July - September 2025 (compared with July - September 2024)

- Rental income amounted to EUR 42.0 million (30.4).

- Net operating income totalled EUR 40.2 million (29.2)

- Profit from property management amounted to EUR 21.8 million (13.2). Profit from property management, excluding exchange rate effects, amounted to EUR 21.8 million.

- Earnings after tax for the period amounted to EUR 19.4 million (-5.6), corresponding to EUR 0.23

(-0.11) per share. - Unrealised changes in value affected profit by EUR-2.9 million (-6.4) on properties and by EUR 3.4 million (-13.0) on interest rate derivatives.

January - September 2025 (compared with January - September 2024)

- Rental income amounted to EUR 122.4 million (91.4).

- Net operating income totalled EUR 115.9 million (87.8).

- Profit from property management amounted to EUR 79.3 million (35.8). Profit from property management, includes a non-recurring income item of EUR 20.5 million regarding negative goodwill in connection with the acquisition of Forum Estates, as well as non-recurring costs and exchange rate effects of EUR -1.3 million. Profit from property management, excluding non-recurring items and exchange rate effects, amounted to EUR 60.1 million.

- Earnings after tax for the period amounted to EUR 64.1 million (-7.3), corresponding to EUR 0.81

(-0.16) per share. - Unrealised changes in value affected profit by EUR -7.5 million (-37.0) on properties and by EUR -4.6 million (-9.4) on interest rate derivatives.

- EPRA NRV amounted to EUR 1,056.1 million (749.1) corresponding to EUR 12.9 (11.9) per share.

"I am proud of the pan-European specialist platform we are building together and the stable returns we are delivering"

- Christian Fredrixon, VD

Key figures1 | Q3 2025 | Q3 2024 | Jan-sep 2025 | Jan-sep 2024 |

Rental income | 42.0 | 30.4 | 122.4 | 91.4 |

Net operating income | 40.2 | 29.2 | 115.9 | 87.8 |

Profit from property management | 21.8 | 13.2 | 79.3 | 35.8 |

Unrealised changes in property values | -2.9 | -6.4 | -7.5 | -37.0 |

Earnings after tax | 19.4 | -5.6 | 64.1 | -7.3 |

Market value of investment properties | 2,492 | 1,764 | 2,492 | 1,764 |

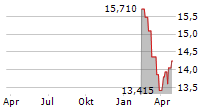

EPRA NRV/share, EUR | 12.9 | 11.9 | 12.9 | 11.9 |

Number of properties with solar panels | 76 | 49 | 76 | 49 |

Net operating income, current earnings capacity | 165.0 | 115.1 | 165.0 | 115.1 |

Net debt LTV ratio, % | 56.1 | 54.6 | 56.1 | 54.6 |

Debt ratio (net debt/EBITDA), multiple | 10.7 | 9.3 | 10.7 | 9.3 |

Prospective debt ratio (net debt/EBITDA), multiple | 9.7 | 9.0 | 9.7 | 9.0 |

Interest coverage ratio, multiple | 2.4 | 2.2 | 2.4 | 2.2 |

¹Refer to the full report for alternative performance measures and definitions.

4 november 2025

For further information, please contact

Christian Fredrixon, CEO

christian.fredrixon@cibusrealestate.com

+46 (0)8 12 439 100

Pia-Lena Olofsson, CFO

pia-lena.olofsson@cibusrealestate.com

+46 (0)8 12 439 100

Link to the report archive:

https://www.cibusrealestate.com/investors/financial-reports/

About Cibus Nordic Real Estate

Cibus is a real estate company listed on Nasdaq Stockholm Mid Cap. The company's business idea is to acquire, develop and manage high-quality properties in Europe with grocery retail chains as anchor tenants. The company currently owns about 650 properties in Europe. The largest tenants are Kesko, Tokmanni, Coop, S Group, Rema 1000, Salling Group, Lidl, Dagrofa and Carrefour.

This information is information that Cibus Nordic Real Estate AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 07:30 CET on 4 November 2025.

Cibus Nordic Real Estate AB (publ)

Kungsgatan 26

111 35 Stockholm, Sweden

Tel: +46 (0)8 12 439 100

Reg no. 559135-0599

www.cibusrealestate.com