JANUARY-DECEMBER 2025

- Rental income increased to SEK 934 m (908). For the like-for-like portfolio, rental income increased by 4.6 percent.

- Net operating income increased by 8.5 percent to SEK 513 m (473) despite the absence of net operating income from properties that were divested during the preceding and current year. For the like-for-like portfolio, net operating income increased by 9.9 percent due to higher rental income and lower property management costs.

- Profit from property management increased by 32.0 percent to SEK 201 m (152) and profit from property management per share outstanding on the balance sheet date increased by 33.9 percent to SEK 1.40/share (1.05).

- The property portfolio's value at the end of the year amounted to SEK 13,562 m (13,701) and change in value of the properties amounted to SEK -6 m (-296) for the year.

- Net profit for the year increased to SEK 78 m (-193).

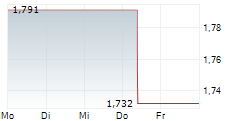

- The net asset value amounted to SEK 47.19 per share (45.59).

OCTOBER-DECEMBER 2025

- Rental income increased to SEK 232 m (227) as a result of annual rent increases and rent increases for renovated apartments.

- Net operating income increased to SEK 118 m (110) due to higher rental income and lower property management costs during the quarter, despite the absence of net operating income from properties that were divested during the preceding and current year.

- Profit from property management for the fourth quarter increased to SEK 40 m (30) as a result of higher net operating income and reduced central administration costs.

SIGNIFICANT EVENTS DURING AND AFTER THE FOURTH QUARTER

- In October, the Gånsta 2:2 property in Enköping was divested and transferred at an underlying property value of SEK 130 m.

- In October, the Navigatören 11 property in Eskilstuna was divested at an underlying property value of SEK 151 m. The closing took place in November.

- In December, the Kyrktuppen 10 property in Södertälje was divested and transferred at an underlying property value of SEK 75 m.

- In December, the Fiskeby 4:123 property in Norrköping was divested at an underlying property value of SEK 19 m. The closing will take place in the first quarter of 2026.

- During the quarter, agreements for sustainability-linked financing of SEK 1.8 bn were signed. The margin of the loan agreement is significantly lower than Neobo's average margin.

- During the quarter, approximately 2 million shares were repurchased at a value of SEK 37 m in accordance with the company's mandate from the 2025 Annual General Meeting.

- The Board of Directors has today decided to adjust Neobo's dividend policy with the aim of providing the Board with increased flexibility in its efforts to achieve the best total return for the company's shareholders.

- The Board of Directors has today announced its intention to launch a share buyback program of up to an additional SEK 50 m until the 2026 Annual General Meeting, once the ongoing SEK 50 m buyback program has been completed.

- The Board of Directors proposes to the General Meeting that no cash dividend be paid for the financial year 2025.

- The Nomination Committee proposes the election of Björn Danckwardt-Lillieström as a new member of the Board of Directors at the 2026 Annual General Meeting.

CEO STATEMENT

Profit from property management increased to SEK 201 m (152) and lowest vacancy rate ever

2025 was a good year for Neobo with a positive performance in all areas. Profit from property management per share increased by 34 percent despite the absence of net operating income from divested properties, and the vacancy rate decreased to 6.3 percent, compared with 8.0 percent when Neobo was formed.

The sharp improvement in earnings is thanks to our committed employees and a business model that continuously generates value in the property portfolio and strengthens our cash flows over time.

Increasing returns from our properties

We continue to work purposefully to increase returns from our properties. Net operating income increased by 10 percent in the like-for-like portfolio due to both higher rental income and lower costs.

During the year, we invested SEK 239 m (164) in value-creating initiatives that increased our net operating income and refined our properties. This includes our renovation of just over 100 apartments in addition to a number of tenant adaptations and energy optimization measures. One of our principal sustainability targets is to reduce energy consumption in our properties. It is therefore particularly positive to note that our efforts have paid off, and that energy consumption fell 5 percent in the like-for-like portfolio during the year.

Rent negotiations are in full swing for 2026 and, to date, negotiations have been completed for 46 percent of our rental income in the residential portfolio with an average rent increase of 3.4 percent.

Divestments that improve neobo

We have made a strong start in terms of optimizing our property portfolio and divested non-priority properties with an underlying value of just over SEK 400 m during the year. These divestments have resulted in a better and more efficiently managed portfolio and also generated valuable liquidity. At year-end, our available liquidity was SEK 275 m (146).

Sustainable refinancing of SEK 4 bn

We have a strong financial position and stable cash flows. Thanks to the healthy increase in our net operating income our interest coverage ratio improved to a multiple of just above 1.8, which is the highest level recorded for a full year. At the same time our loan-to-value ratio decreases to 50.0 percent.

During the year, we refinanced and extended bank loans for nearly SEK 4 bn at significantly lower margins than the average margins in our loan agreements. This is a sign of strength for Neobo and also shows that the financing market has continued to improve over the year. We have also linked a quarter of our lending volume to our company-wide sustainability targets, creating transparency and clear incentives while also demonstrating that we are serious about the sustainable transition.

In the current market situation, we believe that repurchasing own shares combined with continued investment in our property portfolio is the most effective way to create attractive total return for our shareholders.

Repurchase of shares creates shareholder value

The strategy we are following has yielded results. By maintaining our focus on profitability and with the strong commitment of our employees, we are continuing on the path we have embarked upon to manage and refine our properties, take care of our customers and optimize the property portfolio.

Our key mission is to create value for our shareholders. In the current market climate, we believe that repurchasing own shares combined with continued investments in our properties, is the most effective way to generate attractive return for our shareholders. The liquidity freed-up from divestments will therefore be used for both of these purposes and the Board of Directors has today resolved on an adjusted dividend policy and announced its intention to accelerate the pace of share buybacks ahead of the 2026 Annual General Meeting.

Stockholm, February 12, 2026

Ylva Sarby Westman, CEO

For more information, please contact:

Ylva Sarby Westman, CEO

mobile: +46 (0) 706 90 65 97 e-mail: ylva.sarby.westman@neobo.se

Maria Strandberg, CFO

mobile: +46 (0) 703 98 23 80 e-mail: maria.strandberg@neobo.se

About Us

Neobo is a real estate company that manages and refines residential properties over the long term in municipalities with strong demand for rental apartments. Our vision is to create attractive and sustainable living environments where people can thrive and feel secure. Neobo's shares are listed on Nasdaq Stockholm under the ticker symbol NEOBO and ISIN code SE0005034550.

This information is information that Neobo Fastigheter AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2026-02-12 07:00 CET.

Image Attachments

Ylva Sarby Westman