Karelian Diamond Resources Plc - Fundraising of £185,000

PR Newswire

LONDON, United Kingdom, June 20

THIS ANNOUNCEMENT, INCLUDING ITS APPENDICES AND THE INFORMATION HEREIN, IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, RUSSIA, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN, NEW ZEALAND, SINGAPORE OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019/310. IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

20 June 2025

Karelian Diamond Resources plc

("Karelian" or the "Company")

Fundraising of £185,000

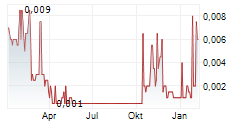

Karelian Diamond Resources plc (AIM: KDR), the Irish mineral resource exploration and development company which has active exploration programmes for Nickel-Copper-Platinum Group Elements in Northern Ireland and for diamonds in the Kuhmo region of Finland, is pleased to announce a placing and subscription to raise a total of £185,000 (before expenses) at 0.75 pence per ordinary share (the "Fundraising").

HIGHLIGHTS

- Karelian has recently, as announced on 12 June 2025, received a mining concession certificate from the Finnish Safety and Chemical Agency (TUKES) entitling it to utilise the minerals within the mining concession at its diamond deposit at Lahtojoki in Finland.

- Funds raised will be used to initiate the next phases of work in relation to the development of its diamond deposit at Lahtojoki together with progressing a follow-up diamond exploration and development programme in Finland where, at Kuhmo, it has already discovered a green diamond in till and appears close to discovering its source.

- Funds will also be used by the Company to progress its understanding of the impact of the copper mineralisation at the historic Cappagh Copper Mine in its recently awarded KDR4 licence (the identification of which was announced by the Company on 16 June 2025) on the Company's search for an economic deposit of Nickel-Copper-Platinum Group Elements on Karelian's licences in Northern Ireland.

- In addition, funds will be used to provide additional working capital for the Company.

Maureen Jones, Managing Director, commented:

"This fundraising enables the Company to continue its work as we begin in particular to move to the next phase of our work at Lahtojoki and also focus on advancing the significant potential for Nickel-Copper-Platinum Group Elements in Northern Ireland."

FUNDRAISING SUMMARY

The Fundraising was arranged at 0.75 pence per ordinary share (the "Issue Price"), representing a discount of 30 per cent. to the closing mid-market price of 1.075 pence on 19 June 2025. CMC Markets UK Plc ("CMC Markets"), trading as CMC CapX, acted as the Company's placing agent in respect of the Fundraising.

Placing of 18,000,000 ordinary shares of €0.00025 each ("Ordinary Shares") at a price of 0.75 pence per Ordinary Share (the "Issue Price") to raise £135,000 before expenses (the "Placing Shares"). In addition, as part of the Fundraising, certain parties have also subscribed for 6,666,666 new Ordinary Shares at the Issue Price to raise £50,000 (the "Subscription Shares").

The Placing Shares and the Subscription Shares, totalling 24,666,666 new Ordinary Shares (together the "Fundraising Shares"), together will represent approximately 12.55 per cent. of the enlarged issued share capital of the Company and have been issued to a combination of mainly new investors and certain existing shareholders.

The Fundraising has been conducted within the Company's existing share authorities and is conditional on Admission becoming effective.

ADMISSION AND TOTAL VOTING RIGHTS

An application will be made shortly to the London Stock Exchange for Admission of the Fundraising Shares. It is expected that Admission will become effective and that dealings in the Fundraising Shares on AIM will commence on or around 26th June 2025.

In accordance with the FCA's Disclosure Guidance and Transparency Rules, the Company confirms that on completion of the Fundraising, and following Admission, the Company's enlarged issued ordinary share capital will comprise 196,436,077 Ordinary Shares.

The Company does not hold any Ordinary Shares in Treasury. Therefore, following Admission, the above figure may be used by shareholders in the Company as the denominator for the calculations to determine if they are required to notify their interest in, or a change to their interest in the Company, under the FCA's Disclosure Guidance and Transparency Rules.

Further Information:

Karelian Diamond Resources plc Brendan McMorrow, Chairman / Maureen Jones, Managing Director |

+353-1-479-6180 |

Allenby Capital Limited (Nomad) Nick Athanas / Nick Harriss |

+44-20-3328-5656 |

Peterhouse Capital Limited (Joint Broker) Lucy Williams / Duncan Vasey |

+44-20-7469-0930 |

CMC Markets (Joint Broker) Douglas Crippen |

+ 44-20-3003-8632 |

Lothbury Financial Services Michael Padley |

+44-20-3290-0707 |

Hall Communications Don Hall |

+353-1-660-9377 |

http://www.kareliandiamondresources.com

4166909_0.jpeg |