THIS PRESS RELEASE MAY NOT BE DISTRIBUTED, RELEASED, OR PUBLISHED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, BELARUS, CANADA, HONG KONG, JAPAN, NEW ZEALAND, RUSSIA, SWITZERLAND, SINGAPORE, SOUTH AFRICA, SOUTH KOREA, OR ANY OTHER JURISDICTION IN WHICH SUCH ACTIONS, WHOLLY OR IN PART, WOULD BE UNLAWFUL OR DEMAND ADDITIONAL REGISTRATION OR OTHER MEASURES. PLEASE REFER TO "IMPORTANT INFORMATION" IN THE END OF THIS PRESS RELEASE.

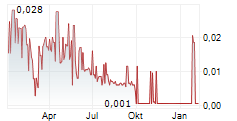

Heliospectra AB (publ) ("Heliospectra" or the "Company") announces today, 20 November 2025, the outcome of the rights issue of new shares amounting to a maximum of approximately SEK 49.5 million, which the Board of Directors resolved on 29 September 2025, and the extraordinary general meeting approved on 30 October 2025 ("Rights Issue"). The subscription period for the Rights Issue ended on 19 November 2025. The outcome shows that 322,004,044 shares, corresponding to approximately 65.1 percent of the Rights Issue, were subscribed for with the support of subscription rights. Additionally, subscription applications for 608,405 shares, corresponding to approximately 0.1 percent of the Rights Issue, were received for subscription of shares without the support of subscription rights. Together, the subscriptions with the support of subscription rights and subscription applications without the support of subscription rights constitute approximately 65.2 percent of the Rights Issue. The Rights Issue will provide the Company with proceeds of approximately SEK 32.3 million before deduction of issue costs and set-off of loan. The Board of Directors of the Company has, in connection with the allocation, resolved to allow set-off the loan of SEK 10 million from Weland Stål AB ("Weland") that was raised on 29 September 2025, and which was announced the same day.

The Board of Directors resolved on 29 September 2025, conditional on the approval of an extraordinary general meeting, to carry out an issue of new shares of up to approximately SEK 49.5 million with preferential rights for existing shareholders. The extraordinary general meeting on 30 October 2025, resolved to approve the Board of Director's resolution on the Rights Issue. The subscription price in the Rights Issue was SEK 0.1 per share, and the subscription period for the Rights Issue lasted until and including 19 November 2025.

Outcome of the Rights Issue and set-off of loan

The Rights Issue amounted to a maximum of 494,710,691 shares, corresponding to approximately SEK 49.5 million. The outcome shows that 322,004,044 shares, corresponding to approximately 65.1 percent of the Rights Issue, were subscribed for with the support of subscription rights. Additionally, applications for the subscription of 608,405 shares without the support of subscription rights, corresponding to approximately 0.1 percent, have been received. Thus, the outcome shows that the Rights Issue, with and without the support of subscription rights, was subscribed to approximately 65.2 percent. The Rights Issue will provide Heliospectra with proceeds of approximately SEK 32.3 million before deduction of issue costs and set-off of loan.

Heliospectra announced on 29 September 2025 that the Company had raised a loan of SEK 10 million from Weland (the "Loan"). Under the terms of the Loan, Weland had a right and obligation to set-off the Loan as payment for subscribed shares in the Rights Issue. Against this background, the Board of Directors has resolved to allow Weland to set-off the Loan as payment for shares subscribed for and allotted in the Rights Issue. The Board of Directors considers the set-off to be appropriate and that it is in the interest of both the Company and its shareholders that the Company's indebtedness is reduced in a timely and cost-effective manner.

Notification of allocation

Those who have subscribed for shares without the support of subscription rights have been allocated shares in accordance with the principles set out in the information document published by the Company on 4 November 2025. Notification of any allocation of shares, subscribed for without the support of subscription rights, will be provided by sending an allocation notice in the form of a transaction note, which is expected to be sent out as soon as possible. Subscribed and allocated shares must be paid for in cash in accordance with the instructions on the transaction note. Investors who have subscribed through a nominee will receive notification of allocation in accordance with their respective nominee's procedures. Only those who have been allocated shares will be notified.

Trading in paid subscribed shares (BTA)

Trading in paid subscribed shares (BTA) will take place on Nasdaq First North Growth Market until the Rights Issue has been registered with the Swedish Companies Registration Office, which is expected to occur in week 48, 2025.

Shares and share capital

Through the Rights Issue, the number of shares in Heliospectra will increase by 322,612,449 shares, from 274,839,273 shares to 597,451,722 shares, and the share capital will increase by SEK 1,321,774.963836, from SEK 1,126,043.558630 to SEK 2,447,818.522466. For existing shareholders who do not participate in the Rights Issue, this will result in a dilution effect of approximately 54 percent of the total number of shares and votes in the Company.

Advisers

MAQS Advokatbyrå AB is legal adviser to the Company in connection with the Rights Issue and Aqurat Fondkommission AB is issuing agent in the Rights Issue.

Contact Information

For More Information:

Rebecca Nordin, CFO & Head of IR at Heliospectra | +46 (0)72 536 8116 | ir@heliospectra.com

http://www.heliospectra.com

About Us

Heliospectra AB (publ) (Nasdaq First North Growth Market: HELIO) was founded in 2006 in Sweden by plant scientists and biologists with one vision - to make crop production more intelligent and resource-efficient. Today, with customers across seven continents, Heliospectra is the global leader in innovative horticulture lighting technology, custom light control systems and specialized services for greenhouse and controlled plant growth environments. Designed by growers for growers, Heliospectra builds customized LED lighting strategies and controls to automate production schedules, forecast yields and monitor crop health and performance with real-time data and response, to deliver the light plants love and the consistent results growers need.

For more information, please visit https://www.heliospectra.com.

Company HELIO is listed at Nasdaq First North Growth Market with Redeye AB as Certified Adviser.

Important information

The release, announcement or distribution of this press release may, in certain jurisdictions, be subject to restrictions by law. The recipients of this press release in jurisdictions where this press release has been published or distributed shall inform themselves of and follow such restrictions. The recipient of this press release is responsible for using this press release, and the information contained herein, in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer to sell or an offer, or the solicitation of an offer, to acquire or subscribe for shares or other securities issued by the Company, neither by the Company or anyone else, in any jurisdiction where such offer or invitation would be illegal prior to registration, exemption from registration or qualification under the securities laws of such jurisdiction.

This press release is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the "Prospectus Regulation") and has not been approved by any regulatory authority in any jurisdiction. No prospectus has been or will be prepared in connection with the Rights Issue. Within the European Economic Area ("EEA"), no public offering of shares is made in member states other than Sweden. In any other EEA Member State, this communication is only addressed to and is only directed at "qualified investors" in that Member State within the meaning of the Prospectus Regulation.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the "Securities Act"), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public offering of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the United States, Australia, Belarus, Canada, Hong Kong, Japan, New Zealand, Russia, Switzerland, Singapore, South Africa, South Korea, or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, "qualified investors" who are (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons"). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the new shares. The information contained in this announcement is for background purposes for the Rights Issue only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. Any investment decision to acquire or subscribe for shares in connection with the Rights Issue must be made on the basis of all publicly available information relating to the Company and the Company's shares.

Failure to follow these instructions may result in a breach of the Securities Act or applicable laws in other jurisdictions.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company's intentions, beliefs, or current expectations about and targets for the Company's future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim", or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors and readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of its date and are subject to change without notice. Neither the Company nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release, unless it is required by law or Nasdaq First North Growth Market's rule book for issuers.

This information is information that Heliospectra is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-11-20 18:10 CET.