NEW YORK, NY / ACCESS Newswire / December 29, 2025 / Global supply chains were built for efficiency, not inspection. For decades, auditability was handled through paperwork, attestations, and trust between counterparties. That model is giving way to something far more rigid.

Auditability is moving from an after-the-fact exercise to a design requirement.

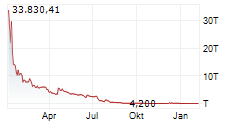

SMX (NASDAQ:SMX) operates in this transition by embedding verification directly into materials. Molecular identity turns physical assets into auditable entities, capable of confirming origin, composition, and custody without reconstructing history through documents.

That shift becomes unavoidable when applied to materials like silver. Silver is traded, regulated, and custody-sensitive. Once it enters a supply chain, auditability stops being a preference and becomes a requirement. Claims are insufficient. Continuity must be proven at every handoff.

Auditability at this level only works when it is supported at the system level. Technology alone does not carry it. Stability, continuity, and repeatable execution determine whether verification survives inspection or collapses under pressure.

Audit-Ready Systems Do Not Tolerate Volatility

Auditable supply chains depend on consistency. Verification systems must behave the same way every time they are tested, regardless of who performs the test or where it occurs. Any form of volatility undermines that consistency.

Silver exposes this reality immediately. Refining, transport, custody transfer, and cross-border movement leave no margin for interpretive gaps. Identity systems operating around silver either perform identically every time or they are rejected outright.

When systems lack continuity, timelines compress, priorities shift, and infrastructure meant to be permanent gets treated as provisional. Auditability cannot scale in that environment. It requires the opposite. Calm execution, repeatable processes, and confidence that deployments will not be interrupted or reworked.

This is why auditability must be engineered, not managed.

Partnerships That Embed Auditability

SMX's partnerships reflect this understanding.

National platforms developed with research agencies and regulators are built to withstand inspection. They are not demonstrations. They are operating systems designed for oversight. Molecular identity provides a physical anchor for auditability that documentation alone cannot replicate.

Industrial integrations place this logic inside machinery. Sorting systems and processing lines operate at speed and volume. Auditability must occur without slowing throughput or introducing discretion. Identity embedded at the material level enables continuous verification, not episodic.

In textiles and circular economy programs, where enforcement pressure continues to rise, auditability has become a condition of participation. Silver reinforces that standard because it already operates under strict custody and provenance requirements. Systems that hold up here gain credibility everywhere else.

These partnerships are not additive features. They are environments where auditability becomes real.

Auditability Depends on Continuity

Audit-ready systems must remain in place long enough to matter. Continuity is not optional.

Silver supply chains make this explicit. Custody frameworks, refinery standards, and regulatory oversight expect verification systems to persist across cycles, audits, and jurisdictional boundaries. Auditability that resets loses value quickly.

When systems remain intact, auditability compounds. Standards tighten. Verification deepens. Oversight becomes simpler rather than more complex. None of that happens if deployments are interrupted or repeatedly reconfigured.

As enforcement expands, auditable supply chains cleanly divide participants. Those who can demonstrate proof consistently and those who cannot. Technology built for inspection, embedded directly into materials like silver, sits on the durable side of that divide.

Auditability is no longer an overlay. It is becoming the operating condition.

That is the environment SMX is built to serve.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

This information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements are based on current expectations, estimates, forecasts, and assumptions regarding future events involving SMX (NASDAQ: SMX), its technologies, its partnership activities, and its development of molecular marking systems for recycled PET and other materials. Forward-looking statements are not historical facts. They involve risks, uncertainties, and factors that may cause actual results to differ materially from those expressed or implied.

Forward looking statements in this editorial include, but are not limited to, its announced capital facility and its terms, expectations regarding the integration of SMX's molecular markers into U.S. recycling markets; the potential for FDA-compliant markers to enable recycled PET to enter food-grade and other regulated applications; the scalability of SMX solutions across diverse global supply chains; anticipated adoption of identity-based verification systems by manufacturers, recyclers, regulators, or brand owners; the potential economic impact of turning recycled plastics into tradeable or monetizable assets; the expected performance of SMX's Plastic Cycle Token or other digital verification instruments; and the belief that molecular-level authentication may influence pricing, compliance, sustainability reporting, or financial strategies used within the plastics sector.

These forward-looking statements are also subject to assumptions regarding regulatory developments, market demand for authenticated recycled content, the pace of corporate adoption of traceability technology, global economic conditions, supply chain constraints, evolving environmental policies, and general industry behavior relating to sustainability commitments and recycling mandates. Risks include, but are not limited to, changes in FDA or international regulatory standards; technological challenges in large-scale deployment of molecular markers; competitive innovations from other companies; operational disruptions in recycling or plastics manufacturing; fluctuations in pricing for virgin or recycled plastics; and the broader economic conditions that influence capital investment and industrial activity.

Detailed risk factors are described in SMX's filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward-looking statements. These statements speak only as of the date of publication. SMX undertakes no obligation to update or revise forward-looking statements to reflect subsequent events, changes in circumstances, or new information, except as required by applicable law.

EMAIL: info@securitymattersltd.com

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/smxs-platform-creates-a-world-where-silver-gets-audited-not-expl-1121814