordance with the Article 19 of the Market Abuse Regulation (EU) 596/2014, as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended.

1 | Details of the person discharging managerial responsibilities / person closely associated | ||||

a) | Name | Nicholas Clark | |||

2 | Reason for the notification | ||||

a) | Position/status | Director | |||

b) | Initial notification /Amendment | Initial Notification | |||

3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | ||||

a) | Name | Acuity RM Group plc | |||

b) | LEI | 213800JHJFKALDJA5X97 | |||

4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | ||||

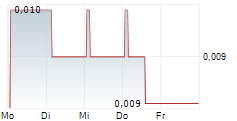

a) | Description of the financial instrument, type of instrument | Ordinary Shares of 1 penny each | |||

Identification code | GB00BR0WHY71 | ||||

b) | Nature of the transaction | Receipt of shares into SSAS following in specie distribution | |||

c) | Price(s) and volume(s) | ||||

Price(s) | Volume(s) | ||||

20.633p | 2,712 | ||||

d) | Aggregated information | ||||

- Aggregated volume | 2,712 | ||||

- Aggregate Value | £559.57 | ||||

e) | Date of the transaction | 12 January 2026 | |||

f) | Place of the transaction | Off market | |||