First underlying EBITDA profit marks our structural turnaround.

Since the spring, Albert Group has undergone a rapid transformation. We focused firmly on efficiency and financial discipline, restructuring the organisation and cutting costs to align around our core strengths. These actions have delivered results. In the third quarter, Albert achieved its first underlying EBITDA profitability, marking a clear structural turnaround and proving that our new, leaner organisation can grow profitably.

Financial progress and strengthened fundamentals

Net revenue reached SEK 40.8 million, with stable performance in both B2B and B2C segments despite the Strawbees divestment. Recurring subscription revenues remained strong, driven by high retention and improved pricing. Group EBITDA totalled SEK 18.7 million, or SEK 3.0 million adjusted for one-off items, our first ever underlying EBITDA profit and clear evidence that the transformation is working. The Strawbees sale added SEK 27 million in cash and removed SEK 1 million in monthly losses, further strengthening liquidity.

A decentralised market driven organisation

Albert now operates through three focused business units Albert, Sumdog and Swedish Film, each led by a VP with full P&L responsibility and clear operational mandate. Our decentralised model combines local ownership with group-wide strategic direction and capital discipline. It enables faster decisions, stronger customer proximity and sharper market focus, creating better conditions for innovation and profitable growth.

Albert is a learning organisation. We constantly evaluate, adapt and refine how we operate to stay agile and performance-driven. Embracing change is part of our DNA, and we will keep evolving to capture new opportunities.

Focus on core and long-term growth

The next phase is about execution. Our focus remains mathematics and adaptive learning, where Albert has its roots and where demand is accelerating. Falling PISA results and a growing emphasis on measurable learning outcomes create strong tailwinds. With a solid balance sheet, a leaner organisation and clear strategic direction, we are well positioned for sustainable growth and long-term shareholder value.

Fredrik Bengtsson

CEO of Albert

-

1 July- 30 September (Q3)

- Annual recurring revenue (ARR) from subscriptions was 137,460k (140,403k) SEK, which is a decrease of 2% compared to the previous year.

- Revenue from non-subscription products over the past four quarters amounted to 25,884k (36,876k) SEK, representing a decrease of 30% compared to the previous year.

- Invoiced sales for the quarter were 38,221k (44,803k) SEK, a decrease of 15% compared to the previous year.

- Net revenue amounted to 40,789k (41,949k) SEK, a decrease of 3% compared to the same period last year.

- EBITDA amounted to 18,738k (-8,373k) SEK.

- EBITA amounted to 15,777k (-12,277k) SEK.

- The result after financial items amounted to -8,988k (-34,886k) SEK.

- The result for the period amounted to -8,043k (-29,370k) SEK.

- Earnings per share amounted to -0.32 (-1.17) SEK, before and after dilution.

- Cash flow from current operations amounted to 20,193k (-3,220k) SEK.

- Cash and cash equivalents at the end of the period amounted to 55,031k (59,384k) SEK.

1 January- 30 September

- Annual recurring revenue (ARR) from subscriptions were 137,460k (140,403k) SEK, which is a decrease of 2% compared to the previous year.

- Revenue from non-subscription products over the past four quarters amounted to 25,884k (36,876k) SEK, representing a decrease of 30% compared to the previous year.

- Invoiced sales for the period were 128,464k (148,716k) SEK, a decrease of 14% compared to the previous year.

- Net revenue amounted to 120,988k (133,051k) SEK, a decrease of 9% compared to the same period last year.

- EBITDA amounted to 1,618k (-22,292k) SEK.

- EBITA amounted to -7,951k (-33,546k) SEK.

- The result after financial items amounted to -55,376k (-81,102k) SEK.

- The result for the period amounted to -52,540k (-73,058k) SEK.

- Earnings per share amounted to -2.09 (-2.91) SEK, before and after dilution.

- Cash flow from current operations amounted to 17,234k (-14,075k) SEK.

- Cash and cash equivalents at the end of the period amounted to 55,031k (59,384k) SEK.

-

Significant events in the third quarter of 2025

- During the quarter, all assets of Strawbees were divested and the remaining personnel were made redundant. The transaction amounted to 2.85 MUSD, contributing a positive cash flow of 20.2 MSEK and an EBITDA impact of 18.7 MSEK. Adjusted EBITDA for the period was 3 MSEK, excluding revenue and costs directly attributable to the divestment.

- Effective 1 July, Erik Bergelin was appointed Chief Financial Officer, transitioning from his previous role as Head of Strategy & Growth at Albert Group.

- On 29 September, Satu Castrén Kittel joined as Vice President of Albert Junior, assuming full P&L responsibility for the brand.

- On 11 September, Albert Group implemented a new decentralized organizational model, establishing clear P&L ownership within the brands and strengthening local market proximity.

Significant events after the end of the period

- Effective 1 October, Fredrik Bengtsson has been appointed Chief Executive Officer. He has served as interim CEO since April 2025.

For additional information, please contact

Fredrik Bengtsson, CEO

Phone: +46 (0) 723 280 144

E-mail: fredrik@hejalbert.se

Erik Bergelin, CFO

Phone: +46 (0) 768 710 747

E-mail: erik@hejalbert.se

About eEducation Albert AB (publ)

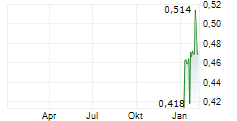

Albert Group is a leading European edtech group focused on personalised and joyful learning at home and in schools. The Group's SaaS based brands, Albert, Sumdog and Film & Skola offer curriculum aligned adaptive digital platforms, operate across core European markets and have served more than 10+ million learners to date. Albert is listed on Nasdaq First North Growth Market (ticker: ALBERT).

Read more at investors.hejalbert.se.

This information is information that eEducation Albert is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-11-11 07:30 CET.