Press release - 2025 Half-year results

Sainte-Marie, September 9, 2025, 7:45p.m.

2025 HALF-YEAR RESULTS

Solid performance fueled by the Property Investment business

- Strong performance from the Property Investment business[1]

- Total gross rental revenues (including €1.9 million share of equity affiliates): [2] €15.8 million, +6,0% o/w +4.0% on a like-for-like basis

- Recurring net income-Property Investment division: +6.2% to €7.7 million

- Property development: start of construction on the Galabé office complex (4,200 sqm in Saint-Paul)

- Property Development: decline as expected (end of the Pinel scheme)

- Property Development revenue: €11.1 million (-47.7% vs. €21.2 million in H1 2024)

- Property Development margin: €1.8 million or 16.4% of revenue (vs. €3.2 million or 14.9% in H1 2024)

- A more limited activity now focused on Block sales (signing of a 48 lot off-plan sale agreement with SHLMR in H1) and building plots (launch of Kaisary phase 3, 37 sea view plots)

- Net revenue (group share) driven by the Property Investment business (+1.8%) and sound financial position

- Consolidated revenue: €25.7 million (-27.1%, €35.2 million in H1 2024)

- Income from operations: €11.3 million (-8.1%), with the momentum of Property Investment business offsetting the decline of the Property Development business

- Net Income (group share): €8.7 million (+1.8% vs. €8.6 million in H1 2024)

- Net asset value: €244.9 million (+1.6% over 12 months) at €6.98/share (+3.1%)

- Gross financial debt: €156.5 million (-€8.9 million vs. year-end 2024), secured and with long residual maturity (7.7 years)

- Cash position: €17.2 million

- LTV (excluding transfer taxes) under control: 32.8% (vs. 31.5% at year-end 2024 and 33.3% at end-June 2024)

- Adjusted 2025 target

- Growth in gross rental income from total economic portfolio[3]: around +2.0% (vs. around +1.0%)

"We are actively pursuing the development of our real estate portfolio, which has delivered very strong performance this semester. We have just launched construction of a next-generation office complex that will enrich the offering at our Savanna business district in Saint-Paul, the second-largest urban area on Reunion Island. This development strategy has helped offset the decline in residential development activity this semester," said Géraldine Neyret, Chairman and Chief Executive Officer of CBo Territoria.

The Board of Directors of CBo Territoria (ISIN: FR0010193979-CBOT), a leading real estate player in La Réunion for nearly 20 years, met on September 8, 2025, and approved the consolidated financial statements for the six months ended June 30, 2025. The audit procedures on the consolidated financial statements have been completed.

CHANGES IN THE ECONOMIC PORTFOLIO

At the end of June 2025, CBo Territoria held total economic assets[4] valued at €379.7 million (excluding tax), stable compared with year-end 2024 (+0.4%, €378.2 million), due to the absence of deliveries during the period, and up +2.2% compared with June 30, 2024 (reflecting the delivery of the France Travail offices in Mayotte and a KFC property in Saint-Joseph, held in partnership). The total portfolio value excluding transfer taxes (including €2.6 million in assets under construction) stood at €382.3 million at the end of June 2025 (vs. €380.6 million at year-end 2024).

The indicators for the commercial property portfolio[5] (87% of total assets) as of June 30, 2025, remain solid.

- Valuation at €329.3 million excluding transfer duties (+0.5% compared with year-end 2024).

- Annualized gross rental income of €28.3 million (including contribution from equity affiliates) stable versus year-end 2024.

- Occupancy rate: 98%.

- Gross yield rate including transfer duties: 8.1% (stable vs. 8.0% at year-end 2024).

FINANCIAL PERFORMANCE IN FIRST HALF 2025

Property Investment: Recurring net income of €7.7 million (+6.2%)

In the first half of 2025, gross rental income from the Property Investment's total economic portfolio including the contribution of commercial assets held in partnership (rent contribution from equity affiliates: €1.9 million, stable over the period), amounted to €15.8 million versus €14.9 million in H1 2024 (+6.0%). This increase breaks down into two components: +2.0% from changes in the commercial scope (+€0.3 million) and +4.0% on a like-for-like basis, including a 3.1% indexation effect (+€0.9 million).

Total net rental income rose by +4.8% to €14.1 million (including a €1.9 million contribution from equity affiliates).

Property Investment's Recurring net income amounted to €7.7 million, compared with €7.3 million in H1 2024 (+6.2%), driven by higher net rental income and controlled financing costs.

Property Development: Continued solid margin (16.4% of total income) despite reduced volume of activity

In residential property development, activity is now focused on two segments: block sales of buildings and sales of residential building plots. During the first half-year, CBo Territoria notably signed an off-plan sale agreement (VEFA) with SHLMR for Le Coutil in June and launched the construction of this program (48 units for €9.7 million).

Property Development revenues stood at €11.1 million as of June 30, 2025, down €10.1 million from H1 2024 (-47.7%). This change is primarily explained by the end of Pinel Dom Scheme activity (base effect of-€3.9 million vs. H1 2024). Block sales totaled €7.6 million (vs. €12.9 million in H1 2024), with revenue recognition expected to be more favorable in H2 2025 given the progress of ongoing projects. Sales of building plots continued to show significant inertia this half-year at €2.4 million (-€1.7 million vs. H1 2024) in a still unfavorable market environment. The Group also recorded the sale of a serviced plot for economic use in Beauséjour.

In the first half of 2025, reservations of residential building plots rose by +5% to €7.9 million for 44 lots (vs. €7.5 million and 43 lots in H1 2024). In June, the Group launched the final phase of the Kaisary program in Saint-Pierre (37 lots, including 2 macro-lots), bringing the available offering to 127 plots at end-June 2025.

Finally, the Property Development's margin came to €1.8 million for the first half-year (vs. €3.2 million in H1 2024), reflecting the contraction in activity. However, the shift in the residential Property Development mix helped maintain a high margin rate of 16.4% (vs. 14.9% in H1 2024).

Results driven by the Property Investment business, with net income (Group share) showing slight growth

Overall, consolidated revenues for the first half amounted to €25.7 million, down -27.1%. The strength of the Property Investment business, along with disciplined control of overhead costs, helped limit the impact of the sharp decline in development activity. As a result, operating income came to €11.3 million (-€1.0 million, or -8.1% vs. H1 2024).

The change in fair value amounted to +€0.5 million in H1 2025 (vs. -€0.5 million in H1 2024), driven by fair value gains linked to higher variable rents and indexation, which offset fair value losses related to changes in the rental situation of certain assets.

Operating income including share of equity affiliates (stable at €1.4 million) held steady at €13.2 million, in line with H1 2024.

Overall, net income (group share) came to €8.7 million, up +1.8% (vs. €8.6 million in H1 2024), or €0.25 per share (+3.6% considering the accretive impact of share buybacks). This reflects stable net cost of financial debt (-€2.0 million) and a stable tax expense (-€2.6 million).

Net Asset Value (NAV): €244.9 million at €6.98/share

Net Asset Value stood at €244.9 million compared with €245.6 million at year-end 2024 (-0.4%) and €241.0 million as of June 30, 2024 (+1.6%). Over the first semester, the change reflects Group share net income of +€8.7 million, the payment of the 2024 dividend (€8.4 million paid in mid-June), and share buybacks (€0.8 million). On a per-share basis, NAV came to €6.98, stable versus year-end 2024 and up +3.1% compared with June 2024, factoring in the accretive impact of share buybacks.

Sound financial structure-Diversified, secure debt profile

After repaying €9.3 million in borrowings in the first half of 2025, the Group's gross financial debt stood at €156.5 million, compared with €165.4 million at year-end 2024, with 80% consisting of mortgage financing.

Following the payment of the 2024 dividend, CBo Territoria maintained cash at hand of €17.2 million, supplemented by €7.3 million in term deposits classified as financial assets.

After accounting for hedging instruments, 88% of financial debt is at fixed rates. The average debt cost remained at a low 2.8% (stable, compared with year-end 2024). Residual maturity stands at 7 years and 8 months.

The LTV ratio excluding transfer taxes stood at 32.8% at end-June 2025 (vs. 33.3% at end-June 2024 and 31.5% at year-end 2024). The ICR improved to 6.2x (vs. 5.5x at end-June 2024 and year-end 2024), and the Net debt/EBITDA ratio stood at 5.1x (vs. 5.1x at end-June 2024 and 4.7x at year-end 2024)

REVISED 2025 TARGET AND OUTLOOK

Considering revised assumptions regarding the rental situation, the Group has slightly adjusted its 2025 target, now expecting gross rental income growth across its total economic property portfolio[6] (commercial, agricultural and miscellaneous, and residential, including the contribution of from equity affiliates) of around +2% (compared with around +1% previously).

The Group is pursuing its development with the launch, at the end of the first semester, of the Galabé office complex (4,200 sqm, scheduled for delivery in H2 2027) located in the Savanna business district in Saint-Paul, at the heart of a very dynamic economic region.

In residential property development, the Group has strong visibility, with a block sales backlog of €20.6 million (+12% vs. year-end 2024) and a land-for-sale available offering of €26,3 million (+10% vs. year-end 2024).

The Group also holds medium-term development potential of more than 820 lots (housing and building plots) on secured land reserves. To date, 209 lots are under construction and 137 lots scheduled for launch within the next 12 months.

A presentation meeting will be held on September 10 at 11:30 a.m. (Paris time).

=> The webcast access link is available on the homepage of cboterritoria.com.

The half-year financial report was filed with the AMF today and it is available on cboterritoria.com Finance/Financial documents section.

2026 Financial calendar: 2025 annual sales-Tuesday, February 10 (after market close)

About CBo Territoria (FR0010193979, CBOT)

A leading real estate player in Réunion Island for 20 years, CBo Territoria has become a multi-regional development property investment company (€379.7m economic property portfolio value at end-June 2025). The Group operates across the entire real estate value chain (Land Developer, Property Developer and Property Investment Company), pursuing growth through its land reserves or land acquisitions.

Since inception, CBo Territoria has been committed to sustainable real estate. CSR is embedded in the company's DNA and is embodied today in its Impact Péï 2030 programme.

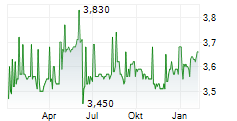

CBo Territoria is a dividend-paying property investment company eligible for PEA PME and listed on Euronext Paris (Compartment C).

INVESTORS Contacts

Caroline Clapier - Director of Finance and Administration - direction@cboterritoria.com

Agnès Villeret - Komodo - Tel.: 06 83 28 04 15 - agnes.villeret@agence-komodo.com

PRESS Contacts:

Finance: Agnès Villeret - agnes.villeret@agence-komodo.com

Corporate-Paris: Dina Morin-dmorin@capvalue.fr

La Réunion & Mayotte: Catherine Galatoire - cgalatoire@cboterritoria.com

APPENDIX

Please note that since the variations are calculated based on the actual figures, discrepancies in the sums may occur due to rounding.

CHANGES IN THE PORTFOLIO (EXCLUDING TRANSFER TAXES)

| In €M | |

| Total economic assets as of 12.31.2024 | 380.6 |

| Built assets under construction | 2.5 |

| Economic assets as of 12.31.2024 | 378.2 |

| Residential sales | (0.1) |

| Development of Property Investment company (delivery, transfers as investment properties) | 1.0 |

| Change in fair value | 0.6 |

| Economic assets as of 06.30.2025 | 379.7 |

| Built assets under construction | 2.6 |

| Total economic assets as of 06.30.2025 | 382.3 |

OPERATING ACTIVITY

| CONSOLIDATED REVENUE | H1 2025 | H1 2024 | V ariation |

| Gross rental income | 13.9 | 13.1 | +5.6% |

| Property Development | 11.1 | 21.2 | -47.7% |

| Other activities | 0.7 | 0.8 | -15.3% |

| Consolidated revenues (in € million) | 25.7 | 35.2 | -27.1% |

| Gross rental revenue | H1 2025 | H1 2024 | V ariation |

| Commercial | 12.9 | 12.2? | +5.7%? |

| Agriculture and miscellaneous | 0.6 | 0.6? | +12.6%? |

| Residential ? | 0.3 | 0.3 | -11.0%? |

| Gross rental r evenue ? | 13.9 | 13.1 | +5.6% ? |

| Commercial contribution from equity affiliates ? | 1.9 | 1.8? | +8.7%? |

| Gross rental revenue incl. contribution from affiliates ? | 15.8 | 14.9 | ? +6.0% |

| Including Commercial ? | 14.9 | 14.0 | ? +6.1% |

| Property Development revenue | H1 2025 | H1 2024 | V ariation |

| Residential | 10.1 | 21.0 | -52.1% |

| Block sales (Intermediate and Social) | 7.6 | 12.9 | -40.9% |

| Sales of building plots | 2.4 | 4.2 | -41.8% |

| Individual clients (Intermediate-Pinel DOM) | 0.0 | 3.9 | - |

| Commercial | 1.1 | 0.2 | X 5.6% |

| Sales of building plots and miscellaneous | 1.1 | 0.2 | |

| Total Property Development revenue (in €M) | 11.1 | 21.2 | -47.7% |

PROFIT AND LOSS ACCOUNT (IFRS)

| In €M | H1 2025 | H1 2024 | Var. in € | Var. in % |

| Revenue | 25.7 | 35.2 | -9.5 | -27.1% |

| Incl. rental income | 13.9 | 13.1 | ||

| Incl. disposals of investment property | 11.1 | 21.2 | ||

| Incl. income from miscellaneous activities | 0.7 | 0.8 | ||

| Income from operations | 11.3 | 12.3 | -1.0 | -8.1% |

| Net of fair value adjustments | 0.5 | (0.5) | +1.0 | |

| Gains and losses on disposals of investment property | 0.1 | 0.1 | ||

| Other operating income and expenses | - | (0.1) | ||

| Operating income | 11.8 | 11.8 | +0.0 | +0.4% |

| Share of profit/(loss) of affiliates | 1.4 | 1.4 | ||

| Operating income including equity affiliates' contribution 1 | 13.2 | 13.2 | +0.0 | +0.1% |

| Cost of net financial debt | (2.0) | (2.1) | ||

| Other financial income and expenses | 0.0 | 0.0 | ||

| Pre-tax income | 11.3 | 11.1 | +0.2 | +1.5% |

| Tax expense | (2.6) | (2.6) | ||

| Net income/(loss) | 8.7 | 8.6 | ||

| Net income/(loss) (Group share) | 8.7 | 8.6 | +0.2 | +1.8% |

| Net earnings per share (Group share ) (€) | 0.25 | 0.24 | +3.6% | |

| Weighted number of shares | 35,245,809 | 35,844,953 |

1 Operating income after share of net profit from companies accounted for under the equity method

Income from operations

| In €M | H1 2025 | H1 2024 | Var |

| Net rental revenue | 12.3 | 11.8 | +4.1% |

| Property development margin | 1.8 | 3.2 | -42.5% |

| Net overhead costs | (2.9) | (2.7) | +8.9% |

| Other operating expenses | 0.2 | 0.1 | N/S |

| Income from operations | 11.3 | 12.3 | -8.1% |

Recurring net income from the Property Investment division

| In €M | H1 2025 | H1 2024 |

| Gross rental revenue | 13.9 | 13.1 |

| Building expenses | (1.6) | (1.3) |

| Net rental revenue | 12.3 | 11.8 |

| Net overheads incurred by the Property Investment | (1.7) | (1.5) |

| Profit from the property investment company after allocation of a share of the structural costs | 10.6 | 10.2 |

| Cost of net financial debt | (1.9) | (2.0) |

| Other financial revenues and expenses | - | - |

| Income tax (excluding equity affiliates) | (2.2) | (2.1) |

| Net recurring income from equity affiliates | 1.2 | 1.1 |

| Property investment company's - Recurring net income (Group share) | 7.7 | 7.3 |

| Property Investment RNI per share (in euros) | 0.22 | 0.20 |

BALANCE SHEET (IFRS)

| ASSETS in €M | 06.30.2025 | 12.31.2024 |

| Non-current assets | 373.5 | 374.0 |

| Investment properties | 341.2 | 339.3 |

| Investment in equity affiliates | 17.0 | 15.9 |

| Financial assets 1 | 8.3 | 11.5 |

| Other non-current assets | 7.0 | 7.3 |

| Current assets | 93.9 | 100.7 |

| Inventories and work in progress | 51.7 | 54.6 |

| IP held for sale | 0.8 | 1.1 |

| Trade and other receivables 2 | 24.2 | 17.3 |

| Cash and cash equivalent | 17.2 | 27.6 |

| LIABILITIES in €M | ||

| Shareholders' equity | 244.9 | 245.6 |

| Group | 244.9 | 245.6 |

| Minority interests | 0.0 | 0.0 |

| Non-current liabilities | 173.5 | 185.4 |

| Financial debt MT/LT | 135.5 | 145.8 |

| Deferred tax liabilities | 38.2 | 37.9 |

| Other non-current liabilities | 1.6 | 1.8 |

| Current liabilities | 47.2 | 43.7 |

| Current borrowings (including bonds) | 21.0 | 19.6 |

| Trade and other payables | 26.2 | 24.0 |

| Total Balance sheet | 467.4 | 474.7 |

1 Excluding equity investments presented under other non-current assets.

2 The €6.8m increase in tenant receivables is due to a change in the invoicing terms for Q3 2025 rents. This led to a €5.6 million increase in contract liabilities. The difference corresponds to VAT.

LOAN-TO-VALUE (LTV)

| In €M | 30.06.2025 | 31.12.2024 | |

| Investment property | 341.2 | 339.3 | |

| Investment properties held for sale | + | 0.8 | 1.1 |

| Operating property excluding headquarters | + | 5.5 | 5.7 |

| Inventories/development | + | 51.7 | 54.6 |

| Total Assets (A) | = | 399.2 | 400.7 |

| Medium- and long-term debt | 135.5 | 145.8 | |

| Short-term debt | + | 21.0 | 19.6 |

| Other financial assets (effect of hedging instruments) | - | 8.3 | 11.5 |

| Available cash and cash equivalents | - | 17.2 | 27.6 |

| Total Liabilities (B) | = | 131.0 | 126.3 |

| LTV Excluding transfer taxes (B/A) | 32.8 | 31.5% |

Breakdown of gross debt as of June 30, 2025

(€156.5 million vs. €165.4 million as of December 31, 2024)

GLOSSARY

Adjusted NAV - Adjusted Net Asset value: The Adjusted Net Asset value is calculated based on consolidated equity, including unrealized capital gains and losses on the property portfolio. The property portfolio is measured at market value by means of an independent appraisal

Adjusted NAV per share: Adjusted Net Asset value per share excluding treasury stock.

Diluted Adjusted NAV per share: Adjusted Net Asset Value per share after factoring in the maximum number of shares that could be created by outstanding dilutive instruments (ORNANE)

Backlog: Sales (before tax) from completed residential and commercial property sales (excluding land sales) that have not yet been recognized

Order book (or booking stock): Total revenue (excluding tax) of lots under reservation contract on the cut-off date

Average cost of debt: Ratio of interest paid over the course of the year prior to capitalization to the average amount of debt outstanding for the year

EBITDA: Operating profit adjusted for depreciation, amortization and provisions

ICR - Interest Coverage Ratio: Proportion of debt costs covered by net rental income

RY - Rental Yield Property: All built real estate assets providing recurring rental income

IP - Investment Property: Built Investment Properties (Commercial+ Residential) + IP Land (excluding Land in Stock/Development)

FV - Fair Value: method of valuing assets according to IFRS international accounting standards, that applies to consolidated accounts; defined as "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date".

Net rental income = Property investment company's operating margin: Rental income net of property expenses, considering provisions for bad debts.

LTV - Loan to Value: Amount of outstanding bank debt net of investment assets and cash/market value of investment properties excluding transfer taxes + net carrying amount of operational properties other than head office + inventories and work-in-progress (consolidated value)

Property development company's operating margin: Revenues less costs of sales, sales, and marketing costs and allowances to provisions

Supply available for sale: Revenue from lots offered for sale, not reserved

ORNANE ("Obligation Remboursable en Numéraire et en Actions Nouvelles et Existantes"): A convertible bond that is redeemed in cash at maturity, with the possibility of repaying the difference between the market price and the conversion threshold in the issuer's shares if the conversion option is exercised in the same currency.

Economic portfolio: Investment assets and share in assets held by associates.

Net profit/loss, Group share: The Group share of net profit/loss is the share of the overall net profit attributable to the Group's shareholders.

Income from operations: Sales development margins + Net rental income - Net management fees +/- Other, non-recurring

Net Recurring Result (NRR): IFRS net recurring result from current and recurring activities (EPRA method) = Net rental income - (share of property investment company's structural costs + property investment company's debt servicing costs - corporate income tax (including share of tax of associates accounted for using the equity method)

Operating result including affiliates' contribution accounted for using the equity method: Operating result + change in fair value + gains or losses on disposals of investment properties + other operating income and expenses + share of the profit or loss of companies accounted for using the equity method

Affiliate: Company accounted for under the equity method. Equity accounting is an accounting technique whereby the carrying value of shares held in an entity by its parent company is replaced by a measurement of the portion that the parent company owns in the equity of that entity

Financial occupancy rate: Ratio between market rent for leased space and rent for total surface area (= actual rent for leased space + market rent for vacant space).

Yield on economic assets: Value of gross rental income from leased premises divided by economic assets, including transfer taxes.

Building plots - Property development: Sales of building plots for residential or commercial real estate

Block sales - Property development: Acquisition of an entire building or real estate program by a single buyer.

Retail sales - Property development: Acquisition of a residential unit or lot by an individual client

[1] A glossary is included in the appendix to this document.

[2] Total net rents (including share of equity affiliates for €1.9 million): €14.1 million, +4.8%.

[3] The property investment business's economic assets include investment properties (commercial, office, and residential), as well as the share of assets held in partnerships accounted for under the equity method. This target factors in adjustments for indexation effects, based on assumptions about changes in the rental market.

[4] The property investment company's economic assets consist of investment assets (commercial, real estate, and residential) and the share of assets held in partnership, accounted for using the equity method.

[5] The commercial property portfolio consists of investment assets (excluding Residential and land assets) and the share of assets held through equity-accounted investments

[6] Gross rental income from the total economic portfolio amounted to €30.3 million in 2024 (including €3.7 million from equity affiliates). This target includes adjustments for indexation effects, based on assumptions regarding changes in the rental market

- SECURITY MASTER Key: nGlqZZhoaG7JlmtxYsZsaWJlbptpw2HFameVmpWdk8uUmHKVnZllbpWcZnJknW5v

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-93899-cbot_2025-half-year-result-09-09-2025.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free