Vancouver, British Columbia, Feb. 12, 2026 (GLOBE NEWSWIRE) -- NEW EARTH RESOURCES CORP. (CSE: EATH) ("New Earth" or the "Company") is pleased to announce that it has submitted an application to the Arizona State Land Department for approximately 268 acres of additional state mineral lease land contiguous to its past-producing Lucky Boy Uranium Project. If approved, the additional acreage would nearly double the Company's current land position within the Lucky Boy area.

The applied-for acreage is located directly adjacent to the Company's existing project area and represents a strategic expansion of New Earth's land position within the broader Lucky Boy area. The Company believes that securing additional state lease ground will strengthen its overall property position and support long-term planning for the project.

The additional 268 acres are intended to complement the Company's current land package and provide greater strategic flexibility for future exploration activities. Consolidating adjacent ground can assist in potential development planning as the Company continues to evaluate and advance the project area.

"The application for additional state lease ground represents a logical extension of our existing land position at Lucky Boy," said Lawrence Hay, CEO of New Earth Resources Corp. "The expanded acreage would significantly strengthen our footprint in the area and provide greater flexibility as we continue to evaluate the project's potential. We believe consolidating adjacent land is an important step in advancing the project in a disciplined and methodical manner."

The lease applications are subject to review and approval by the Arizona State Land Department in accordance with applicable regulations. There can be no assurance that the applications will be approved in whole or in part. The Company will provide further updates as material information becomes available.

OTHER CORPORATE DEVELOPMENTS

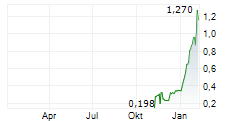

The Company announces that in 2026 to date, the Company has received aggregate gross proceeds of $749,750 through the issuance of an aggregate of 5,998,000 shares of the Company pursuant to exercises of previously issued share purchase warrants. The proceeds from the warrant exercises are expected to be used for general working capital.

About the Company

New Earth Resources Corp. is a Canadian-based mineral exploration company acquiring and developing advanced and early-stage exploration projects. Its flagship project is its 100% owned, past-producing Lucky Boy Uranium Property located in Gila County, Arizona, USA. Consisting of 14 Lode Claims, and spanning approximately 273 acres, the Lucky Boy Project covers a small open pit and underground workings that produced uranium in the 1950's, and again in the 1970's. In addition to Lucky Boy, included in the Company's uranium portfolio are three claims located in Saskatchewan, Canada covering 365 hectares.

The Company also has the option to acquire a 100% interest in 23 claims covering approximately 1,102 hectares in the Strange Lake area of Quebec, Canada, known as the "SL Project", which is prospective for rare earth elements. In addition, the Company has the option to acquire a 100% interest in the Red Wine Rare Earth Project, comprising 2 non-contiguous mineral claims located in Labrador, Canada covering approximately 1,575 hectares.

For further information, please refer to the Company's website at www.newearthresourcescorp.com or the Company's disclosure record on SEDAR+ (www.sedarplus.ca), or contact the Company by email at info@newearthresourcescorp.com

On Behalf of the Board of Directors Lawrence Hay" President and CEO Tel: 778.317.8754 Email: info@newearthresourcescorp.com

Forward-Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

-