DJ Extension of Share Repurchase Programme

Molten Ventures Plc (GROW)

Extension of Share Repurchase Programme

04-Aug-2025 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Molten Ventures plc

("Molten Ventures", "Molten", or the "Company")

Extension of Share Repurchase Programme

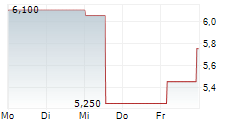

Molten Ventures (LSE: GROW), a leading venture capital firm investing in and developing high-growth digital technology

businesses, announces that, upon completion of its GBP15m share repurchase programme announced on 12 February 2025, it

will commence an additional share repurchase programme of up to GBP10m (the "Programme").

The Programme goes significantly beyond the minimum 10% of realisation proceeds previously outlined in the Capital

Allocation Policy, bringing the total committed since the commencement of the current programme in July 2024 to GBP40m,

as the Company remains committed to narrowing the current share price discount to net asset value.

The Programme will be financed through existing cash resources and will continue until the earlier of either the

expiration of the general authority received at the Company's 2025 AGM ("General Authority") or upon reaching the

maximum purchase amount intended under the Programme.

The purchased ordinary shares of 1 pence each in the capital of the Company ("Ordinary Shares") will be held in

treasury.

To implement the Programme, the Company has entered into an irrevocable, non-discretionary agreement with Goodbody

Stockbrokers UC ("Goodbody"), acting as agent, to conduct the Programme on its behalf and carry out on-market purchases

of Ordinary Shares. Share repurchases may be made from time to time depending on market conditions, share price and

trading volume.

The Company confirms that it currently has no unpublished inside information.

The Programme will operate in accordance with and under the terms of the relevant General Authority. The Programme will

be conducted within the parameters of the Market Abuse Regulation 596/2014/EU and the delegated regulations made

pursuant to it.

As at 31 July 2025, the Company's issued share capital consists of 189,046,450 Ordinary Shares, the total number of

Ordinary Shares in treasury is 8,995,778 and the total number of voting rights in the Company is 180,050,672.

The Company will announce any market repurchase of Ordinary Shares no later than 7.30am on the business day following

the calendar day on which the repurchase occurred.

Enquiries

Molten Ventures plc

+44 (0)20 7931 8800

Ben Wilkinson (Chief Executive Officer)

ir@molten.vc

Andrew Zimmermann (Chief Financial Officer)

Goodbody Stockbrokers

Joint Financial Adviser and Corporate Broker

Don Harrington

+44 (0) 20 3841 6202

Charlotte Craigie

Tom Nicholson

William Hall

Deutsche Numis

Joint Financial Adviser and Corporate Broker

Simon Willis +44 (0)20 7260 1000

Jamie Loughborough

Iqra Amin

Sodali

+44 (0)7970 246 725/

Public relations

+44 (0)771 324 6126

Elly Williamson

molten@sodali.com

Jane Glover

About Molten Ventures

Molten Ventures is a leading venture capital firm in Europe, developing and investing in high growth technology companies.

It invests across four sectors: Enterprise & SaaS; AI, Deeptech & Hardware; Consumer Technology; and Digital Health with highly experienced partners constantly looking for new opportunities in each.

Listed on the London Stock Exchange, Molten Ventures provides a unique opportunity for public market investors to access these fast-growing tech businesses, without having to commit to long term investments with limited liquidity. Since its IPO in June 2016, Molten has deployed over GBP1bn capital into fast growing tech companies and has realised GBP660m to 31 March 2025.

For more information, go to https://investors.moltenventures.com/investor-relations/plc

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BY7QYJ50

Category Code: POS

TIDM: GROW

LEI Code: 213800IPCR3SAYJWSW10

OAM Categories: 2.4. Acquisition or disposal of the issuer's own shares

3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 397764

EQS News ID: 2178610

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2178610&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

August 04, 2025 02:00 ET (06:00 GMT)