Cityvarasto Plc - Inside Information 19.1.2026 at 9.15 am EET.

Inside information, positive profit warning: Cityvarasto Plc upgrades its revenue guidance for the 2025 financial year, and refines its adjusted EBITDA guidance

Cityvarasto upgrades its revenue guidance for the financial year ending 31 December 2025. The adjusted EBITDA guidance for the same period has been refined compared to the guidance issued on 24/9/2025 and 17/11/2025. Based on preliminary, unaudited figures for 2025, the Group's revenue is estimated to amount to EUR 27.1-27.2 million, representing an increase of approximately 21.2% compared to 2024. Adjusted EBITDA is estimated to amount to EUR 12.05-12.15 million, representing an increase of around 20.0 percent compared to 2024.

New, updated guidance for 2025:

- Revenue for the 2025 financial year is estimated to amount to EUR 27.1-27.2 million (2024: EUR 22.4 million), representing an increase of approximately 21.2% compared to the 2024 financial year.

- Adjusted EBITDA for the 2025 financial year is estimated to amount to EUR 12.05-12.15 million (2024: EUR 10.1 million), representing an increase of approximately 20.0% compared to the 2024 financial year.

Previous profit guidance for 2025, issued on 24/09/2025 and 17/11/2025:

- Revenue for the 2025 financial year was estimated to grow by 15-20% compared to the 2024 financial year.

- Adjusted EBITDA for the 2025 financial year was estimated to grow by 15-20% compared to the 2024 financial year.

Background to the previous guidance

The previous guidance was based on the assumption that there would be no significant changes in the operating environment during the remainder of the year.

Background to the new guidance

After the first three quarters, the Group's revenue and adjusted EBITDA were at the upper end of the issued profit guidance, with revenue increasing by 19.6% and adjusted EBITDA by 20.3% compared to the corresponding period in 2024. Q4/2025 was Cityvarasto's first quarter as a listed company. During this quarter, the company focused on enhancing its operations, while also developing the organisation and operational models to support future growth.

Based on preliminary, unaudited figures, the development of revenue from ancillary services during that quarter was better than previously estimated, along with the performance of the real estate business, which was also at a good level. The revision of the revenue guidance was driven by strong performance across all business segments, most notably by higher-than-expected van rental volumes and seasonally stronger revenue in the typically quieter October-December period.

With regard to adjusted EBITDA, operational profitability in both business segments was at a good level during the fourth quarter, taking seasonality into account especially in the real estate business. At Group level, adjusted EBITDA was affected by increased administrative costs related to operating as a listed company, as well as growth investments in the self-storage business, and a one-off credit loss related to a business premises leaseholder. In segment reporting, the aforementioned expenses impact the real estate business segment.

Cityvarasto will comment its financial performance for 2025 in more detail and provide guidance for 2026 in connection with the 2025 financial statements release, which will be published on Tuesday, 24 February 2026

Further infomation

Ville Stenroos, CEO, Cityvarasto Plc, tel. +358 29 123 4747

Matti Leinonen, CFO, Cityvarasto Plc, tel. +358 29 123 4768

Certified Advisor

Skandinaviska Enskilda Banken AB (publ) Helsinki Branch, tel. +358 9 6162 8000

Information about Cityvarasto

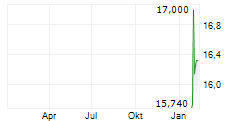

Cityvarasto is a Finnish company established in 1999, operating in the self-storage sector. In addition to the parent company Cityvarasto Plc, the Cityvarasto Group includes, as its principal subsidiaries, PakuOvelle.com Oy, which specialises in van rentals, and Suomen Opiskelijamuutot Oy, a moving services company. The company's shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol CITYVA.