BRUSSELS (dpa-AFX) - Despite data showing a drop in the nation's inflation in the month of December, German stocks showed weakness Friday morning as investors chose to take some profits, cashing in recent gains.

Geopolitical concerns weighed as Greenland worries returned to the fore, with media reports suggesting that European troops are landing in the country to defend it against real U.S. military threat.

The deployment of troops from several European countries and other North Atlantic Treaty Organization (NATO) allies was announced after high-level negotiations between Denmark and U.S. officials ended in stalemate on Thursday.

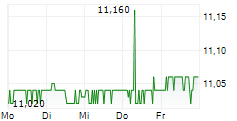

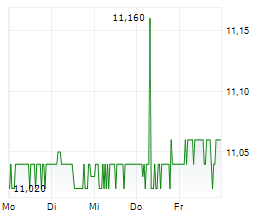

The benchmark DAX was down 47.47 points or 0.19% at 25,327.04 about half an hour before noon.

Brenntag and BASF dropped by 2.4% and 2.3%, respectively. Volkswagen, Mercedes-Benz, BMW, SAP, Porsche Automobil Holding and Heidelberg Materials lost 1 to 1.6%.

Daimler Truck Holding declined after reporting a drop in 2025 sales. Continental, Siemens, Zalando, Bayer, Adidas and Symrise also drifted lower.

Siemens Energy climbed 3.25%. Fresenius moved up nearly 2% and Fresenius Medical Care gained 1.1%. Qiagen, Commerzbank, RWE, Merck and Rheinmetall posted moderate gains.

Kloeckner & Co shares soared 28% after Worthington Steel announced that it would buy the German stee processor in a deal valued at $2.4 billion.

Data from Destatis showed the harmonized index of consumer prices rose 2% on a yearly basis in December, following a 2.6% gain in the previous month.

Likewise, consumer price inflation weakened to 1.8% from 2.3% in each of the previous two months. The latest inflation rate was the slowest since September 2024 and also matched the provisional estimate.

On a monthly basis, the HICP climbed 0.2% and the CPI remained flat in December. Both rates were in line with the initial estimates.

In 2025, CPI inflation averaged 2.2%, the same rate as seen in 2024 and weaker than the 5.9% posted in 2023.

Core inflation softened to 2.8% in 2025 from 3% in 2024.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News