Paris, June 18, 2025

At 7 p.m.

Launch of a new "Solana Treasury Company" activity and strategic repositioning of the Group Acheter-Louer.fr

Issuance of convertible bonds into shares at a fixed conversion price for a total gross amount of €3.68 million to finance this new activity, restructure the remaining convertible bonds with a variable conversion price, and finance working capital.

The company ACHETER-LOUER.FR (the "Company"), a specialist in matchmaking and media solutions in real estate and housing offering digital marketing, data, and 2D-3D imaging services, announces its decision to strategically reposition as a Solana Treasury Company, financed through a reserved issue of convertible bonds into shares at a fixed conversion price for a total gross amount of €3.68 million.

This new activity will be conducted through its wholly owned subsidiary ALFR Opportunity Invest ("ALFR-OI").

Launch of the new Solana Treasury activity

This new activity will involve strategically accumulating Solana (SOL), one of the leading digital assets globally. Solana is a high-performance blockchain designed to host large-scale decentralized applications, with low fees and high transaction speeds. By holding SOL long-term and staking[1] it, the Group aims to generate an estimated passive yield[2] between 5% and 11% annually, while capturing the potential price appreciation of this innovative asset.

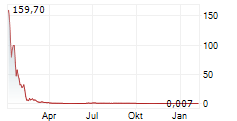

It is noted that Solana's price is highly volatile, which could result in rapid and significant depreciation of the Group's holdings. Additionally, unlike traditional assets, Solana's liquidity may be affected by sudden market shifts, regulatory changes, or exchange platform malfunctions.

To carry out this new activity-through which shareholders can benefit from revenues generated by the Group's Solana holdings-the Group will rely on the services of a Digital Asset Service Provider (PSAN) registered with the French Financial Markets Authority (AMF), and a licensed custodian for secure asset storage.

To finance the launch of this activity, the Company has decided to carry out a private placement by the issuance of convertible bonds for a total gross amount of €3.68 million. The Company may, depending on market conditions, conduct additional fundraising via bond issuance and/or capital increases to puruchase more SOL.

In the short term, the Group's historical real estate marketing and 3D imaging business may be sold, depending on market conditions to ensure an optimal sale price.

Issuance of convertible bonds with a fixed conversion price at a premium of 300% to current market price for a total amount of €3.68 million

Legal faremwork and terms of issuance

On 18 June 2025, the Company's Management Board used the powers granted under the 12th resolution of the shareholders' meeting of 4 September 2024 to issue financial securities granting access to share capital, without shareholders' preferential subscription rights, in favor of specific categories of investors under Article L.225-138 of the French Commercial Code.

The convertible bonds were subscribed the same day by Digital Ventures I (the "Investor"), an investment firm focused on digital assets, for around €2.15 million in cash, and €1.53 million by debt offset (the Investor held a liquid and payable claim against the Company).

No convertible bonds have been converted as of this press release.

Use of proceeds :

The net proceeds of €2.15 million will be allocated as follows:

- €1.5 million to acquire and hold Solana

- €0.65 million to finance operational and working capital needs of the Company and ALFR-OI, particularly during the observation period of the Company's "safeguard procedure" opened on 11 February 2025 by the Paris Commercial Court

This also allows the Company to cancel its plan to take a €485,000 loan from RETO and avoids placing a first-ranking pledge over its subsidiaries' shares[3].

Key terms of the Convertible Bonds

- Nominal value: €1 per convertible bond, subscribed at par

- Maturity: 60 months

- No interest

Conversion rights:

- At any time by the Investor

- By the Company, after year 2 and only if the 10-day VWAP of the share is at least 120% of the Conversion Price

The Investor can demand cash repayment at 120% of nominal value in the event of default.

Conversion Price: fixed at €0.0012 per convertible bond, but cannot be lower than the nominal value of the share on conversion date (currently €0.112). The Company thus plans to reduce its nominal value per share.

Each convertible bond grants the right to 1 new share.

The convertible bonds will not be listed on Euronext Growth.

New shares from convertible bonds conversion

New shares will have full rights and be listed on the same line as existing shares on Euronext Growth Paris.

Liquidity and funding horizon

The Company expects the proceeds to fund operations until December 2025.

Risk factors

Previously disclosed in the 2024 annual report, with additional risks for the new strategy:

- High volatility of Solana price

- Liquidity risk due to regulatory or technical issues

- Regulatory and tax risks from evolving laws and cross-jurisdiction differences

Operational and cybersecurity risks, including wallet security and private key management

Legal disclaimer

This convertible bond issue does not require a prospectus under EU regulation 2017/1129. This press release is not a public offering.

About Acheter-Louer.fr (Ticker: ALALO)

Acheter-Louer.fr provides real estate and housing content, advertising, digital tools, and media solutions for individuals and professionals. Services include:

- Real estate ads, magazines, mobile apps

- Podcasts, newsletters, blogs

- Digital marketing, lead generation

- AI price prediction tools

- Virtual agencies in the metaverse

- 3D imaging studio (TriDisPhere.fr)

- Online real estate auctions, call center services

PEA-PME eligible.

Investor contact: investisseurs@acheter-louer.fr

Investor info: https://www.acheter-louer.fr/qui-sommes-nous/infos-invest

[1] Mechanism by which an investor "locks" their SOL to participate in the security and proper functioning of the blockchain. In return, they periodically receive rewards denominated in SOL.

[2] Rewards related to "staking" that are in addition to any potential appreciation in the price of SOL.

[3] Press release issued by the Company on 30 april 2025

- SECURITY MASTER Key: m2twY5xmZJyVmW6alZlla5KZaJdlxWLIbZSVxGRxmMyUcJyRyplqZsicZnJjmGtt

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-92367-cp-18-06-2025-alalo-english.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free