Quarter 4, June 2025 - August 2025

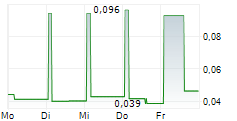

- Net revenue was 5 915 (21 123) tkr.

- EBITDA was -5 876 (2 402) tkr.

- Operating cash flow was -5 004 (130) tkr.

Year-end period, September 2024 - August 2025

- Net revenue was 31 573 (36 829) tkr.

- EBITDA was -16 299 (-12 340) tkr.

- Operating cash flow was -12 370 (-23 707) tkr.

- Cash position in the end of period was 14 562 (15 303) tkr.

- Licensed products at the end of period were 30 (31).

- Products with distribution rights at the end of the period were 16 (12).

- Products with marketing authorization at the end of the period were 29 (21).

- Products launched in Nordics at end of the period were 16 (13).

Significant events during the quarter

- Newbury Pharmaceuticals Secures Generic Approval for Melatonin Newbury.

Significant events after the end of the quarter

- Newbury Pharmaceuticals Secures Generic Approval for Ivermectin Newbury.

- Newbury Pharmaceuticals Secures Generic Approval for Mirtazapin Newbury.

A word from the CEO

Turnover and Performance

The turnover in Q4 was impacted by lower-than-expected tender wins resulting in a modest turnover for the quarter. The low turnover was partly due to high competition in monthly tenders, delayed launches of new products, a failed product approval and low inventory levels for key products.

In the Nordic business we successfully launched our first product in Finland during September - but other launches across the Nordics expected during second half of 2025 calendar year were delayed.

The Nordic business is expected to achieve +11 MSEK in turnover in Q1 and thus get back on track.

The international business has during the year made steady progress in addressing new regulatory requirements, which we expect to be fully resolved in 2026.

As a result of the delays in both the Nordic and International business we are below our internal expectations for the year 2024/2025 and below previous year Q4. New orders from the international business are not expected in Q1 and despite expected solid sales in Q1 2025/2026 from the Nordic business, we anticipate that the calendar year2025 will fall short of internal expectations mainly due to lack of international sales orders.

Product Launch and approvals

Additional three products have been successfully registered during Q4 and during Q1 2025/2026. However, one product (Liraglutide Newbury) planned for launch had to be considered a failed product as the partner was unable to meet the post-approval commitments from the authorities and to deliver a competitive product. Liraglutide was expected to be launched in this period with minimal competition, however, in a volatile diabetes therapy segment with diminishing number of patients. The failed product will be compensated with other product(s) from the supply partner and is treated as a receivable in our balance sheet.

Outlook

Q1 has started positively with sales expected to be the highest quarterly sales in the Nordics. This trend is expected to continue in the following quarters (with regular volatility in monthly tender wins).

The international business is expected to resolve the regulatory hurdles and return with new orders/supplies during 2026.

Our product portfolio continues to grow, with new products registered during the quarter and more registrations expected in the near term. By the end of 2025 we expect to have 20 products launched and anticipate having more than 25 products launched in March 2026 which will increase to more than 30 products launched by December 2026. As more products become available for launch, we will gain additional opportunities to win tenders and increase sales volumes to accelerate the turnover in the coming years.

Audit

This report has not been reviewed by Newbury Pharmaceuticals auditor.

The report is publised on Newbury Pharmaceuticals website:

https://www.newburypharma.com/investors/financial-information/

For more information, contact:

Lars Minor, CEO

lars.minor@newburypharma.com

Mobile: +46 72-377 3005

www.newburypharma.com

About Newbury Pharmaceuticals

Newbury Pharmaceuticals is building a pipeline of proprietary and licensed products with focus on specialty and branded products in the Nordics. Newbury aims to make a difference by offering treatment solutions within areas like oncology, rare diseases and neurology. The portfolio is built by leveraging experience and extensive international network. Newbury offers strategic partnerships of innovation for the benefit of the Nordic healthcare market.

Västra Hamnen Corporate Finance is the Company's Certified Adviser on Nasdaq First North and can be reached at ca@vhcorp.se or +46 (0) 40 200 250.

This information is information that Newbury Pharmaceuticals is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-10-29 08:00 CET.