"2025 was a year in which Eniro took clear steps from transformation to positioning. We are building on the breakthrough of 2024 and ending the year with our strongest revenue quarter, SEK 244 million in sales, and full-year sales of SEK 955 million, despite a weaker year for Dynava." said Eniros President and CEO, Hosni Teque-Omeirat

October - December 2025 | January - December 2025 | ||

• Net sales for the quarter amounted to SEK 244 million (239). • Operating result amounted to SEK 10 million (24). • EBITDA amounted to SEK 27 million (42), with an EBITDA-margin of 10.9 percent (17.6). 1) • Adjusted EBITDA amounted to SEK 30 million (42). 1) • Result before income tax amounted to SEK 2 million (19). • Net result for the period amounted to SEK 8 million (29). • Earnings per share before and after dilution amounted to SEK 0.01 (0.04). • Cash flow from current operations amounted to SEK 43 million (64). | • Net sales for the period amounted to SEK 955 million (951). • Operating profit amounted to SEK 55 million (72). • EBITDA amounted to SEK 123 million (143), with an EBITDA-margin of 12.8 percent (15.0). 1) • Adjusted EBITDA amounted to SEK 139 million (143). 1) • Profit before tax amounted to SEK 39 million (57). • Net result for the period amounted to SEK 46 million (68). • Earnings per share before and after dilution amounted to SEK 0.06 (0.09). • Cash flow from current operations amounted to SEK 90 million (109). • ARR for the Marketing Partner business area amounted to SEK 537 million (489). 1) • The Board of Directors proposes an ordinary dividend of SEK 0.05 (0.00) per share. | ||

1) Alternative performance measures are reconciled on page 22 and defined on page 24 in the report. | |||

Significant events during the fourth quarter 2025 • No significant events during the fourth quarter. | |||

Significant events during January - December 2025 • On January 3, 2025, Eniro announced that the closing of the acquisition of Medialuotsi Oy had taken place. • On February 19, 2025, the Board of Directors decided to evaluate a separate listing of Dynava. • On February 21, Eniro announced that Stefan Liljedahl has been appointed as new Interim Chief Financial Officer (CFO) during the recruitment of a new permanent CFO. Stefan took up the position on March 10, 2025. • On April 2, Eniro Kapaten's appeal against the redemption decision of preference shares 2022 lost in the Court of Appeal. The company has appealed the judgment and applied for leave to appeal. • On April 25, Eniro announced that Mario von Dahn has been appointed new Chief Financial Officer (CFO). Mario will take up the position on August 19, 2025. • The Annual General Meeting on May 28 resolved to re-elect Board members Fredric Forsman, Mia Batljan, Fredrik Crafoord, Mats Gabrielsson, Joost Merks and to re-elect the Chairman of the Board Fredric Forsman and to elect Trond Dale. • The AGM decided that no dividend will be paid for the financial year 2024; the year's profits will be carried forward. • On July 1, 2025, Eniro acquired Qwamplify Nordics to strengthen its position in digital marketing in the Nordic region. • On August 19, 2025 Mario von Dahn took the position as Chief Financial Officer (CFO) at Eniro. | |||

Significant events after the end of the period • On February 4, 2026, Eniro announced that the closing of the acquisition of Mainostoimisto SST Oy had taken place. • On February 10, 2026, Eniro announced that the company made an agreement with Kapatens. • On February 18, 2026 the Supreme Court announced that the lower instances judgements had been set aside and the case was dismissed. | |||

Hosni Teque-Omeirat, president and CEO Eniro Group AB

"With a strong cash position, stable profitability and an increasingly resilient organisation, we are entering 2026 with a clear focus on investments. We are strengthening our sales capacity, product development, partnerships and marketing - with a particular emphasis on AI-driven innovation."

For more information, please contact:

Hosni Teque-Omeirat, president and CEO Eniro Group AB (publ)

Tel: +46 (0)70-225 18 77

E-post: hosni.teque-omeirat@eniro.com

This information is information that Eniro Group AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 08.30 CET on 19 February 2026.

Eniro exists for companies that want to achieve success and growth in their market. Today, Eniro optimizes the opportunity for companies to create local presence, searchability and marketing digitally. This makes Eniro an important partner for small and medium-sized companies. The company's clear goal is to give SMEs the same conditions and resources that large companies have access to. Eniro offers a platform that optimizes local marketing through intelligence, automation and streamlining of communication. In the digital landscape, Eniro partners with the largest media groups in the world.

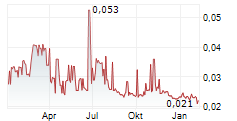

Eniro Group AB (publ) is listed on Nasdaq Stockholm (ENRO) and operates in Sweden, Denmark, Finland and Norway. In 2025, the Eniro Group had sales of SEK 955 million and approximately 900 employees with headquarters in Stockholm. The group also includes Dynava, which offers customer service and answering services for major companies in the Nordic region, as well as directory assistance services.