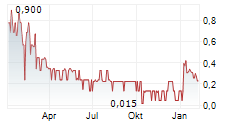

CALGARY, Alberta, Dec. 30, 2025 (GLOBE NEWSWIRE) -- Prairie Provident Resources Inc. ("Prairie Provident" or the "Company") (TSX:PPR) announces that, further to the special resolution of Prairie Provident shareholders passed at the annual and special meeting of shareholders held May 22, 2025, the Company will implement a 30-to-1 consolidation of its outstanding common shares (the "Consolidation"), on the basis of one post-Consolidation common share for every 30 pre-Consolidation common shares. The Consolidation will be effective December 31, 2025 (the "Effective Date").

The Toronto Stock Exchange ("TSX") has accepted notice of the Consolidation, and the common shares of Prairie Provident are expected to begin trading on TSX on a post-Consolidation basis two to three trading days following its receipt of final documentation. The post-Consolidation common shares will continue to trade on TSX under the symbol "PPR" but with a new CUSIP number (73965Q888) and new ISIN (CA73965Q8882).

As a result of the Consolidation, the number of outstanding common shares will be reduced from 1,401,575,636 pre-Consolidation common shares currently outstanding to approximately 46,719,000 post-Consolidation common shares as at the Effective Date, subject to adjustment for the rounding down of fractions as outlined below.

The Consolidation will also result in proportionate adjustments to the exercise price (as applicable) and number of common shares issuable pursuant to the Company's outstanding share purchase warrants, broker warrants, stock options, restricted share units (RSUs) and deferred share units (DSUs), all in accordance with the plans and other documents governing such securities.

Registered shareholders of Prairie Provident holding their common shares in certificated form will be sent a letter of transmittal with instructions for the surrender of certificates representing their pre-Consolidation common shares. Such shareholders will need to return to Alliance Trust Company ("Alliance"), as registrar and transfer agent for the common shares, a completed letter of transmittal in order to receive a certificate or direct registration system (DRS) advice statement for their post-Consolidation common shares. The form of letter of transmittal will also be available electronically under the Company's issuer profile on SEDAR+ at www.sedarplus.ca and from the Prairie Provident website at www.ppr.ca. Registered shareholders whose pre-Consolidation common shares are represented by a DRS advice statement will not be required to return a completed letter of transmittal to Alliance, and will instead be automatically issued a new DRS advice statement for the number of post-Consolidation common shares held.

Non-registered shareholders who hold their common shares through a broker, financial institution or other intermediary should note that the intermediary's procedures for processing the Consolidation, in respect of pre-Consolidation shares held for the non-registered owner's account, may differ from those applicable to registered shareholders. Non-registered shareholders with questions should contact their intermediary for more information.

The Consolidation will not result in any fractional common shares. If the Consolidation would otherwise result in a shareholder holding a fraction of a post-Consolidation common share, the number of post-Consolidation common shares held by such holder will be rounded down to the nearest whole number, and the fractional interest will be cancelled without consideration. A holder of fewer than 30 pre-Consolidation common shares will therefore cease to be a shareholder, as their fractional post-Consolidation number will be rounded down to zero.

Further details regarding the Consolidation are contained in the Company's information circular dated April 15, 2025 for the annual and special meeting of Prairie Provident shareholders held May 22, 2025, a copy of which is available under the Company's issuer profile on SEDAR+ at www.sedarplus.ca and on the Prairie Provident website at www.ppr.ca.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company engaged in the exploration and development of oil and natural gas properties in Alberta, including a position in the emerging Basal Quartz trend in the Michichi area of Central Alberta.

For further information, please contact:

Dale Miller, Executive Chairman

Phone: (403) 292-8150

Email: info@ppr.ca