NEW YORK CITY, NEW YORK / ACCESS Newswire / January 9, 2026 / Silver has always played it cool.

It's the laid-back precious metal-the one that shows up everywhere from fine jewelry to solar panels to your grandmother's flatware, pretending it's just happy to be included. It shines politely, conducts electricity, kills bacteria, and never once asks for credit. But don't let the humble glow fool you. Silver has lived a life.

Before it ends up around your neck, inside your phone, or holding down a family roast chicken, silver travels a long, complicated road: mines, refineries, traders, borders, warehouses, manufacturers. Somewhere along the way, its backstory usually vanishes-melted down, mixed up, and reborn with no memory of where it's been or what it's seen.

For centuries, that amnesia was just part of the deal. Precious metals weren't expected to talk about their past. They were expected to sit there quietly and appreciate in value.

But what if silver could remember everything?

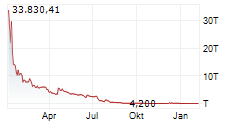

That's the idea SMX (NASDAQ:SMX; SMXWW) is quietly toying with-giving precious metals like silver a kind of molecular memory. SMX, already known for tracking plastics and raw materials across complex global supply chains, is exploring how its technology could apply to metals that have historically been impossible to trace once they're refined.

The premise sounds almost sci-fi, but the execution is anything but flashy. SMX uses microscopic molecular markers-completely invisible, incredibly durable, and embedded directly into the material. These aren't QR codes or tags that can fall off or be scratched away. They're more like a secret handshake at the atomic level, paired with a digital platform that logs each step of the journey.

If silver were marked at the mining stage, it could carry its identity through refining, manufacturing, resale, recycling, and reuse. Melt it. Shape it. Turn it into a necklace, a battery component, or a spoon. The silver still knows who it is.

Think of it as silver with receipts.

That kind of transparency suddenly changes a lot.

For consumers, "ethically sourced" silver is often a vibe rather than a verifiable fact. With molecular tracking, jewelers and manufacturers could actually prove where their silver came from-and just as importantly, where it didn't. No conflict zones. No illegal mining. No shrugging and saying, "Trust us."

Authentication is another silver lining (yes, we went there). Counterfeit bullion and adulterated metals are a very real problem, especially as retail investors flock to precious metals. Molecular identification adds a nearly impossible-to-fake layer of verification. If silver could talk, it wouldn't say, "I'm pure." It would say, "Scan me."

Then there's the industrial side. Silver is critical to clean energy, electronics, and medical applications. Governments, regulators, and manufacturers increasingly want proof-not promises-about sourcing and sustainability. A digitally traceable silver supply chain turns compliance from a paperwork nightmare into a data-backed reality.

And let's not forget recycling. Silver is infinitely recyclable, but once it's melted down, tracking reuse becomes a guessing game. With persistent identity, companies could finally see how circular their silver really is-what's reused, what's lost, and where inefficiencies are hiding.

No, this doesn't mean your candlesticks are about to confess their secrets or your earrings will start judging your outfit choices. The technology runs quietly in the background, doing exactly what silver has never been asked to do before: tell the truth.

Silver has always been valued for its versatility. With SMX's approach, it could also become one of the most transparent materials on Earth-still shiny, still essential, but finally able to back up its story.

And honestly? After everything it's been through, silver's earned the right to talk.

Contact:

Jeremy Murphy/ jeremymurphy@me.com

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/what-if-silver-could-spill-the-tea-inside-smxs-vision-for-tracki-1125973