Business impacted during the period by the group's ongoing transformation and economic volatility

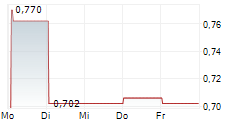

- In a turbulent global economic environment, Showroomprivé recorded a decline in Gross Merchandise Volume of approximately 14% and a decline in revenue of approximately 17% in the first quarter of 2025

- The core business was impacted by the transfer of inventories to the new site in the Paris region as well as a limited offering in the Fashion segment, which is currently undergoing a revitalization process

- Growth drivers remain well positioned but are being slowed down by the economic environment. The Bradery recorded revenue growth of 17% over the period

- SRP Services continues to demonstrate its relevance and posted solid performance, driven by the Retail Media

- The group has initiated a strategic review of its activities in order to continue adapting its business model to changing customer expectations and the new competitive landscape

- Postponement of the publication of the 2024 Universal reference document to finalise audit procedures and therefore approve 2024 accounts in light of changes needed in appendices

La Plaine Saint Denis, France, April 30, 2025 - Showroomprivé (SRP Groupe), a European group specializing in flash sales, publishes its revenue for the first quarter of its 2025 financial year.

| (€ millions) | Q1 2024 | Q1 2025 | Variation 25/24 in % |

| Gross Merchandise Value (GMV)[1] | 247.3 | 211.9 | -14.3% |

| Internet sales | |||

| France | 119.1 | 99.2 | -16.7% |

| International | 31.3 | 26.3 | -16.0% |

| Total Internet Revenue | 150.4 | 125.5 | -16.5% |

| Other revenue | 2.2 | 2.0 | -11.0% |

| Net Revenue | 152.6 | 127.5 | -16.5% |

EVENT SALES ACTIVITY UNDER PRESSURE IN THE FIRST QUARTER OF 2025

Showroomprivé generated gross merchandise volume (GMV) of €211.9 million in the first quarter of its 2025 financial year, down 14.3% compared with the first quarter of 2024. Revenue was also down 16.5% to €127.5 million in a persistently sluggish market, with the flash sales sector remaining turbulent according to Foxintelligence. The traditional business also suffered from a shortage of offer in the Fashion division, where a reorganization work is underway. In addition, adjustments necessary as part of the launch of the new logistic warehouse in January reinforced this contraction with a negative impact estimated at 3.1 points.

The Marketplace continued its growth momentum, capitalizing on its strong positioning in a market where purchasing power remains constrained, and driven by a proactive strategy. This strategy took the form of a new search bar offering improved visibility and the transfer of brands from the core business, enabling Marketplace sales to grow by around 36%. This policy, accompanied by the development of dropshipping, will continue over the coming months, with a dilutive impact on revenue due to lower sales recognition of the Marketplace under IFRS, but should be accretive to margins. SRP Services is also returning to growth thanks to retail media, boosted by the arrival of a new director in the last quarter of 2024. The other divisions should also benefit from the management changes initiated over the last few months. As for Beauté Privée, a new Managing Director, Alexia Marland, was appointed on 25 March 2025, with the mission of giving new commercial impetus and improving the experience of its five million active members.

Other growth drivers, which are better positioned than the traditional core business in France, were nevertheless held back by the economic environment. The Bradery posted continued strong growth of 17%. International business, which posted a 16% decline in revenue, suffered from a more challenging base effect and a slowdown in the growth of e-commerce in the countries where the Group operates. After several quarters of significant growth, the Travel & Leisure segment saw sales decline by 10% in the first quarter, impacted by the decline in the Fashion segment, which has historically been the driver of audience growth.

David Dayan, Chairman and CEO of Showroomprivé, comments: "In a particularly volatile and uncertain economic environment for the flash sales sector, and more broadly for the consumer sector, the contraction in our business volume this quarter, due to the combined impact of the economic situation and the scarcity of offers, reinforces our conviction that we need to adapt our model. In line with the ACE plan, which has already delivered initial results, notably in terms of cost control and the turnaround of our media agency business, we have initiated a strategic review to evolve our positioning and identify new sources of value creation with the aim of:

- Renew and consolidate our offerings with a finely tuned and optimized link between our traditional business and the Marketplace;

- Increase traffic on the platform with a permanent high-quality offering and an enhanced experience;

- Focus on revamping our offering while preserving our low-price DNA;

- Develop our growth drivers (Marketplace, Travel, and SRP Media).

We are determined to successfully implement these measures to return to profitable growth in line with a clear ambition: to pivot with agility to better meet our customers' expectations and respond to market changes."

Key performance indicators

| Q1 2024 | Q1 2025 | Variation 25/24 in % | |

| New Buyers * (in millions) | 0.24 | 0.21 | -12.0% |

| Buyers** (in thousands) | 237 | 210 | -12.0% |

| of which repeat buyers*** | 1.5 | 1.3 | -13.1% |

| As % of total number of buyers | 84% | 84% | - |

| Number of orders (in millions) | 2.9 | 2.3 | -23.3% |

| GMV by buyer (IFRS) | 170.2 | 167.9 | -1.4% |

| Average number of orders per buyer | 2.0 | 1.8 | -11.7% |

| Average basket size | 84.2 | 94.0 | 11.7% |

* All buyers who have made at least one purchase on the Group's platforms since its launch.

** Member who has placed at least one order during the year

*** Member having placed at least one order during the year and at least one order in previous years

Despite a tough quarter for new business, Showroomprivé kept bringing in new shoppers, with over 210,000 first-time buyers during the quarter. The loyal buyer rate remained stable at 84% despite a slight decline in numbers to 1.3 million. Orders fell by 23.3%, but this decline was partially offset by a significant increase in the average basket size (+11.7%).

EXERCISE OF THE CALL OPTION ON THE PART OF THE REMAINING CAPITAL OF THE BRADERY COMPANY

For the record, in May 2022, Showroomprivé acquired a 51% majority stake in The Bradery and committed to buying back the remaining share capital from The Bradery's founders (puts exercisable in 2025 and 2026, respectively). Timothée Lynier and Edouard Caraco, the two co-founders of The Bradery, have decided to exercise their option to sell part of their stake in the company, namely 22.3% of The Bradery shares not yet held by Showroomprivé. The price at which the transaction will be carried out will be determined based on the achievement of certain operating performance targets in 2024 and 2025. The two managers will remain committed to The Bradery and will retain their current operational responsibilities. At the same time, Stephan Ploujoux has joined The Bradery's management team as General Manager in the fourth quarter of 2024 with the task of further developing and sustaining its strong growth.

Postponement of the publication of the 2024 UNIVERSAL REFERENCE DOCUMENT (containing the 2024 annual financial report )

As announced in its press release dated March 13, 2025, the Board of Directors of SRP Group approved the 2024 consolidated financial statements (for the year ended December 31, 2024) at its meeting on March 13, 2025.

However, due to the recent events mentioned above (in particular the decline in business volume in the first quarter of 2025 and the exercise of the put option on part of the remaining share capital of The Bradery), the Group has deemed it necessary to amend the notes to the 2024 financial statements in order to assess the impact of these events. The audit procedures being still ongoing, the board of directors of SRP Group will convene at a later date to reapprove the accounts once the audit procedures have been completed.

As a result, the Group is obliged to postpone the publication of its 2024 universal registration document (containing the 2024 annual financial report), which was initially scheduled for today. The 2024 universal registration document will be published on the company's website and on the AMF website by the end of May 2025.

2025 OUTLOOK

After a slower-than-expected start to the year, the Group do not see a rebound at the beginning of the second quarter, and visibility remains limited for the full year. As a result, Showroomprivé will continue to implement its ACE plan and capitalize on the logistics rationalization measures already implemented, which should generate €5 million in savings by 2025. The teams will also remain particularly vigilant in controlling the cost structure and monitoring inventory levels. At the same time, management has begun a strategic review of the Group's activities, guided by a constant desire to adapt its offering and business model to a changing environment and to meet new customer expectations.

NEXT information

Publication of the universal reference document: by the end of May 2025

2024 Annual General Meeting: June 25, 2025

FORWARD-LOOKING STATEMENTS

This press release contains summary information only and is not intended to be comprehensive.

This press release may contain forward-looking information and statements about the Group and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements may be identified by the words "believe", "anticipate", "objective" or similar expressions. Although the Group believes that the expectations reflected in such forward-looking statements are reasonable, investors and shareholders of the Group are cautioned that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Group, that could cause actual results and events to differ materially and adversely from those communicated, implied or indicated by such forward-looking information and statements. These risks and uncertainties include those discussed or identified in the documents filed or to be filed with the Autorité des marchés financiers by the Group (notably those detailed in chapter 4 of the Company's reference document). The Group undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

About showroomprive

Showroomprivé is a European player in online event sales, innovative and specialized in fashion. Showroomprivé offers a daily selection of more than 3,000 partner brands on its mobile apps and website in France and six other countries. Since its creation in 2006, the company has experienced rapid growth.

Listed on the Euronext Paris market (code: SRP), Showroomprivé generated gross business volume including VAT[2] of nearly €1 billion in 2024 and net revenue of €650 million. The Group is led by co-founder David Dayan and employs more than 1,100 people.

For more information: http://showroomprivegroup.com

Contact

| Showroomprivé | NewCap |

| Sylvie Chan Diaz, Investor Relations investor.relations@showroomprive.net | Financial communication Théo Martin, Louis-Victor Delouvrier |

| Anthony Alfont Relations.presse@showroomprive.net | Media relations Gaelle Fromaigeat, Nicolas Merigeau showroomprive@newcap.eu |

[1] Gross Merchandise Value ("GMV") represents, all taxes included, the total amount of the invoiced transaction and therefore includes gross Internet sales, including Marketplace sales, other services and other

[2] Gross merchandise volume ("GMV") represents the total amount of transactions invoiced, including all taxes, and therefore includes gross Internet sales, including sales on the Marketplace, other services and other revenues.

- SECURITY MASTER Key: x2ptkZ1oZmaXm25waJlraZNjbJeTlmKZmZaYlWhxk52anZ9glJthbMqYZnJimG5n

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-91391-2025.04.30-en-pr-q1-2025_vfinal.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free