DECLINE OF HISTORICAL BUSINESSES, MITIGATED BY GROWTH DRIVERS

- Showroomprivé recorded Growth Merchandise Volume[1] of €440 million (-11.9% vs. 2024) for the first six months of 2025 and a decline in revenue to €276 million (-13.4%), mainly impacted by lower revenue in its traditional businesses in France.

- The Group recorded strong performance in its growth drivers compared to 2024: a sharp increase in sales on the Marketplace and sustained growth in The Bradery's business, while sales declined slightly in Travel and Leisure and internationally.

- In response to market developments and the new competitive landscape, the Group initiated a strategic review of its activities in the first quarter and will present a new plan for the last quarter of the current financial year.

- The approval of the consolidated financial statements for the 2024 financial year, the audit work, and the availability of the corresponding universal registration document should be completed before the end of the year.

La Plaine Saint Denis, France, July 31, 2025 - Showroomprivé (SRP Groupe), a European group specializing in flash sales, publishes its revenue for the first half of its 2025 financial year.

ACTIVITY

Revenue[2] details

| (€ millions) | H1 2024 | H1 2025 | Variation |

| 25/24 | |||

| (in %) | |||

| Gross Merchandise Value (GMV) | 498.8 | 439.7 | -11.9% |

| France Internet sales | 246.3 | 211.1 | -14.3% |

| International Internet sales | 67.0 | 58.7 | -12.4% |

| Total Internet Revenue | 313.3 | 269.8 | -13.9% |

| Other revenue | 4.8 | 5.8 | 19.8% |

| Net Revenue | 318.1 | 275.6 | -13.4% |

Showroomprivé generated a Growth Merchandise Volume of €439.7 million in the first half of its 2025 financial year, down 11.9% compared with the first half of 2024. Revenue was also down, by 13.4% to €275.6 million, against the backdrop of a contraction in household consumption at the start of the year[3] and a decline in the audience for event-based sales websites[4].

On historical businesses, the Group suffered overall from this complex environment, with a decline in Growth Merchandise Volume:

- The Fashion division, with sales down by 21.0%, has been the hardest hit, particularly in women's ready-to-wear (down 36%) and jewelry (down 32%). In response to this situation, the Group has focused on strengthening and renewing its sales teams, who will be at full capacity by October.

- The Home division has also been hit, with a fall of 15.2%, with the high-tech and DIY Garden categories suffering the sharpest declines in business.

- The Beauty division also recorded a drop in sales, down 5.7% over the period, but Beauté Privée has taken steps to increase the average basket and the number of items per order.

SRP Services is pursuing the growth it regained in the last quarter of 2024 with the development of retail media to replace trade marketing[5] and intensified commercialization of available media space.

Beauté Privée, which will concentrate the focus of the Group's offering on the Beauty axis, continued its redesign, culminating in the migration to Shopify. Over the first half year, business declined, but this was contained, particularly in the second quarter, thanks to a rich offering and sustained sales efforts. This work, aimed at providing a clearer and more qualitative product range on the Beauté Privée website, will be continued.

On its growth drivers, the Group records a good overall performance.

The Marketplace (GMV + 33.7%) has accelerated its growth by accumulating several actions that have a positive impact on both the volume of activity and the margin. The opening of its activity in Belgium, Portugal and Spain at the end of 2024 thus contributed 27% to its growth. The arrival of new accounts as well as the transfer of others historically presented in event sales are in line with the development policy of dropshipping[6].

The Bradery continues to post strong growth (GMV + 15.4%), underpinned by attractive premium brands and expansion in the Travel and Leisure sector.

The Travel & Leisure business (GMV -13.3%) was penalized by the decline in traffic on the website, as well as a reduction in the range offered by certain major players in the sector.

International revenues were down for the first time to -12.4%. This decline was due in particular to the weakness of the Fashion and Home goods offer over the period.

Q1-Q2 business dynamics

| (€ millions) | Q1 2025 | Q2 2025 | Variation |

| Q2/Q1 | |||

| (in %) | |||

| Gross Merchandise Value (GMV) | 213.2 | 226.5 | 6.3% |

| France Internet revenue | 99.2 | 112.0 | 12.9% |

| International Internet revenue | 26.3 | 32.3 | 22.8% |

| Total Internet Revenue | 125.5 | 144.3 | 15.0% |

| Other revenue | 2.0 | 3.8 | 91.8% |

| Net Revenue | 127.5 | 148.1 | 16.2% |

Looking at the details for the first half, the growth in business between the first quarter (Q1) and the second quarter (Q2) is encouraging: +6.3% in Growth Merchandise Volume (only +1.7% in 2024) and +16.2% for net revenue (+8.5% in 2024).

KEY PERFORMANCE INDICATORS

| H1 2024 | H1 2025 | Var 25/24 | |

| (in %) | |||

| Gross Merchandise Value (GMV)(€m) | 498.8 | 439.7 | -11.9% |

| New Buyers * (in millions) | 0.5 | 0.4 | -11.4% |

| Buyers** (in millions) | 2.3 | 2.1 | -8.6% |

| of which repeat buyers*** | 1.9 | 1.6 | -14.2% |

| As % of total number of buyers | 79% | 75% | |

| Number of orders (in millions) | 6.0 | 4.8 | -20.5% |

| GMV by buyer (€) | 212.8 | 205.3 | -3.5% |

| Average number of orders per buyer | 2.6 | 2.2 | -13.0% |

| Average basket size (€) | 83.2 | 92.2 | 10.9% |

* All buyers who have made at least one purchase on the Group's platforms since its launch.

** Member who has placed at least one order during the year

*** Member having placed at least one order during the year and at least one order in previous years

Despite the drop in investment and a weaker fashion offer over the period, Showroomprivé was able to attract 446,000 new first-time buyers over the half-year. The rate of repeat buyers fell by a few points to 75%. The number of orders fell by 20.5%, but this was partially offset by an increase in the average basket (+10.9%).

CASH

On June 30, 2025, the Group had consolidated available cash[7] of €45.8 million.

This level of cash enables the Group to get through the usual seasonal low point of the summer months (July and August), and to tackle the upturn in sales activity, traditionally strong in the last four months of the year.

| (millions €) | H1 2024 | H1 2025[8] |

| Cash flow from operating activities | -8.9 | -17.2 |

| Cash flow from investing activities | -7.9 | -0,8 |

| Cash flows from financing activities | -2.9 | 17.7 |

| Net change in cash and cash equivalents | -19.7 | -0,3 |

| Opening cash | 70.6 | 46.0 |

| Change in cash | -19.7 | -0.3 |

| Cash at end of period | 50.9 | 45.8 |

Cash flow generated by operations amounted to -€17.2 million in the first half of 2025, compared with -€8.9 million in the same period in 2024, impacted by the decline in business and the sizing to avoid increasing inventories, as well as significant disposals of slow-moving inventories.

Cash flow from development investments amounted to -€0.8 million for the period, down significantly compared to the first half of 2024, reflecting a return to more normal investment levels following the Group's structural logistics investments in a new warehouse in 2024.

Cash flow from financing activities amounted to €17.7 million, compared with -€2.9 million in the first half of 2024, including €20 million drawn down on our RCF facility.

EXERCISE OF THE CALL OPTION ON PART OF THE REMAINING CAPITAL OF THE BRADERY COMPANY

In May 2022, Showroomprivé acquired 51% of The Bradery with a commitment to buy back the remaining share capital from the company's founders (two put options exercising in 2025 and 2026 respectively).

As a reminder, Timothée Lynier and Edouard Caraco, the two co-founders of The Bradery, have decided to exercise their put option on part of their stake in the company, namely 22.3% of The Bradery shares. Both managers remain strongly committed within The Bradery.

POSTPONEMENT OF THE PUBLICATION OF THE 2024 UNIVERSAL REGISTRATION DOCUMENT (CONTAINING THE 2024 ANNUAL FINANCIAL REPORT) AND THE 2025 HALF-YEAR FINANCIAL REPORT

Further to its press releases of April 30 and May 22, 2025, the Group announces that:

- The analysis of the impact on the financial statements of the exercise of the promise to purchase part of the remaining share capital of The Bradery by the co-founders is still in progress and does not yet allow the publication of the 2024 Universal Registration Document (DEU) (including the 2024 annual financial report).

- The strategic review announced at the same time by the Group is also in the process of being finalized, but it is not yet possible to express a definitive opinion on the valuation of certain assets, particularly the value of goodwill, deferred tax and equity interests.

Consequently, the 2024 financial statements and the 2025 half-year accounts could not be approved by the Board of Directors. The 2024 universal registration document and the 2025 half-year financial report could not be finalized. As indicated by the Company in its press release of 6 June 2025, the President of the Bobigny Commercial Court has agreed, at the Company's request, to extend the deadline for holding its Annual General Meeting (initially scheduled on June 25, 2025) to December 31, 2025.

The Company will inform the market of developments related to the closing of its financial statements, the publication of its 2024 universal registration document (DEU) (including the 2024 annual financial report) and the date on which the General Meeting will be called.

2025 OUTLOOK

After a 1st quarter less dynamic than expected, the Group did not see any recovery in the 2nd quarter, and visibility remains limited for the second half of the year.

Given the situation, Showroomprivé will be speeding up its strategic review in order to propose a new plan by the end of 2025, which will be a continuation of the ACE plan but with the aim of significantly deepening its effects.

In the meantime, the teams will remain particularly vigilant on cost control, and in particular the implementation of a dynamic inventory optimization policy, while capitalizing on the rationalization of logistics, which should generate savings of €5 million over the year.

NEXT information

2025 Third Quarter Revenue: October 16, 2025

FORWARD-LOOKING STATEMENTS

This press release contains summary information only and is not intended to be comprehensive.

This press release may contain forward-looking information and statements about the Group and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements may be identified by the words "believe", "anticipate", "objective" or similar expressions. Although the Group believes that the expectations reflected in such forward-looking statements are reasonable, investors and shareholders of the Group are cautioned that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Group, that could cause actual results and events to differ materially and adversely from those communicated, implied or indicated by such forward-looking information and statements. These risks and uncertainties include those discussed or identified in the documents filed or to be filed with the Autorité des marchés financiers by the Group (notably those detailed in chapter 4 of the Company's reference document). The Group undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

About showroomprive

Showroomprivé is a European player in online event sales, innovative and specialized in fashion. Showroomprivé offers a daily selection of more than 3,000 partner brands on its mobile apps and website in France and six other countries. Since its creation in 2006, the company has experienced rapid growth.

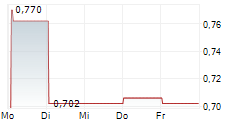

Listed on the Euronext Paris market (code: SRP), Showroomprivé generated gross business volume including VAT of nearly €1 billion in 2024 and net revenue of €650 million. The Group is led by co-founder David Dayan and employs more than 1,100 people.

For more information: http://showroomprivegroup.com

Contact

| Showroomprivé | NewCap |

| Benoît Jacheet, Group CFO investor.relations@showroomprive.net | Financial communication Théo Martin, Louis-Victor Delouvrier |

| Anthony Alfont Relations.presse@showroomprive.net | Media relations Gaelle Fromaigeat, Nicolas Merigeau showroomprive@newcap.eu |

[1] Gross Merchandise Value ("GMV") or "Sales" represents, all taxes included, the total amount of the invoiced transaction and therefore includes gross Internet sales, including Marketplace sales, other services and other revenues

[2] These data have not been audited and have not been reviewed by the statutory auditors

[3] Source: Insee Informations Rapides - May 28, 2025

[4] A 5% decline in H1 2025 according to research firm Fox Intelligence, based on a sample of major event sales websites: Showroomprivé, Veepee, Privé by Zalando, BazarChic, Private Sport Shop, BrandAlley, Bricoprivé, West Wing and Beauté Privée.

[5] Trade marketing refers to all the actions implemented by Showroomprivé and its partner brand to optimize sales on the website by better promoting products.

[6] Direct delivery from the supplier

[7] The "consolidated available cash" corresponds to the aggregate amount as reflected in the IFRS financial statements (including cash and cash equivalents)

[8] These data have not been audited and have not been reviewed by the statutory auditors

- SECURITY MASTER Key: l26bYpqYZ2zGx21xasdnnGVsamhhxmGcZpaelZdvZpuUbm2TyJdol5WcZnJkmWdo

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-93422-pr-h1-2025.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free