Eniro Group AB (publ) ("Eniro") has reached an agreement with Kapatens Investment AB ("Kapatens"). The agreement means that the parties will jointly request that the Supreme Court overturns the lower courts' judgements regarding Kapatens' appeal against Eniro's decision on 12 September 2022 concerning the redemption of preference shares etc.

If and when the Supreme Court announces its decision to overturn the lower courts' judgments, the two suspended appeals in Solna District Court concerning share dividend and amendment to the articles of association shall be withdrawn, whereby Eniro shall pay a total settlement compensation of SEK 17 million. Kapatens withdraws all appeals and waives any further claims against Eniro or its board of directors.

Eniro's share structure with only one class of shares remains in accordance with the decisions made at the annual general meeting on 12 September 2022.

The settlement requires that the Supreme Court decides to set aside the lower courts' judgments in accordance with the parties' joint request. If this does not happen, the court may either reject the application for leave to appeal, in which case the Court of Appeal's judgment will become final, or decide to grant leave to appeal, in which case Eniro's appeal will be examined on its merits.

Background

Eniro's general meeting resolved to have only one class of shares and that all outstanding preference shares would be redeemed and converted into ordinary shares. At the same time, a directed new issue of shares was carried out. All decisions were registered and executed. Kapatens appealed the decision to redeem Series B preference shares, as well as the subsequent decisions concerning share dividend and amendment to the articles of association. The Court of Appeal, like the District Court, upheld Kapatens' appeal. Both judgments included dissenting opinions in support of Eniro's decision. Eniro appealed and applied for leave to appeal to the Supreme Court on 28 April 2025. The Supreme Court has not yet considered the application.

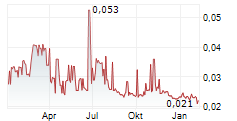

The delay in the legal proceedings with Kapatens has caused significant disruption to Eniro's operations. It limits the company's freedom of action, including its ability to pay dividends, despite its significant profitability and strong financial position. The proceedings have also led to increasing uncertainty in trading in the company's shares. The Board of Directors, with the support of the company's major shareholders, representing a total of approximately 70 percent of the company's total shares, has therefore concluded that a settlement with Kapatens is preferable to continued legal proceedings. The Board of Directors has assessed that the settlement compensation is reasonable in light of these circumstances.

For more information, please contact:

Fredric Forsman, Chairman of the Board, Eniro Group AB (publ)

Tel: +46 (0)73-978 78 44

E-mail: fredric@spectrumone.com

This information is information that Eniro Group AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 11:30 CET on 10 February, 2026.

Eniro exists for companies that want to achieve success and growth in their market. Today, Eniro optimizes the opportunity for companies to create local presence, searchability and marketing digitally. This makes Eniro an important partner for small and medium-sized companies. The company's clear goal is to give SMEs the same conditions and resources that large companies have access to. Eniro offers a platform that optimizes local marketing through intelligence, automation and streamlining of communication. In the digital landscape, Eniro partners with the largest media groups in the world.

Eniro Group AB (publ) is listed on Nasdaq Stockholm (ENRO) and operates in Sweden, Denmark, Finland and Norway. In 2024, the Eniro Group had sales of SEK 951 million and approximately 900 employees with headquarters in Stockholm. The group also includes Dynava, which offers customer service and answering services for major companies in the Nordic region, as well as directory assistance services.